Get the free Surety Bond - Supervised Lender - coloradoattorneygeneral

Show details

This document serves as a surety bond for a supervised lender in Colorado, ensuring financial responsibility and compliance with the Colorado Uniform Consumer Credit Code (UCCC).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond - supervised

Edit your surety bond - supervised form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond - supervised form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing surety bond - supervised online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit surety bond - supervised. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

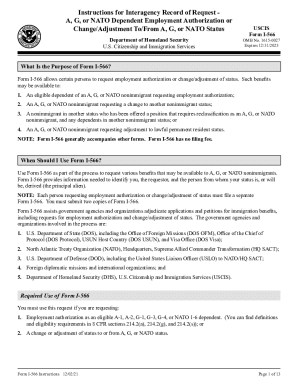

How to fill out surety bond - supervised

How to fill out Surety Bond - Supervised Lender

01

Gather necessary documentation required for the Surety Bond application.

02

Determine the amount of the Surety Bond based on state requirements and the type of lending you provide.

03

Contact a licensed surety bond provider or agent who specializes in supervised lenders.

04

Complete the application form provided by the surety bond company, providing accurate and truthful information.

05

Submit any required financial statements or proof of financial stability.

06

Pay the premium required for the bond, which is typically a percentage of the total bond amount.

07

Upon approval, review the bond documentation for accuracy before signing.

08

Submit the signed bond to the appropriate regulatory agency or authority as required.

Who needs Surety Bond - Supervised Lender?

01

Individuals or businesses operating as supervised lenders, which includes those providing loans in accordance with state regulations.

02

Lending institutions that must comply with legal requirements to secure a surety bond to operate legally.

03

Entities seeking to establish trust with clients, as a Surety Bond ensures protection against potential misconduct.

Fill

form

: Try Risk Free

People Also Ask about

How much does a $5000 surety bond cost?

$5,000 surety bonds typically cost 0.5–10% of the bond amount, or $25–$500.

What is the primary purpose of a surety bond?

What Is the Purpose of a Surety Bond? Surety bonds provide financial guarantees that contracts and other business deals will be completed ing to mutual terms. Their primary purpose is to protect consumers and government entities from loss due to poor workmanship, malpractice, theft and fraud.

What is a surety bond good for?

A surety bond is a legally binding agreement that guarantees performance, compliance or even payment. It is not considered insurance. The agreement is composed of three parties: the obligee entity requiring the bond, the principal individual applying for the bond and the surety entity who is issuing bond.

What is the purpose of a surety bond?

Surety bonds are an essential risk management tool. In its simplest form, a surety bond is a written agreement, often required by law, to guarantee performance or payment of another company's obligation under a separate contract or compliance with a law or regulation.

Under what circumstances a surety bond is required?

When do I need a contract surety bond? Any federal construction contract valued at $150,000 or more requires surety bonds when a contractor bids or as a condition of contract award. Most state and municipal governments have a similar requirement. Many private owners also elect to require contract surety bonds.

What is better, a surety bond or a letter of credit?

Enhanced Security & Working Capital. A surety bond leaves the Principal free to allocate capital strategically, while an LC will likely tie up capital and impact existing credit lines or loan covenants. A surety bond is also backed by the financial security and stability of the Surety provider.

What are the three types of surety bonds?

There are many types of surety bonds, and each state has its own bonding requirements for different industries. However, there are four major types of surety bonds that you should know: license and permit bonds, contract bonds, court bonds, and fidelity bonds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Surety Bond - Supervised Lender?

A Surety Bond - Supervised Lender is a legally binding agreement where a surety company guarantees the obligations of a lender who is supervised by a financial regulatory authority. It ensures compliance with lending laws and protects consumers.

Who is required to file Surety Bond - Supervised Lender?

Any lender who operates under supervision of a financial regulatory authority and is authorized to provide loans is typically required to file a Surety Bond - Supervised Lender.

How to fill out Surety Bond - Supervised Lender?

To fill out a Surety Bond - Supervised Lender, the lender must complete the bond form with details such as the lender's name, address, license number, and the amount of the bond, along with signatures from the lender and surety company representatives.

What is the purpose of Surety Bond - Supervised Lender?

The purpose of a Surety Bond - Supervised Lender is to ensure that lenders operate in compliance with laws and regulations, protecting consumers from potential misconduct or failure to meet financial obligations.

What information must be reported on Surety Bond - Supervised Lender?

The information that must be reported on a Surety Bond - Supervised Lender includes the bond amount, names and addresses of all parties involved, the date of execution, and any conditions or terms set forth by the regulatory authority.

Fill out your surety bond - supervised online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond - Supervised is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.