Get the free Form 700 - fppc ca

Show details

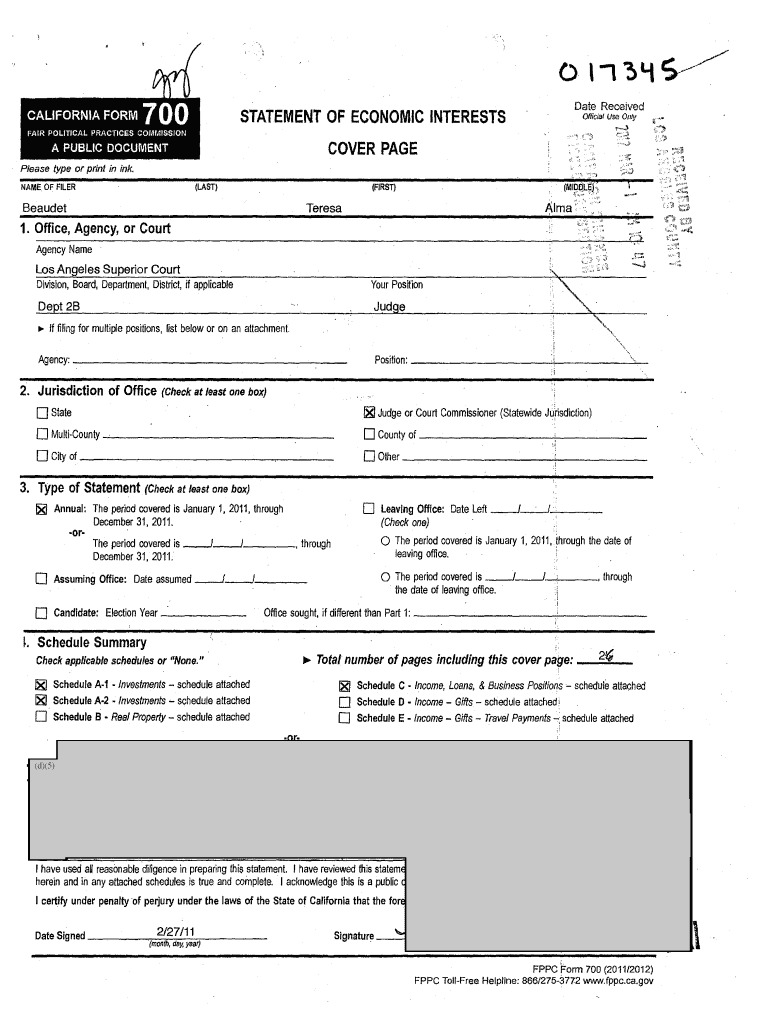

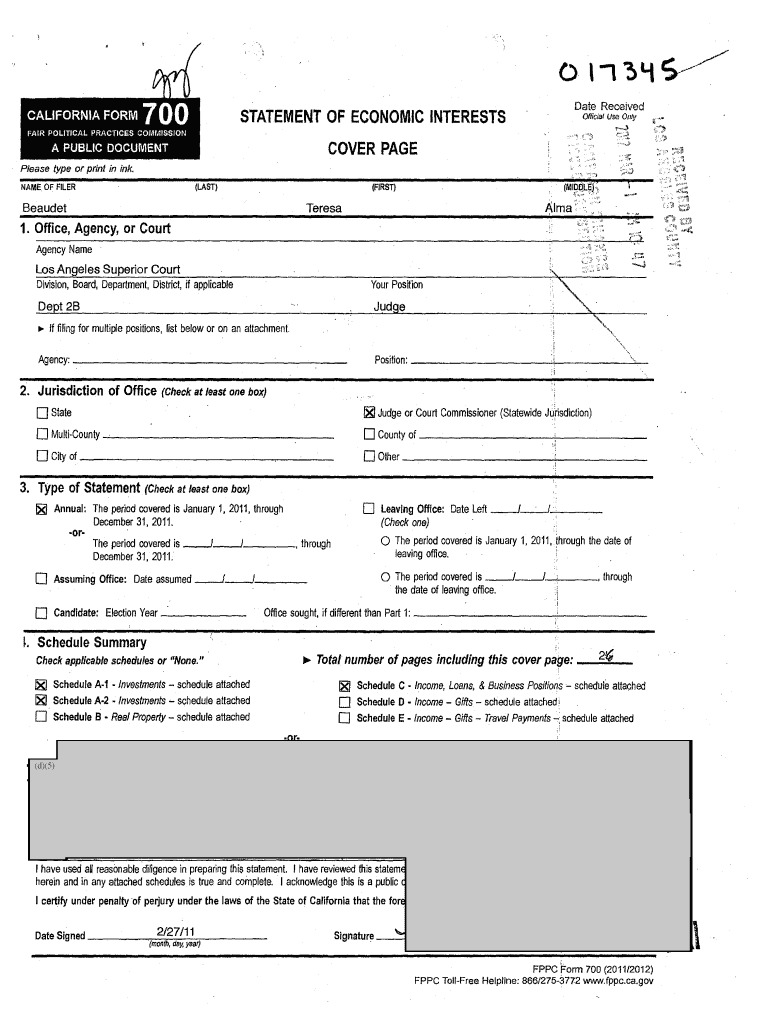

This document is a public statement required for certain officials in California to disclose their economic interests, including investments, real property, and income received from various sources.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 700 - fppc

Edit your form 700 - fppc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 700 - fppc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 700 - fppc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 700 - fppc. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 700 - fppc

How to fill out Form 700

01

Obtain Form 700 from the appropriate agency's website or office.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information in the designated fields, such as name, address, and contact information.

04

Provide detailed information about the subject of the form, including relevant dates and descriptions.

05

Review the certification section and sign the form where indicated.

06

Include any necessary attachments or supporting documents as required.

07

Submit the completed Form 700 to the specified office or agency, either by mail or online as directed.

Who needs Form 700?

01

Anyone involved in certain financial or real estate transactions that require disclosure.

02

Public officials and employees who need to report their financial interests and potential conflicts of interest.

03

Individuals applying for certain permits or licenses that necessitate the completion of Form 700.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of Form 700?

The Form 700 provides transparency and ensures accountability in two ways: It provides necessary information to the public about an official's personal financial interests to ensure that officials are making decisions in the best interest of the public and not enhancing their personal finances.

What should I disclose on Form 700?

Answer. On an assuming office statement, disclose all reportable investments, interests in real property, and business positions held on the date you assumed office. In addition, you must disclose income (including loans, gifts and travel payments) received during the 12 months prior to the date you assumed office.

Are all public officials required to disclose their financial interests by filing a Form 700 statement of economic interests?

Every elected official and public employee who makes or participates in making governmental decisions is required to submit a Statement of Economic Interests, also known as the Form 700. The Form 700 provides transparency and ensures accountability in governmental decisions.

What is Form 700 filing?

A Statement of Economic Interest (FORM 700) is a state form on which state and local government officials publicly disclose their personal assets and income that may be materially affected by their official acts.

What is considered public record in California?

Government Code §7920.530 defines a public record as “any writing containing information relating to the conduct of the public's business prepared, owned, used or retained by any state or local agency regardless of physical form or characteristics." The California Commission on Peace Officer Standards and Training (

Is Form 700 public record?

The Form 700 is a public document. Form 700s filed by State Legislators and Judges, members of the FPPC, County Supervisors, and City Council Members are available on the FPPC's website.

What should I disclose on Form 700?

Answer. On an assuming office statement, disclose all reportable investments, interests in real property, and business positions held on the date you assumed office. In addition, you must disclose income (including loans, gifts and travel payments) received during the 12 months prior to the date you assumed office.

Who completes Form 700?

Who Files the Form 700? State and local government agencies must adopt a conflict of interest code. The codes designates positions within the agency that make or participate in making governmental decisions. Individuals in these positions file Form 700.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 700?

Form 700 is a financial disclosure form used by public officials and employees to report their economic interests and potential conflicts of interest.

Who is required to file Form 700?

Public officials, including elected members of city councils, boards, and commissions, as well as certain government employees, are required to file Form 700.

How to fill out Form 700?

To fill out Form 700, individuals must provide detailed information about their investments, real estate holdings, gifts received, and other sources of income as specified in the form's sections.

What is the purpose of Form 700?

The purpose of Form 700 is to promote transparency in government by ensuring that public officials disclose their financial interests and identify any potential conflicts of interest.

What information must be reported on Form 700?

Form 700 requires reporting of various financial interests including investments, real property, income sources, gifts, and business positions held by the individual or their immediate family members.

Fill out your form 700 - fppc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 700 - Fppc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.