Get the free CALIFORNIA SCHEDULE D-1

Show details

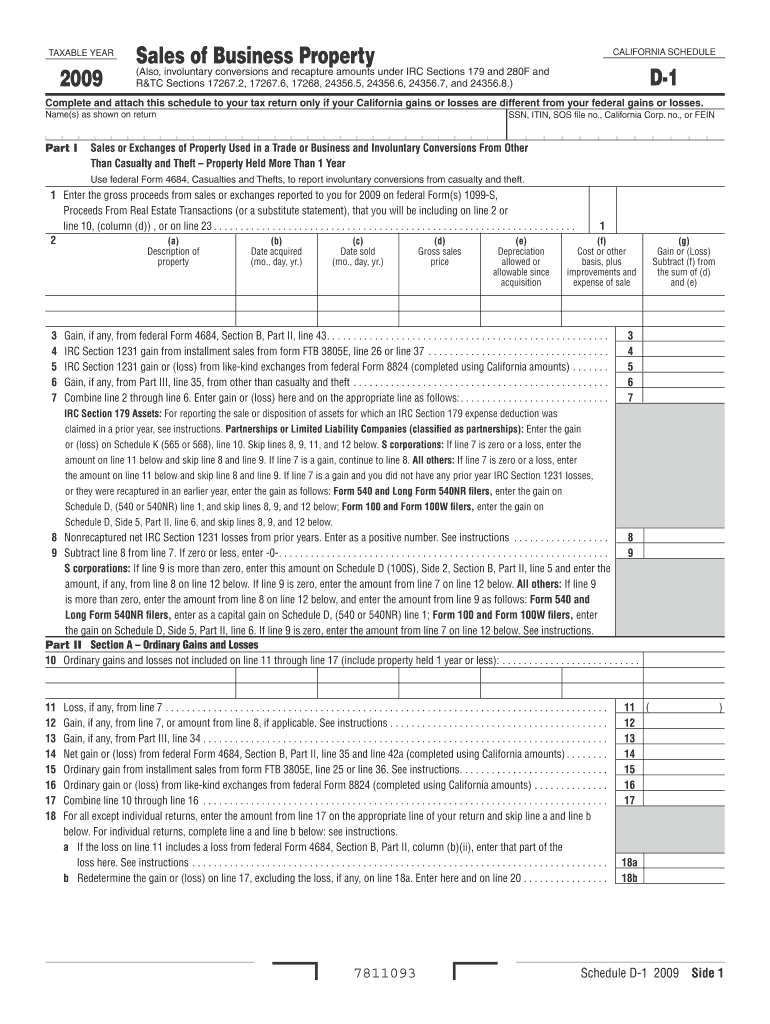

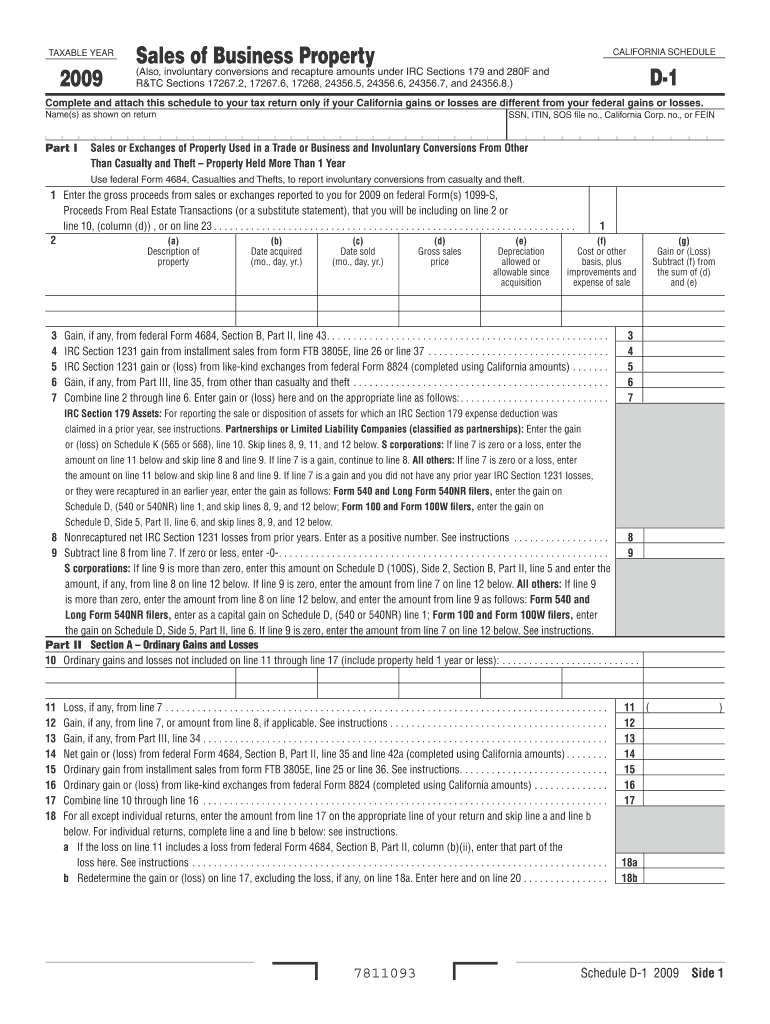

This schedule is for reporting sales or exchanges of business property, including involuntary conversions and recapture amounts under specified IRC Sections, particularly if California gains or losses

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california schedule d-1

Edit your california schedule d-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california schedule d-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california schedule d-1 online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit california schedule d-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california schedule d-1

How to fill out CALIFORNIA SCHEDULE D-1

01

Gather all required financial documents and records of transactions.

02

Identify the capital gains and losses incurred during the tax year.

03

Fill out your personal information at the top of the form, including your name and Social Security number.

04

On Part I, report your short-term capital gains and losses by listing each transaction along with its details.

05

On Part II, report your long-term capital gains and losses, following the same method as Part I.

06

Calculate the total gains and losses for both short-term and long-term sections.

07

Net the short-term and long-term gains and losses to determine your overall capital gains or losses.

08

If necessary, carry over any unused losses to the next tax year as indicated on the form.

09

Review your filled-out Schedule D-1 for accuracy before filing.

10

Submit the completed form along with your California tax return.

Who needs CALIFORNIA SCHEDULE D-1?

01

Individuals who have sold capital assets such as stocks, bonds, or real estate and experienced capital gains or losses.

02

Taxpayers seeking to report their income from capital gains to the state of California.

03

Those who are required to file a California state tax return and have capital transactions to disclose.

Fill

form

: Try Risk Free

People Also Ask about

Does California give credit for taxes paid to other states?

Taxpayers may qualify for a credit for income taxes paid to another state when the same income that is taxed by the other state is also taxed by California. Other state income taxes which are paid to the other state do not necessarily have to be in the same year, as long as the taxes relate to the same transaction.

How to figure out California capital loss carryover?

California Capital Loss Carryover Worksheet For Full-Year Residents Loss from Schedule D (540NR), line 11, stated as a positive number. Amount from Form 540NR, line 17. Amount from Form 540NR, line 18. Subtract line 3 from line 2. Combine line 1 and line 4. Enter loss from Schedule D (540NR), line 8 as a positive number.

How do I claim my California state tax refund?

You may submit a letter requesting a refund, or you may use CDTFA-101, Claim for Refund to file your claim. Your claim must be in writing and state legal basis for your refund claim.

How do I claim the California credit for taxes paid to another state?

To add the credit for taxes paid to another state, please follow the steps below: Click State on the left side menu. Click the three dots to the right of your state and select edit. Select "Begin" under Credits. Select "Begin" under Schedule S, Other State Tax Credit. Enter your information into the form and click continue.

Do you have to pay the $800 California S Corp fee the final year?

S corporations in California must pay the greater of 1.5% of net income or $800 as the minimum franchise tax annually. Payment is required even if the business earns no income or is inactive. Payment options include online via Web Pay, mailing a check with FTB Form 100-ES, or using third-party tax software.

What is California Schedule D 1?

Generally, California law follows federal law. To report sales or exchanges of property other than capital assets, including the sale or exchange of property used in a trade or business and involuntary conversions (other than casualties and thefts), get California Schedule D-1, Sales of Business Property.

Who qualifies for California tax credit?

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or individual earning up to $31,950 per year. You must claim the credit on the 2024 FTB 3514 form, California Earned Income Tax Credit, or if you e-file follow your software's instructions.

Is California a reverse credit state?

CA Reverse Tax Credit The CA Reverse Tax Credit is an essential provision within the California tax code designed to mitigate the financial impact of double taxation on California residents who earn income in other states.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CALIFORNIA SCHEDULE D-1?

CALIFORNIA SCHEDULE D-1 is a form used to report capital gains and losses for taxpayers in California. It helps individuals and businesses calculate their gain or loss from the sale of capital assets.

Who is required to file CALIFORNIA SCHEDULE D-1?

Taxpayers who have sold or exchanged capital assets, such as stocks, real estate, or other investments, and need to report their capital gains or losses for California state tax purposes must file CALIFORNIA SCHEDULE D-1.

How to fill out CALIFORNIA SCHEDULE D-1?

To fill out CALIFORNIA SCHEDULE D-1, taxpayers need to provide details about each capital asset sold, including the date of acquisition, date of sale, sale price, cost basis, and the resulting gain or loss. The form typically also includes sections for summarizing the totals and calculating the overall net gain or loss.

What is the purpose of CALIFORNIA SCHEDULE D-1?

The purpose of CALIFORNIA SCHEDULE D-1 is to allow taxpayers to report capital gains and losses accurately, ensuring compliance with California tax laws and calculating the appropriate tax obligation on these transactions.

What information must be reported on CALIFORNIA SCHEDULE D-1?

The information that must be reported on CALIFORNIA SCHEDULE D-1 includes the description of the asset sold, purchase and sale dates, sales price, cost basis, and the resulting gain or loss for each transaction, along with totals that reflect the overall capital gains or losses.

Fill out your california schedule d-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Schedule D-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.