Get the free FTB 909

Show details

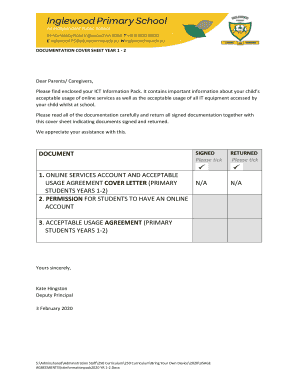

Instructions and specifications for transmitting city business license information through Secure Web Internet File Transfer.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ftb 909

Edit your ftb 909 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ftb 909 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ftb 909 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ftb 909. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ftb 909

How to fill out FTB 909

01

Obtain the FTB 909 form from the California Franchise Tax Board website or local office.

02

Fill out your personal information, including name, address, and Social Security number.

03

Provide details about your tax return, including the tax year and any relevant tax information.

04

Complete the sections that apply to your situation, following the instructions provided on the form.

05

Review your completed form for accuracy and completeness.

06

Sign and date the form where indicated at the bottom.

Who needs FTB 909?

01

Individuals who are claiming a refund for excess tax withheld.

02

Taxpayers who need to request a reissue of a refund check.

03

People who are correcting or documenting a previously filed tax return.

Fill

form

: Try Risk Free

People Also Ask about

What does suspense mean in FTB for estimated tax payment?

FTB has also stated that some types of estimated tax payments are not immediately. applied to the taxpayer's account;аthese payments are held in a suspense account until. the taxpayer files that year's tax return.

What is FTB used for?

Description. Our mission is to help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians.

What does FTB suspension mean?

If a legal entity has been “FTB Suspended” with the California Secretary of State it was suspended by the California Franchise Tax Board most likely because the company did not pay its annual franchise tax.

What does suspense mean on FTB?

FTB has also stated that some types of estimated tax payments are not immediately. applied to the taxpayer's account;аthese payments are held in a suspense account until. the taxpayer files that year's tax return.

How do I resolve a FTB suspension?

To revive your business and be in good standing, you must: File all past due tax returns. Pay all past due tax balances. File a revivor request form.

What is the penalty for not paying California estimated taxes?

The penalty is 5 percent of the unpaid tax (underpayment), plus 0.5 percent of the unpaid tax for each month or part of a month it remains unpaid (monthly). The maximum penalty is 25 percent of the unpaid tax. Learn how we pursue the elimination of penalties and interest on every case.

Why would I be getting a letter from state of California Franchise Tax Board?

It's possible that the FTB is verifying whether you are indeed eligible for the refund or if there was a miscalculation. The notice may request supporting documents or adjustments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FTB 909?

FTB 909 is a form used by the California Franchise Tax Board for reporting various tax-related information.

Who is required to file FTB 909?

Certain taxpayers, including individuals and entities that meet specific criteria set by the California Franchise Tax Board, are required to file FTB 909.

How to fill out FTB 909?

To fill out FTB 909, taxpayers should provide accurate information as requested on the form, ensuring all necessary details are included and any required attachments are added.

What is the purpose of FTB 909?

The purpose of FTB 909 is to collect information that facilitates the California Franchise Tax Board in administering tax laws and ensuring compliance.

What information must be reported on FTB 909?

FTB 909 requires reporting information such as taxpayer identification details, income sources, deductions, and other relevant financial information.

Fill out your ftb 909 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ftb 909 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.