Get the free FILING REQUIREMENTS FOR CLAIMS FOR SECTION 63.1 EXCLUSION - boe ca

Show details

This document outlines the changes in filing requirements for claims of parent/child transfers exclusion from change in ownership, including key provisions of Assembly Bill 3843 and related examples

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign filing requirements for claims

Edit your filing requirements for claims form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your filing requirements for claims form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing filing requirements for claims online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit filing requirements for claims. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

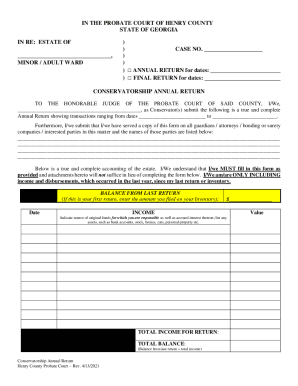

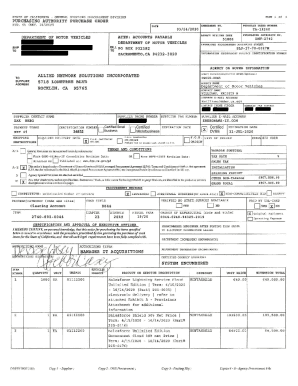

How to fill out filing requirements for claims

How to fill out FILING REQUIREMENTS FOR CLAIMS FOR SECTION 63.1 EXCLUSION

01

Gather relevant documentation required for the claim.

02

Complete the claim form accurately, ensuring all information is clear and legible.

03

Attach necessary supporting documents, such as proof of eligibility for the Section 63.1 exclusion.

04

Review the completed form and documents for completeness and accuracy.

05

Submit the claim form and attachments to the appropriate agency or department.

06

Keep a copy of the submission for your records.

07

Monitor the status of your claim after submission.

Who needs FILING REQUIREMENTS FOR CLAIMS FOR SECTION 63.1 EXCLUSION?

01

Individuals or entities who believe they qualify for a tax exclusion under Section 63.1.

02

Taxpayers seeking to reduce their taxable income through applicable exclusions.

03

Any taxpayer who meets the specific criteria outlined under Section 63.1 regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the parent child exclusion from reassessment in California?

If the property transfer occurred on or after February 16, 2021, the exclusion is limited to the first $1,000,000 (this amount is adjusted annually by a factor provided by the State Board of Equalization) of value that would be added upon reassessment of the principal residence.

Who must pay Pennsylvania's transfer tax?

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate (including contracted-for improvements to property) transferred by deed, instrument, long-term lease or other writing. Both grantor and grantee are held jointly and severally liable for payment of the tax.

What is the prop 19 transfer exclusion?

In November 2020, California voters approved Proposition 19, which, among other things, provided what is known as an “intergenerational transfer exclusion” that allows the taxable value of a property to remain the same for the person receiving the property (the transferee) as that of the person transferring the

What is Section 63.1 of the California Revenue and Taxation Code?

(1) “Purchase or transfer between parents and their children” means either a transfer from a parent or parents to a child or children of the parent or parents or a transfer from a child or children to a parent or parents of the child or children.

What is prop 58 grandparent to grandchild?

Proposition 58 in California Explained Proposition 58 allows parents to transfer property to their children without triggering a property tax reassessment. Similarly, Proposition 193 permits grandparents to transfer property to their grandchildren without facing property tax reassessment.

Who qualifies for property tax exemption in Texas?

There are several partial and absolute exemptions available. Some of these exemptions include General Residential Homestead, Over 65, Over 55 Surviving Spouse, Disability Homestead, Disabled Veterans, Charitable, Religious, Freeport and Pollution Control.

What does exclusion mean in taxes?

A tax exclusion reduces the amount of money you report as your gross income, ultimately reducing the total taxes you owe for the year. Certain forms of compensation are exempt from taxable income, which means you'll pay no income taxes on the excluded amount.

What is a transfer exclusion?

An exclusion occurs when the Assessor does not reassess a property upon change in ownership or completion of new construction as generally required under Proposition 13. Exclusions are enacted by constitutional or statutory provisions in the California Revenue and Taxation Code.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FILING REQUIREMENTS FOR CLAIMS FOR SECTION 63.1 EXCLUSION?

Filing requirements for claims for Section 63.1 exclusion refer to the specific regulations and processes that must be followed to submit a claim for exclusion under Section 63.1 of the relevant legislation.

Who is required to file FILING REQUIREMENTS FOR CLAIMS FOR SECTION 63.1 EXCLUSION?

Any individual or entity that believes they qualify for an exclusion under Section 63.1 is required to file the appropriate forms and documentation to support their claim.

How to fill out FILING REQUIREMENTS FOR CLAIMS FOR SECTION 63.1 EXCLUSION?

To fill out the filing requirements, claimants must complete the designated forms accurately, provide necessary documentation, and follow the instructions provided by the regulatory authority or organization overseeing the claims process.

What is the purpose of FILING REQUIREMENTS FOR CLAIMS FOR SECTION 63.1 EXCLUSION?

The purpose of these filing requirements is to ensure that claims for exclusion under Section 63.1 are submitted in a consistent manner, allowing for proper evaluation of eligibility and determination of benefits or exclusions.

What information must be reported on FILING REQUIREMENTS FOR CLAIMS FOR SECTION 63.1 EXCLUSION?

Claimants must report personal identification details, the reason for claiming the exclusion, supporting evidence or documentation, and any other information specified by the filing authority.

Fill out your filing requirements for claims online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Filing Requirements For Claims is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.