Get the free Pooled Money Investment Account Portfolio Summary Report - treasurer ca

Show details

This document provides a summary of the Pooled Money Investment Account (PMIA) as of September 19, 2012, detailing portfolio performance, loan approvals, investment designations, and surplus money

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pooled money investment account

Edit your pooled money investment account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pooled money investment account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pooled money investment account online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pooled money investment account. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

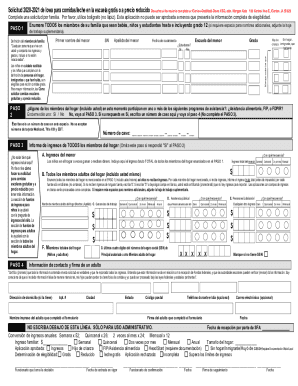

How to fill out pooled money investment account

How to fill out Pooled Money Investment Account Portfolio Summary Report

01

Gather all relevant financial data pertaining to the investments in the pooled money account.

02

Include the date range for the report at the top of the document.

03

List each investment along with its corresponding amount and type.

04

Calculate the total value of the investments in the account.

05

Disclose any income generated from the investments during the reporting period.

06

Include notes regarding any changes in investment strategy or management.

07

Ensure all figures are accurate and clearly labeled.

08

Review the completed report for any errors or omissions before submitting.

Who needs Pooled Money Investment Account Portfolio Summary Report?

01

Investment managers overseeing pooled money accounts.

02

Accountants responsible for financial reporting.

03

Regulatory bodies requiring compliance reports.

04

Investors seeking transparency in portfolio performance.

05

Financial analysts conducting performance evaluations.

Fill

form

: Try Risk Free

People Also Ask about

What is the pooled money investment account in California?

PMIA stands for Pooled Money Investment Account. The PMIA is how the State Treasurer invests taxpayers' money to manage California's cash flow and support the financial security of local governments. The main goals? Safety, liquidity, and yield!

What is the difference between a mutual fund and a pooled fund?

The major difference between pooled funds and mutual funds is their legal status under securities law. Pooled funds are not “public” investments, which means investment and trading in pooled funds is restricted. Securities legislation defines the rules for a “public” security.

What is a pooled investment account?

The pooled investment account lets the investors be treated as a single account holder, enabling them to buy more shares collectively than they could individually, and often for better — discounted — prices. Mutual funds are among the best-known of pooled funds.

What is the pooled money investment account?

Through the Pooled Money Investment Account (PMIA), the State Treasurer invests taxpayers' money to manage the State's cash flow and strengthen the financial security of local governmental entities. PMIA policy sets as primary investment objectives safety, liquidity and yield.

What are the disadvantages of pooled funds?

Disadvantages of Pooled Funds High fees. Several pooled funds may charge high fees, including management fees and other expenses, which can take a significant share of the investor's returns. Lack of control. Market risk. Lack of customisation.

What is a laif?

Local Agency Investment Fund (LAIF)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Pooled Money Investment Account Portfolio Summary Report?

The Pooled Money Investment Account Portfolio Summary Report is a document that provides a summary of investments held in a pooled money investment account. It includes details about the types of investments, their performance, and overall portfolio composition.

Who is required to file Pooled Money Investment Account Portfolio Summary Report?

Entities that manage pooled money investment accounts, such as state and local government agencies, are typically required to file this report to ensure transparency and accountability regarding their investment activities.

How to fill out Pooled Money Investment Account Portfolio Summary Report?

To fill out the Pooled Money Investment Account Portfolio Summary Report, entities must gather relevant financial data, including investment types, amounts, dates, and yield rates, and accurately input this information into the designated fields of the report template.

What is the purpose of Pooled Money Investment Account Portfolio Summary Report?

The purpose of the Pooled Money Investment Account Portfolio Summary Report is to provide stakeholders and regulatory bodies with a clear overview of how pooled funds are being invested and managed, promoting transparency and ensuring compliance with investment regulations.

What information must be reported on Pooled Money Investment Account Portfolio Summary Report?

The report must include information such as the total value of the pooled account, individual investment details (including type and amount), overall performance metrics, and the dates of transactions or endorsements made.

Fill out your pooled money investment account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pooled Money Investment Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.