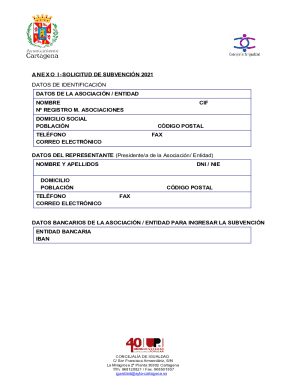

Get the free San Francisco Redevelopment Multifamily Bond Program - treasurer ca

Show details

This document provides an overview of the San Francisco Redevelopment Agency's Multifamily Bond Program, detailing bond issuance terms, funding requirements, underwriting processes, and compliance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign san francisco redevelopment multifamily

Edit your san francisco redevelopment multifamily form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your san francisco redevelopment multifamily form via URL. You can also download, print, or export forms to your preferred cloud storage service.

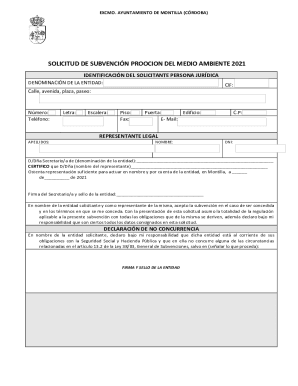

Editing san francisco redevelopment multifamily online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit san francisco redevelopment multifamily. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

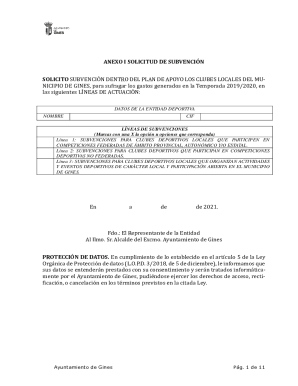

How to fill out san francisco redevelopment multifamily

How to fill out San Francisco Redevelopment Multifamily Bond Program

01

Gather necessary financial documents, including tax returns and income statements.

02

Review the eligibility criteria specific to the San Francisco Redevelopment Multifamily Bond Program.

03

Fill out the application form completely with accurate personal and property information.

04

Provide detailed descriptions of the multifamily project, including plans and budget estimates.

05

Attach supporting documentation, such as project feasibility studies and community benefit plans.

06

Submit the completed application to the appropriate housing department or agency.

07

Follow up with the agency for any additional documentation or clarification requests.

08

Attend any required meetings or hearings to discuss your application.

Who needs San Francisco Redevelopment Multifamily Bond Program?

01

Developers looking to finance multifamily housing projects in San Francisco.

02

Investors seeking to support affordable housing initiatives.

03

Organizations focused on community development and housing equity.

04

Individuals or groups aiming to create or rehabilitate multifamily residential units.

Fill

form

: Try Risk Free

People Also Ask about

What is a bond in simple terms?

A bond is a loan that the bond purchaser, or bondholder, makes to the bond issuer. Governments, corporations and municipalities issue bonds when they need capital. An investor who buys a government bond is lending the government money. If an investor buys a corporate bond, the investor is lending the corporation money.

What is a bond in immigration?

What is an immigration bond? A bond is an amount of money someone pays to the Department of Homeland Security to assure them that if you are released, you will come to court for all your future hearings (and ICE check-ins). How much is a bond? By law the lowest possible bond is $1,500.

What is the bond programme?

A bond is a form of a public security. When issued, bonds provide local governments with funds to finance large capital improvements. A bond program includes both the authority to issue bonds and a listing of the purposes for which the funds may be used.

What is the downside of buying I bonds?

You're locked in for the first year, unable to sell at all. Even after that, there's a penalty of three months' interest if you sell before five years. So if you think you'll need any of the money before that, I bonds may not be for you.

What is a bond program?

The CalHFA Bond Recycling Program is designed to preserve and recycle prior year(s) tax-exempt private activity bond volume cap that would otherwise expire upon repayment of construction period financing (resulting in redemption of bonds) to be accessed by developers that seek construction and/or rehabilitation

What is the CalPFA's affordable housing bond program?

CalPFA's Affordable Housing Bond Program provides for-profit and nonprofit developers access to tax-exempt bonds to finance low-income multifamily and senior housing projects.

What is the CalHFA bond recycling program?

The Mortgage Revenue Bond (MRB) and tax-exempt multifamily Housing Bond programs (collectively, Housing Bonds) are financing tools used by state housing finance agencies (HFAs) to finance low-interest mortgages for low- and moderate-income home buyers and to acquire, construct, and rehabilitate multifamily housing for

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is San Francisco Redevelopment Multifamily Bond Program?

The San Francisco Redevelopment Multifamily Bond Program is a financing initiative that allows for the construction and rehabilitation of multifamily housing in San Francisco using tax-exempt bonds. It aims to promote affordable housing development.

Who is required to file San Francisco Redevelopment Multifamily Bond Program?

Developers and property owners seeking to utilize the financing provided through the San Francisco Redevelopment Multifamily Bond Program are required to file. This typically includes those planning to build or rehabilitate multifamily housing projects in the city.

How to fill out San Francisco Redevelopment Multifamily Bond Program?

To fill out the San Francisco Redevelopment Multifamily Bond Program application, one must collect necessary information about the proposed project, including project costs, financing details, and compliance with affordable housing requirements, then submit the completed application form to the appropriate city agency.

What is the purpose of San Francisco Redevelopment Multifamily Bond Program?

The purpose of the San Francisco Redevelopment Multifamily Bond Program is to provide a source of funding for the development of affordable multifamily housing, thereby addressing the city's housing crisis and promoting community revitalization.

What information must be reported on San Francisco Redevelopment Multifamily Bond Program?

Information that must be reported includes project details, financing sources, compliance with affordability requirements, anticipated impacts on the community, and progress towards the completion of the multifamily housing project.

Fill out your san francisco redevelopment multifamily online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

San Francisco Redevelopment Multifamily is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.