Get the free OCEAN MARINE INSURANCE TAX RETURN - insurance ca

Show details

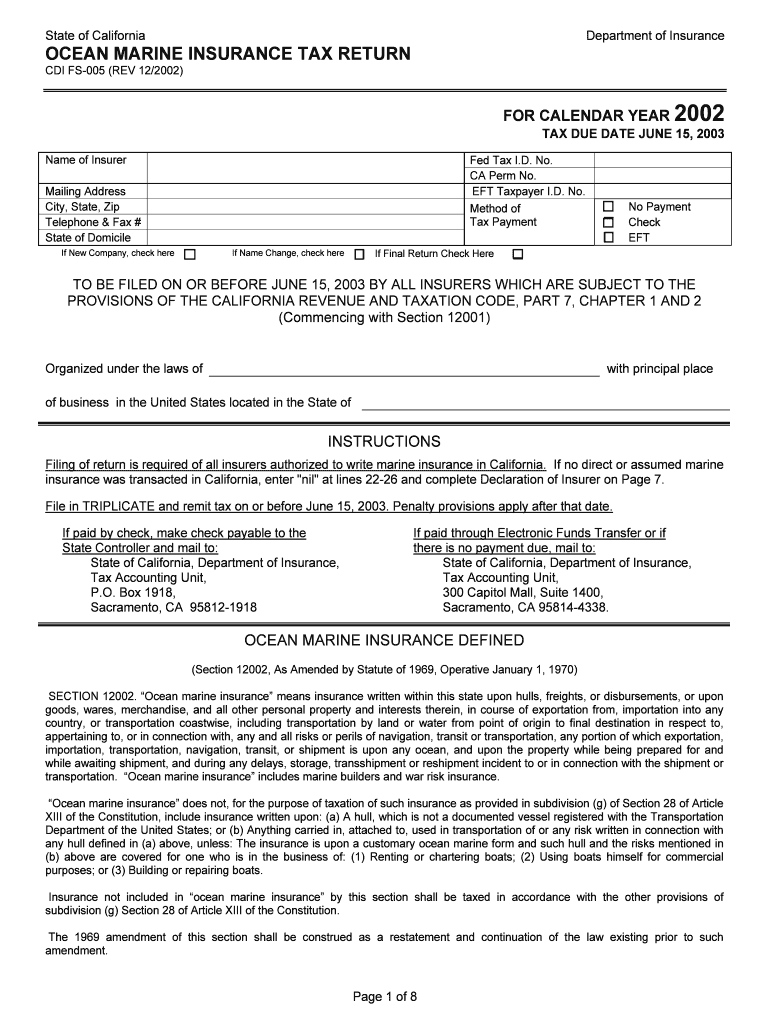

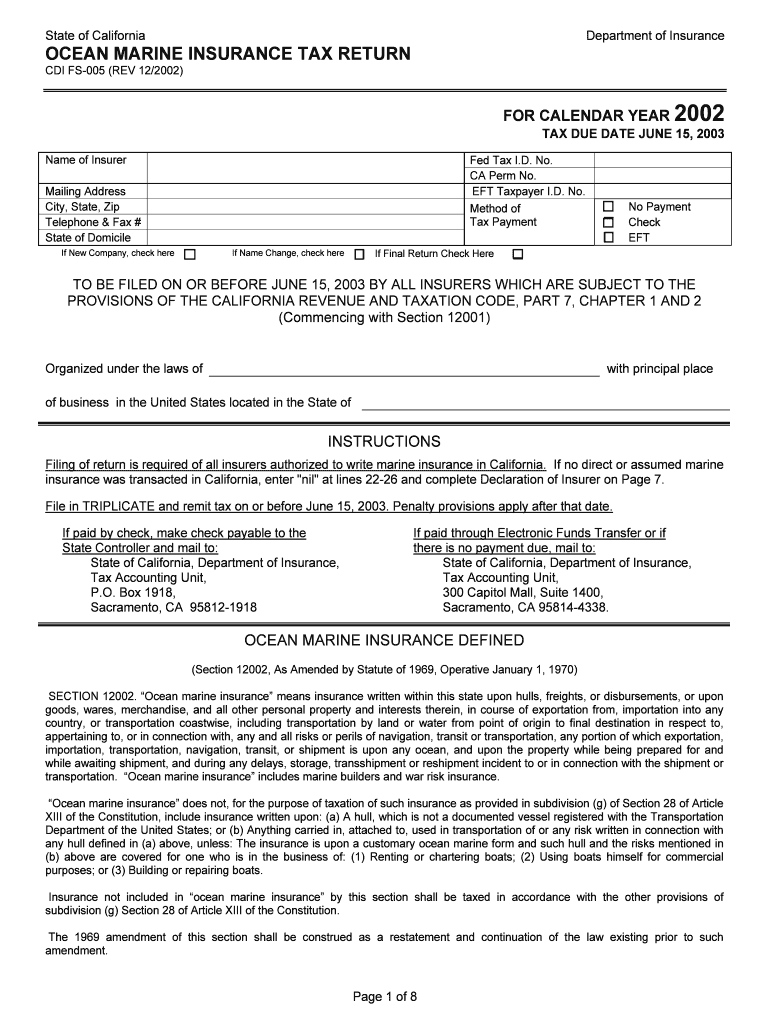

This document is a tax return for insurers authorized to write marine insurance in California for the calendar year 2002, detailing required information for tax calculations and submission.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ocean marine insurance tax

Edit your ocean marine insurance tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ocean marine insurance tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ocean marine insurance tax online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ocean marine insurance tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ocean marine insurance tax

How to fill out OCEAN MARINE INSURANCE TAX RETURN

01

Gather necessary documents and information related to your ocean marine insurance activities.

02

Start with the identification section, including your name, address, and taxpayer identification number.

03

Report the total gross premiums received from ocean marine insurance for the reporting period.

04

Deduct any allowable expenses related to your ocean marine insurance business.

05

Calculate the taxable income from your ocean marine insurance activities.

06

Complete any additional schedules or forms required for your specific situation.

07

Review the entire return for accuracy and completeness.

08

Submit the completed return by the relevant due date, along with any required payments.

Who needs OCEAN MARINE INSURANCE TAX RETURN?

01

Individuals and businesses involved in providing ocean marine insurance services.

02

Insurance companies that underwrite ocean marine insurance policies.

03

Self-employed marine insurance agents and brokers.

04

Anyone claiming deductions for marine insurance related expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the return premium in marine insurance?

If your marine insurance policy says that you can get back all or part of the money you paid for the insurance (the premium) if something specific happens, and that thing does happen, then you're entitled to get that money back. To disable ads and read rest of the premium content, subscribe to KanoonGPT Pro.

What are the three types of marine insurance?

Types of Marine Insurance Policy Floating Policy – Also known as an open policy, or a blanket policy. Voyage Policy – A Marine Insurance policy designed to cover a single shipment or consignment. Time Policy – A Marine Insurance policy that is issued for a fixed period of time, usually a year.

What are the rules for marine insurance?

— A marine policy must specify — (1) the name of the assured, or of some person who effects the insurance on his behalf; (2) the subject-matter insured and the risk insured against; (3) the voyage, or period of time, or both, as the case may be, covered by the insurance; (4) the sum or sums insured; (5) the name or names

What is marine insurance in English?

Marine insurance offers coverage for any damage or loss related to ships, cargo, terminals, transports, or transfer. Simply put, a marine insurance policy will cover any loss or damage surrounding the boat or watercraft.

What is ocean marine insurance coverage?

Ocean marine insurance covers various risks and perils associated with transporting goods and cargo over water. Over time, this coverage has evolved to encompass an array of maritime sectors, extending its benefits to a diverse range of marine service providers.

What does marine insurance protect against?

Marine insurance provides coverage for goods, ships, and other transport means against risks like damage, theft, or loss during transit. The policyholder pays a premium based on the value of the shipment and the associated risks.

How to claim marine insurance?

Claim Settlement Process in Marine Insurance Notification of Loss. The first step in the claim settlement process is the notification of loss. Documentation and Assessment. Survey and Assessment. Claim Review. Quantification of Loss. Settlement Offer. Negotiation and Agreement. Payment.

What is the advantage of marine insurance?

Marine insurance offers financial protection to businesses against the loss or damage of goods in transit, whether shipped by sea, air, road, rail or inland waterways. It covers cargo during various stages of transport, including loading and unloading at ports and movement between destinations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OCEAN MARINE INSURANCE TAX RETURN?

OCEAN MARINE INSURANCE TAX RETURN is a tax document filed by entities engaged in providing marine insurance coverage. It details the premiums earned and other relevant financial information related to marine insurance activities.

Who is required to file OCEAN MARINE INSURANCE TAX RETURN?

Entities or businesses that underwrite marine insurance policies and collect premiums are required to file the OCEAN MARINE INSURANCE TAX RETURN.

How to fill out OCEAN MARINE INSURANCE TAX RETURN?

To fill out the OCEAN MARINE INSURANCE TAX RETURN, gather all relevant financial data including premiums collected, claims paid out, and any applicable deductions. Follow the specific guidelines provided in the tax form instructions to ensure accurate reporting.

What is the purpose of OCEAN MARINE INSURANCE TAX RETURN?

The purpose of the OCEAN MARINE INSURANCE TAX RETURN is to report income and expenses from marine insurance activities to tax authorities, ensuring compliance with tax regulations and the accurate calculation of tax liabilities.

What information must be reported on OCEAN MARINE INSURANCE TAX RETURN?

The OCEAN MARINE INSURANCE TAX RETURN must report information including total premiums earned, claims paid, administrative expenses, other deductions, and any relevant adjustments or credits applicable to marine insurance operations.

Fill out your ocean marine insurance tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ocean Marine Insurance Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.