Get the free California Film & Television Tax Credit Program - film ca

Show details

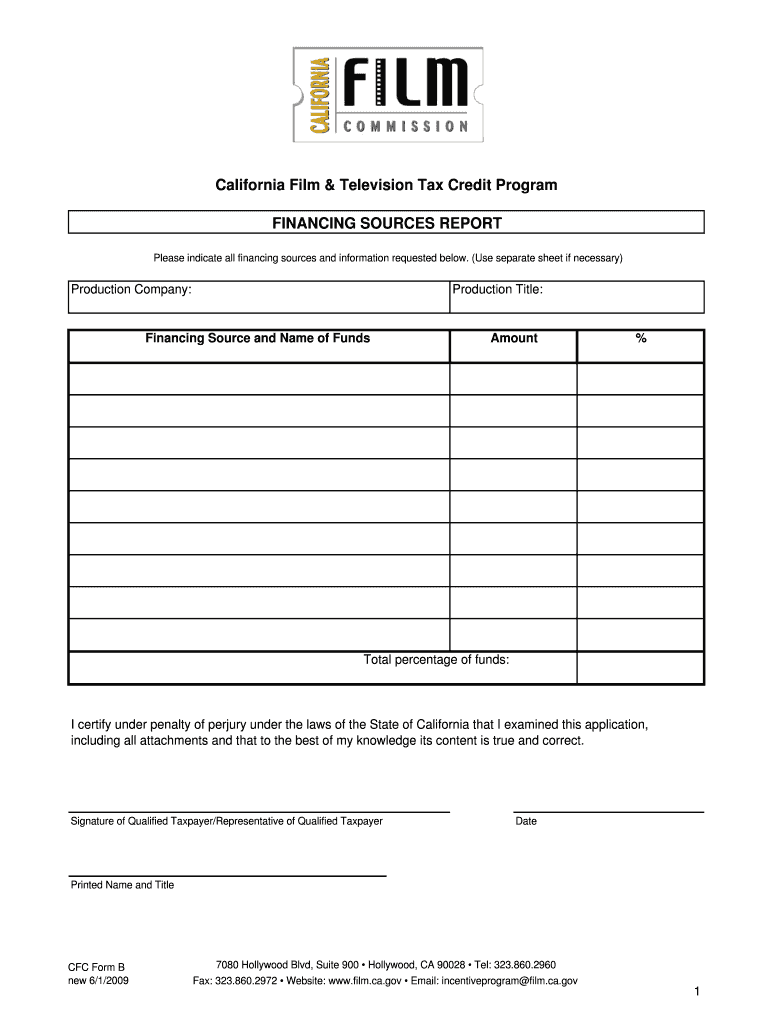

A report to indicate all financing sources and information related to film and television production in California, verifying the truth of the provided information under California law.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california film television tax

Edit your california film television tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california film television tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california film television tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit california film television tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california film television tax

How to fill out California Film & Television Tax Credit Program

01

Determine eligibility: Ensure your project qualifies by checking the program's requirements, such as budget thresholds, types of productions, and filming locations.

02

Complete the application: Fill out the California Film & Television Tax Credit application form with accurate project details.

03

Prepare required documentation: Gather necessary supporting documents, including proof of financing, a detailed production budget, and a breakdown of the proposed filming schedule.

04

Submit your application: Send your completed application and documentation to the California Film Commission before the deadlines set for the application period.

05

Await response: Wait for the California Film Commission to review your application and notify you of your approval or any needed adjustments.

06

Begin production: Once approved, you can start filming, keeping detailed records for tax credit verification purposes.

07

Complete the post-production phase: After filming, finalize all required audit documentation and apply for the tax credits by submitting the final report to the Film Commission.

Who needs California Film & Television Tax Credit Program?

01

Producers and production companies looking to film movies, television shows, or other qualifying projects in California.

02

Companies aiming to reduce their production costs through tax incentives.

03

Filmmakers who are compliant with the specific eligibility criteria defined by the California Film Commission.

04

Businesses interested in supporting local economies through film production and job creation within the state.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for the $350 payment in California?

Tier 1: Single filers who make less than $75,000 would get $350. Joint filers with an income under $150,000 receive $700. If they have at least one dependent, they will receive an additional $350. So, for example, that means a married couple earning $100,000 per year with one child gets $1,050.

Who qualifies for California tax credit?

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or individual earning up to $31,950 per year. You must claim the credit on the 2024 FTB 3514 form, California Earned Income Tax Credit, or if you e-file follow your software's instructions.

How to check if you qualify for California inflation relief?

Residency: You must have lived in California for more than half of the year 2020. Identification: You must have used an Individual Taxpayer Identification Number (ITIN) when filing your taxes. Income Limits: Your total California Adjusted Gross Income (AGI) must not exceed $75,000.

How does a film tax incentive work?

Cash Rebates: Cash rebates are paid to production companies directly by the state, usually as a percentage of the company's qualified expenses. Grant: Grants are distributed to production companies by three states and the District of Columbia.

Who qualifies for California income tax credit?

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or individual earning up to $31,950 per year. You must claim the credit on the 2024 FTB 3514 form, California Earned Income Tax Credit, or if you e-file follow your software's instructions.

How to claim film tax credits?

Your company can claim the relief on a film if: the film is certified as British by the British Film Institute. it's intended for theatrical release. at least 10% of the 'core costs' relate to activities in the UK. it started principle photography on or before 31 March 2025.

What are the film incentives for California 2025?

If included, the new program — with expanded eligibility, increased credit, and a $750M cap — would take effect July 1, 2025. Otherwise, passage is expected by September, with a January 1, 2026 start, unless an urgency clause allows earlier implementation.

What makes you eligible for a tax credit?

No more than $31,950 in earned income. For tax year 2022 forward, no earned income is required. You may even have a net loss of as much as $34,602 for tax year 2024 if you otherwise meet the CalEITC requirements. Have a qualifying child under 6 years old at the end of the tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is California Film & Television Tax Credit Program?

The California Film & Television Tax Credit Program is a financial incentive program designed to attract film and television productions to California, providing tax credits for qualified expenses incurred during the production process.

Who is required to file California Film & Television Tax Credit Program?

Eligible productions that wish to receive tax credits under the California Film & Television Tax Credit Program must apply and file, which typically includes production companies engaged in qualified film and television projects.

How to fill out California Film & Television Tax Credit Program?

To fill out the California Film & Television Tax Credit Program application, production companies must complete specific forms detailing the production's budget, expenses, and other relevant information as outlined by the California Film Commission.

What is the purpose of California Film & Television Tax Credit Program?

The purpose of the California Film & Television Tax Credit Program is to stimulate the state's economy by promoting job creation and retaining film and television production activities within California.

What information must be reported on California Film & Television Tax Credit Program?

Productions must report detailed information including the production's budget, expenditures, and various project-related data to ensure compliance and eligibility for the tax credits offered by the program.

Fill out your california film television tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Film Television Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.