Get the free California Schedule P (100)

Show details

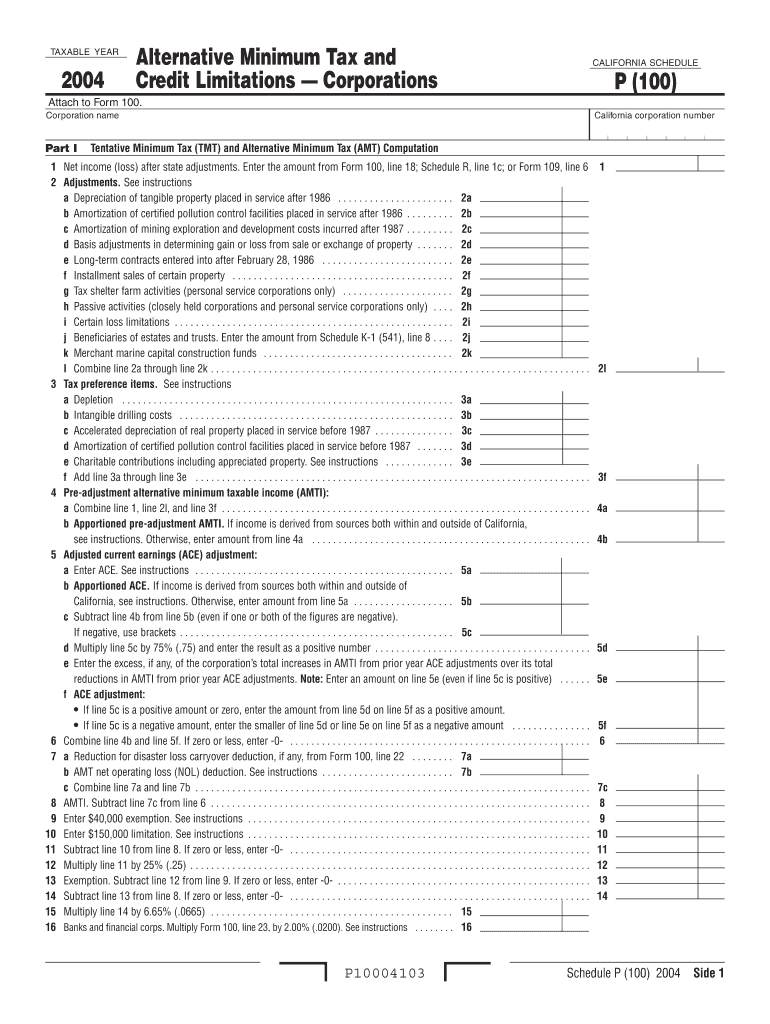

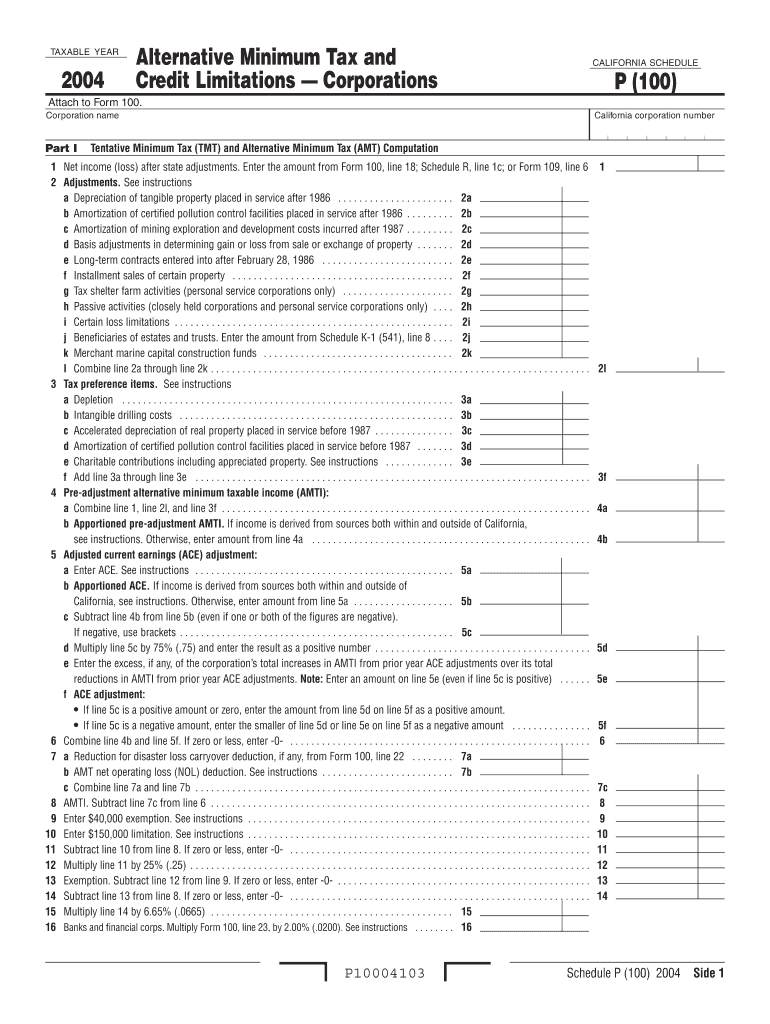

This document is a form for California corporations to compute the Tentative Minimum Tax (TMT) and Alternative Minimum Tax (AMT) along with credits that may reduce the tax owed.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california schedule p 100

Edit your california schedule p 100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california schedule p 100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california schedule p 100 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit california schedule p 100. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california schedule p 100

How to fill out California Schedule P (100)

01

Gather necessary financial information, including income statements and balance sheets.

02

Obtain a copy of California Schedule P (100) form from the California Franchise Tax Board website.

03

Fill out Section A with the corporation's identification information, including name and address.

04

Complete Section B by reporting the corporation's total income and deductions for the tax year.

05

Fill out Section C to report any adjustments required for California tax purposes.

06

Review the instructions for any special considerations or additional schedules required.

07

Sign and date the form, ensuring all required attachments are included.

08

Submit the completed Schedule P (100) with the California corporate tax return by the due date.

Who needs California Schedule P (100)?

01

California Schedule P (100) is required for corporations doing business in California that need to report their income and deductions for California tax purposes.

02

Corporations that are part of a combined reporting group or have income from sources within and outside California must also file this schedule.

03

It is needed by those seeking to account for various tax adjustments specific to California tax law.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum tax for a corporation in California?

Except for newly incorporated or qualified corporations, all corporations doing business in California are subject to an annual minimum tax franchise tax of $800.

What is California schedule CA?

Schedule CA (California Adjustments) is used to report any adjustments to your federal adjusted gross income based on the differences between California and federal tax rules. For example, certain types of income that are taxable federally may be exempt in California, and vice versa.

What is minimum alternate tax in corporate tax?

MAT or Minimum Alternate Tax is a provision in Direct tax laws to limit tax exemptions availed by companies, so that they pay at least a minimum amount of corporate tax to the government. The key reason for introduction of MAT is to ensure minimum levels of taxation for all domestic and foreign companies in India.

What is the alternative minimum tax for corporations in California?

California tax laws give special treatment to some types of income and allow special deductions and credits for some types of expenses. Corporations that benefit from these laws may have to pay AMT in addition to the minimum franchise tax. The AMT rate for C corporations is 6.65 percent.

What is the alternative minimum tax for C corporations in California?

Corporations that benefit from these laws may have to pay AMT in addition to the minimum franchise tax. The AMT rate for C corporations is 6.65 percent. Use Schedule P (100) to calculate AMT and to figure credits that are limited by the Tentative Minimum Tax (TMT) or that may reduce AMT.

What is the purpose of Schedule P?

Schedule P of Form 5471 is used to report previously taxed earnings and profits (“PTEP”) of a U.S. shareholder of a controlled foreign corporation (“CFC”). The term PTEP refers to earnings and profits (“E&P”) of a foreign corporation.

What is the AMT rate in California?

Once AMTI is determined and the exemption is applied, the remaining taxable amount is subject to California's AMT rate of 7%. This tax is then compared to the standard state income tax calculated under regular rules. If the AMT amount is higher, the taxpayer must pay the difference as additional tax.

What is California schedule P?

Use Schedule P (540), Alternative Minimum Tax and Credit Limitations – Residents, to determine if: You owe AMT. Your credits must be reduced or eliminated entirely. Your credits may be limited even if you do not owe AMT, so be sure to complete Side 1 and Side 2 of Schedule P (540).

What is CA schedule P?

Use Schedule P (540), Alternative Minimum Tax and Credit Limitations – Residents, to determine if: You owe AMT. Your credits must be reduced or eliminated entirely. Your credits may be limited even if you do not owe AMT, so be sure to complete Side 1 and Side 2 of Schedule P (540).

What is the minimum tax in California for corporations?

Except for newly incorporated or qualified corporations, all corporations doing business in California are subject to an annual minimum tax franchise tax of $800.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is California Schedule P (100)?

California Schedule P (100) is a supplemental schedule required by the California Franchise Tax Board that provides a report for corporations on the amount of income derived from various sources.

Who is required to file California Schedule P (100)?

Corporations operating in California that are subject to the state corporate tax and have certain types of income must file California Schedule P (100).

How to fill out California Schedule P (100)?

To fill out California Schedule P (100), corporations must gather information on their income, categorize it based on sourcing rules, and report the amounts on the form following the instructions provided by the California Franchise Tax Board.

What is the purpose of California Schedule P (100)?

The purpose of California Schedule P (100) is to determine the source of income for corporations, ensuring that income is accurately reported according to California tax laws for proper tax liability calculation.

What information must be reported on California Schedule P (100)?

Information that must be reported on California Schedule P (100) includes total income, types of income (such as business, non-business, and apportionable income), deductions, and adjustments related to income sourcing.

Fill out your california schedule p 100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Schedule P 100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.