Get the free California Film & Television Tax Credit Program Employment Diversity Report - film ca

Show details

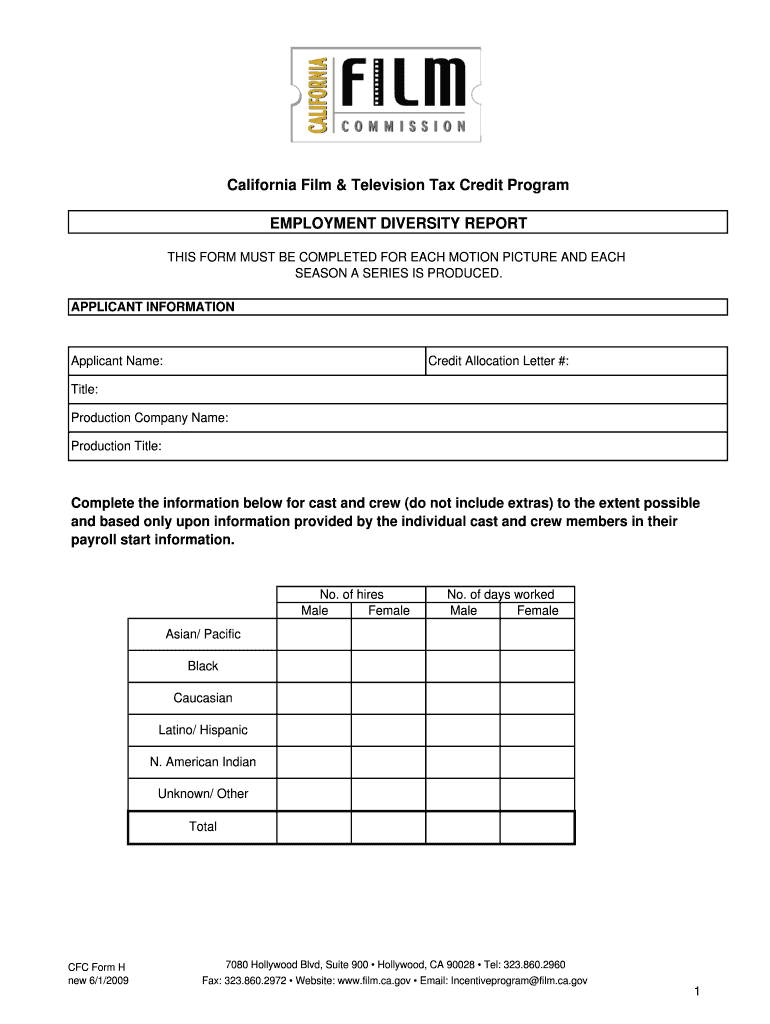

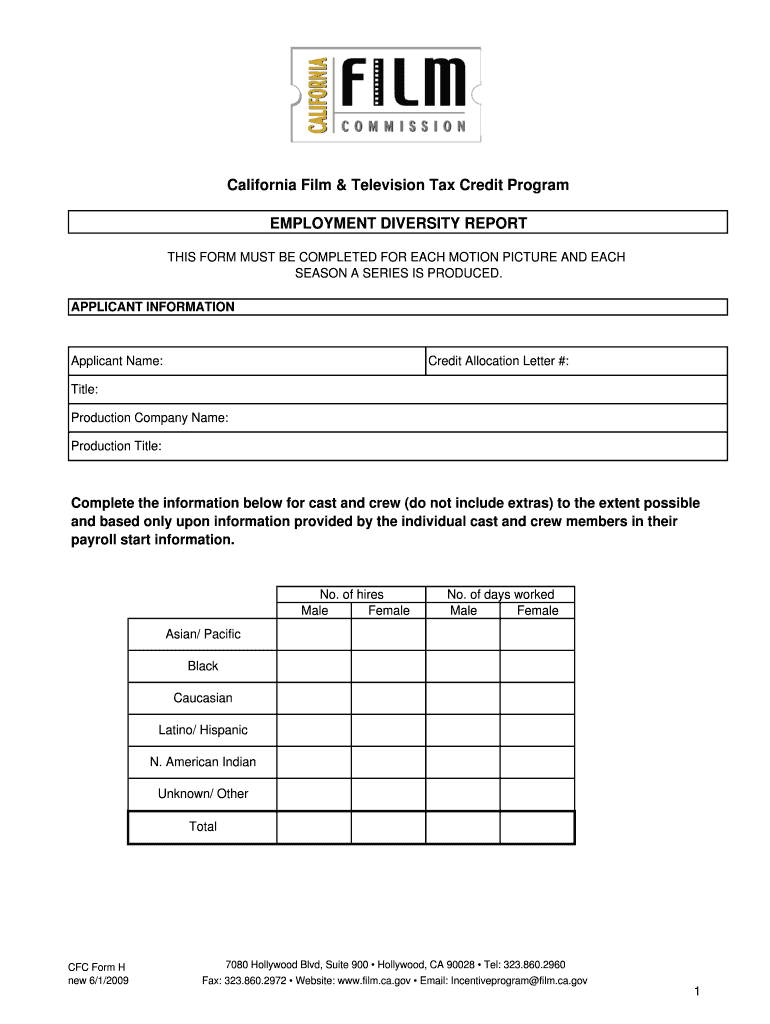

This form must be completed for each motion picture and each season a series is produced to report on the employment diversity of cast and crew members.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california film television tax

Edit your california film television tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california film television tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california film television tax online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit california film television tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california film television tax

How to fill out California Film & Television Tax Credit Program Employment Diversity Report

01

Start by gathering demographic information for all cast and crew members involved in the production.

02

Review the California Film & Television Tax Credit Program guidelines to understand reporting requirements.

03

Enter the total number of employees and their respective roles (cast, crew, etc.).

04

Collect data on gender, ethnicity, and disability status from crew and cast members while ensuring confidentiality.

05

Use the template provided by the California Film & Television Tax Credit Program to input the gathered data.

06

Check for accuracy and completeness before submission.

07

Submit the completed report by the designated deadline to the relevant authorities.

Who needs California Film & Television Tax Credit Program Employment Diversity Report?

01

Productions applying for the California Film & Television Tax Credit Program.

02

Filmmakers and producers looking to promote diversity in their hiring practices.

03

State agencies assessing the impact of the tax credit program on diversity in the entertainment industry.

Fill

form

: Try Risk Free

People Also Ask about

What is the California film tax credit 2025?

Governor's Proposal Increase the Credit's Annual Cap From $330 Million to $750 Million. The Governor's Budget proposes to raise the amount of tax credits available for the CFC to allocate to $750 million starting in 2025‑26.

What is the S481 tax credit for film?

Ireland's 32% Tax Credit for Film, Television and Animation 'Section 481' is a tax credit, incentivising film and TV, animation and creative documentary, post production & VFX and games development in Ireland, administered by Ireland's Department of Culture and the Revenue Commissioners (Revenue).

How to claim film tax credit?

Film Tax Relief is claimed by the film production company for each accounting period through your Corporation Tax Return (CT600). Your tax return must also be accompanied by supplementary information, including: Proof that your film qualifies as British (either by BFI or as a qualifying co-production).

How to claim film tax relief?

To qualify for creative industry tax reliefs, all films must be certified as British. The film must pass a cultural test or qualify through an internationally agreed co-production treaty. The British Film Institute manages certification and qualification on behalf of the Department for Culture, Media and Sport.

How much is the California film tax credit?

As currently written, the legislation would increase the amount of the tax credit from 20% of qualified expenses to 35%. That would increase to 40% for productions outside of the Los Angeles area, or in economically depressed areas of Los Angeles.

What is the film tax credit?

The government released the specific regulations for the Independent Film Tax Credit (IFTC) on 9th October 2024, which ratify the expenditure credit and enable film productions to claim back some of their costs each year. The IFTC offers an uplift of 53% compared to the normal rate of 34% for other productions.

How does the 45V tax credit work?

The 45V Clean Hydrogen Production Tax Credit was established under the Inflation Reduction Act of 2022 to incentivize more hydrogen production with lower greenhouse gas emissions. The tax credit creates a new 10-year incentive for clean hydrogen of up to $3.00/kilogram.

What is the tax credit 181 for film?

Tax Bill 181: A Game-Changer for Film Financing Tax Bill 181 has been instrumental in fostering a more investor-friendly environment for film and television production. The bill includes various tax credits that allow investors to offset a portion of their taxable income by investing in entertainment projects.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is California Film & Television Tax Credit Program Employment Diversity Report?

The California Film & Television Tax Credit Program Employment Diversity Report is a document that producers must complete to provide information on the diversity of their workforce during the production of a film or television project receiving tax credits under the program.

Who is required to file California Film & Television Tax Credit Program Employment Diversity Report?

Producers of eligible film and television projects who are receiving tax credits under the California Film & Television Tax Credit Program are required to file the Employment Diversity Report.

How to fill out California Film & Television Tax Credit Program Employment Diversity Report?

To fill out the report, producers must collect and input demographic information about their cast and crew, including race, ethnicity, gender, and other relevant data, and submit it through the designated online portal or as instructed by the program guidelines.

What is the purpose of California Film & Television Tax Credit Program Employment Diversity Report?

The purpose of the Employment Diversity Report is to monitor and promote workforce diversity within the film and television industry in California, ensuring that individuals from various backgrounds have equal opportunities in production roles.

What information must be reported on California Film & Television Tax Credit Program Employment Diversity Report?

The report must include demographic information regarding the cast and crew members, such as their race, ethnicity, gender identity, and other characteristics as specified by the reporting guidelines of the California Film & Television Tax Credit Program.

Fill out your california film television tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Film Television Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.