Get the free Proposed Welfare Exemption Rules - boe ca

Show details

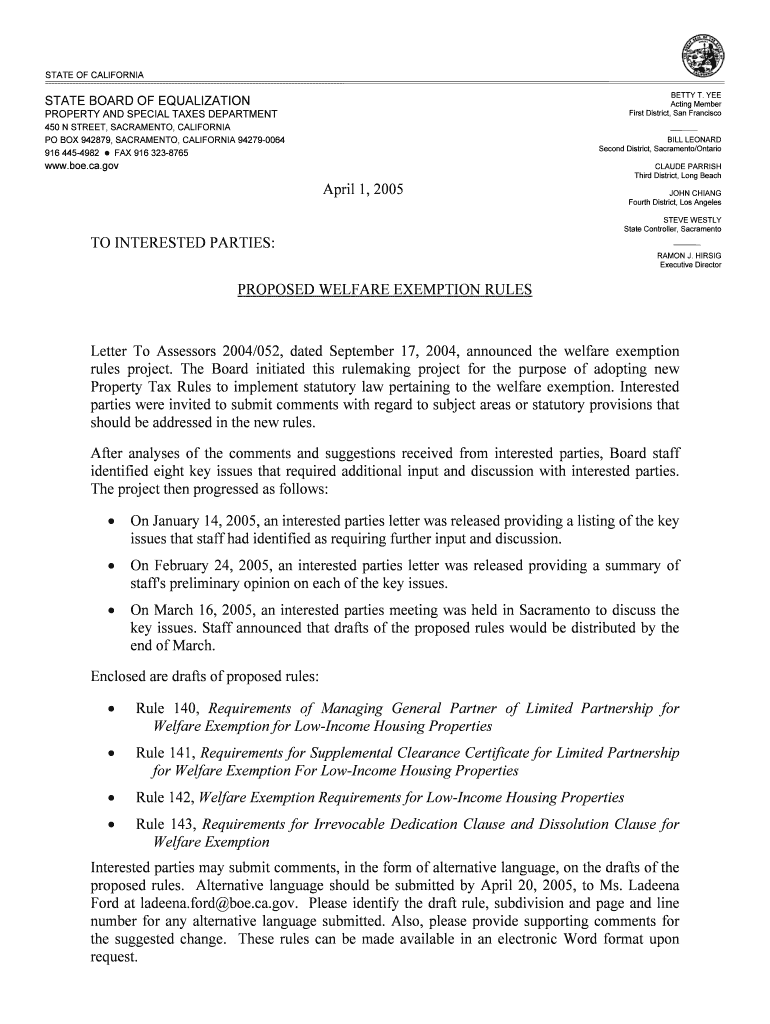

This document outlines the proposed rules for the welfare exemption as related to property tax for low-income housing, including definitions, requirements for managing general partners, and procedural

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign proposed welfare exemption rules

Edit your proposed welfare exemption rules form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your proposed welfare exemption rules form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing proposed welfare exemption rules online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit proposed welfare exemption rules. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out proposed welfare exemption rules

How to fill out Proposed Welfare Exemption Rules

01

Step 1: Obtain the Proposed Welfare Exemption Rules form from the appropriate tax authority.

02

Step 2: Read the instructions thoroughly to understand the requirements.

03

Step 3: Fill out the organization’s information, including name, address, and contact details.

04

Step 4: Provide details about the purpose of the organization and how it qualifies for the exemption.

05

Step 5: Attach any required documentation that supports the exemption claim.

06

Step 6: Review the completed form for accuracy and completeness.

07

Step 7: Submit the form by the deadline set by the tax authority.

Who needs Proposed Welfare Exemption Rules?

01

Non-profit organizations that provide welfare services.

02

Charitable organizations seeking tax exemption.

03

Government agencies processing exemption claims.

04

Individuals or entities supporting a non-profit organization.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for property tax exemption in California?

To obtain the exemption for a property, you must be its owner or co-owner (or a purchaser named in a contract of sale), and you must live in the property as your principal place of residence. You must also file the appropriate exemption claim form with the Assessor.

What is the tax abatement for affordable housing?

Tax abatement programs can be used by state or local governments to provide a financial incentive for developers of multifamily rental housing. Often these only apply to rents affordable to certain income levels, or that are developed or rehabilitated in certain areas.

Who is usually exempt from property taxes?

A property tax exemption provides relief from property taxes for eligible individuals and groups, including religious organizations, governmental entities, seniors, veterans and homeowners with disabilities.

What age in California do you stop paying property taxes?

Senior Tax Exemptions in California The Senior Citizen Homeowners' Property Tax Exemption is available to homeowners who are at least 65 years old and meet certain income requirements.

Who is usually exempt from property taxes?

A property tax exemption provides relief from property taxes for eligible individuals and groups, including religious organizations, governmental entities, seniors, veterans and homeowners with disabilities.

What qualifies as tax exempt in California?

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption. Sales to the U.S. Government. Sales of prescription medicine and certain medical devices.

What is Section 214 G of the California Revenue and Taxation Code?

Revenue and Taxation Code section 214, subdivision (g), provides that the welfare exemption is available to property owned and operated by qualifying organizations and used exclusively for low-income rental housing.

How do you qualify for property tax exemption in California?

You may qualify for the Homeowners' Exemption if: You own the property. It was your principal residence on January 1st at 12:01 a.m. You don't already have a Homeowners' Exemption on any other property. And you submit a completed application for Homeowner's Exemption .

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Proposed Welfare Exemption Rules?

The Proposed Welfare Exemption Rules refer to guidelines set forth for specific exemptions related to welfare services, allowing certain organizations to be exempt from property taxes if they meet specific criteria.

Who is required to file Proposed Welfare Exemption Rules?

Organizations that provide welfare services and wish to obtain property tax exemptions must file the Proposed Welfare Exemption Rules, typically including nonprofit entities focused on charitable activities.

How to fill out Proposed Welfare Exemption Rules?

To fill out the Proposed Welfare Exemption Rules, organizations must complete the necessary application forms, provide supporting documentation that demonstrates their eligibility for the exemption, and ensure all required information is accurately reported.

What is the purpose of Proposed Welfare Exemption Rules?

The purpose of the Proposed Welfare Exemption Rules is to provide a framework for exempting qualifying welfare organizations from property taxes, thereby enabling them to allocate more resources towards their charitable missions.

What information must be reported on Proposed Welfare Exemption Rules?

The information that must be reported includes the organization's mission, financial statements, details of services provided, and evidence of community impact, among other relevant data that supports the claim for exemption.

Fill out your proposed welfare exemption rules online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Proposed Welfare Exemption Rules is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.