Get the free Apelaciones de avalúos de propiedades residenciales - boe ca

Show details

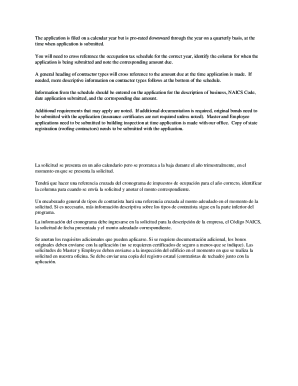

Guía para los propietarios de California sobre cómo apelar el valor catastral de sus propiedades residenciales, incluyendo procesos, tipos de apelaciones y requisitos.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign apelaciones de avalos de

Edit your apelaciones de avalos de form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your apelaciones de avalos de form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing apelaciones de avalos de online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit apelaciones de avalos de. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out apelaciones de avalos de

How to fill out Apelaciones de avalúos de propiedades residenciales

01

Begin by gathering necessary property information such as the property address and tax identification number.

02

Review your property's current assessed value and compare it with similar properties in your area.

03

Obtain the required Apelaciones de avalúos de propiedades residenciales form from your local tax authority's website or office.

04

Fill out the form by providing accurate personal details, including your name, address, and contact information.

05

Clearly state the reasons for your appeal, including any evidence or documentation that supports your claim for a lower valuation.

06

Attach any supporting documents like recent property appraisals, photos, or sale prices of similar properties.

07

Double-check all information for accuracy and completeness before submission.

08

Submit the completed form and supporting documents to the appropriate tax assessor's office by the specified deadline.

09

Keep a copy of all documents submitted for your records.

Who needs Apelaciones de avalúos de propiedades residenciales?

01

Homeowners who believe their property has been overvalued for tax purposes.

02

Individuals or businesses seeking to contest their property tax assessment.

03

Real estate investors looking to reduce their tax liabilities through accurate property valuation.

Fill

form

: Try Risk Free

People Also Ask about

¿Cuánto se cobra por hacer un avalúo de una casa?

Si el terreno tiene +100% del lote mínimo el costo del avalúo se determinará por el valor del inmueble Si el terreno cuesta hasta $600,000.00 el costo del avalúo se calculará sumando $1,208.00 más $2.00 por cada $1,000.00 adicionales.

¿Quién hace avalúos de propiedades?

El proceso de evaluación de una casa se lleva a cabo por un perito, quien analiza una serie de factores clave. Los elementos que se consideran en el avalúo de una casa son: Ubicación: La zona donde se encuentra la casa es uno de los factores más importantes.

¿Quién puede realizar un avalúo de una casa?

¿Quién puede realizar un avalúo inmobiliario? La persona encargada de realizar esta estimación monetaria es un perito certificado en la materia, quien debe estar autorizado por catastros municipales o tesorerías estatales. Además, el perito debe tener un registro ante la Sociedad Hipotecaria Federal (SHF).

¿Cuál es el valor de un avalúo de una casa?

¿Cuánto cuesta un avalúo de una casa? Una de las preguntas más comunes es cuánto cuesta un avalúo de una casa. El costo de un avalúo puede variar dependiendo de la ubicación y del tipo de propiedad, pero en general, los precios oscilan entre $3,000.00 y $8,000.00.

¿Qué son los avalúos de la propiedad?

El avalúo es el resultado del proceso de estimar el valor de un bien, determinando la medida de su poder de cambio en unidades monetarias y a una fecha determinada.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Apelaciones de avalúos de propiedades residenciales?

Apelaciones de avalúos de propiedades residenciales refers to the process of appealing the assessed value of residential properties, typically for tax purposes, when a property owner believes that the valuation provided by the assessing authority is too high.

Who is required to file Apelaciones de avalúos de propiedades residenciales?

Property owners who disagree with the assessed value of their residential properties are required to file Apelaciones de avalúos de propiedades residenciales in order to contest the appraisal.

How to fill out Apelaciones de avalúos de propiedades residenciales?

To fill out Apelaciones de avalúos de propiedades residenciales, property owners should obtain the necessary forms from their local tax assessor’s office, provide accurate property information, state their reasons for the appeal, and attach supporting documents, such as comparable property valuations.

What is the purpose of Apelaciones de avalúos de propiedades residenciales?

The purpose of Apelaciones de avalúos de propiedades residenciales is to allow property owners to challenge and possibly reduce their property tax liability by contesting the assessed value assigned to their properties.

What information must be reported on Apelaciones de avalúos de propiedades residenciales?

The information that must be reported includes the property's address, the assessed value, the owner's contact information, reasons for the appeal, and any relevant evidence or documentation that supports the owner's claim regarding the assessment.

Fill out your apelaciones de avalos de online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Apelaciones De Avalos De is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.