Get the free HOUSE BILL 11-1265 - state co

Show details

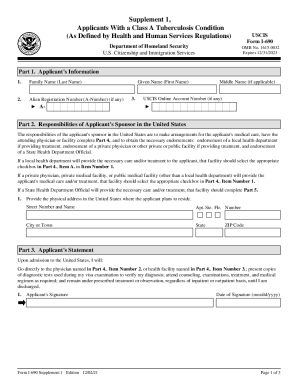

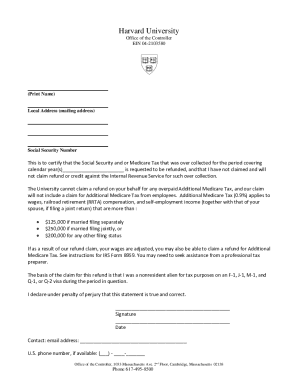

An act concerning the filing of claims for refunds of sales or use tax, including provisions on criminal penalties for false statements and clarifications on statutes of limitations for refunds.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign house bill 11-1265

Edit your house bill 11-1265 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your house bill 11-1265 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing house bill 11-1265 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit house bill 11-1265. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out house bill 11-1265

How to fill out HOUSE BILL 11-1265

01

Obtain a copy of HOUSE BILL 11-1265 form from the official website or authorized office.

02

Read the instructions carefully to understand the purpose of the bill

03

Fill in your personal information in the designated sections, including name, address, and contact details.

04

Provide any required documentation or supporting materials as specified.

05

Review the bill for any errors or omissions.

06

Sign and date the document where indicated.

07

Submit the completed form by the specified deadline.

Who needs HOUSE BILL 11-1265?

01

Individuals or organizations affected by the regulations set forth in HOUSE BILL 11-1265.

02

Anyone seeking to comply with legal requirements established by the bill.

03

Stakeholders aiming to participate in the processes regulated by HOUSE BILL 11-1265.

Fill

form

: Try Risk Free

People Also Ask about

What is House Bill 1301?

New House Bill H.R. 1301 has been introduced in Congress, proposing the elimination of estate and generation-skipping transfer taxes. This bill, if passed, would completely change the estate planning for individuals with taxable estates.

What is House Bill 1540?

I appreciate the opportunity to provide testimony on House Bill 1540, a bill that proposes a significant step toward ensuring educational opportunity and equity for all North Dakota students. This legislation establishes an education savings account (ESA) program, providing families.

What happens when a bill that is ready to be signed comes before the President?

Summary. Mississippi lawmakers have approved the most radical and costly change to the state's personal income tax system to date. House Bill 1, which was recently signed by Gov. Tate Reeves, ultimately eliminates Mississippi's personal income tax.

What is House Bill 228?

228 - To amend the Internal Revenue Code of 1986 to increase and adjust for inflation the above-the-line deduction for teachers.

How many readings on the floor of each house does the Constitution require a bill to go through?

The California Constitution requires a bill to be “read” three times before it can be debated and voted upon by either house.

What is House Bill 1 in Mississippi?

Only the House can originate revenue legislation, and only the Senate confirms presidential nominations and approves treaties, but the enactment of law always requires both chambers to separately agree to the same bill in the same form before presenting it to the President.

What is the House bill 1301 in Florida?

Child Welfare; Authorizes Office of Statewide Prosecution to investigate & prosecute specified violations; revises provisions relating to false reports of abuse, abandonment, & neglect; requires DCF to enter into agreements with certain military installations for child protective investigations; authorizes law

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HOUSE BILL 11-1265?

HOUSE BILL 11-1265 is a legislative bill that focuses on addressing specific policy issues within a state, often related to public welfare or administrative processes.

Who is required to file HOUSE BILL 11-1265?

Individuals or entities that are impacted by the provisions of the bill, as specified in the legislation, are typically required to file HOUSE BILL 11-1265.

How to fill out HOUSE BILL 11-1265?

To fill out HOUSE BILL 11-1265, one must follow the provided guidelines in the bill, ensuring all required sections are completed accurately and necessary documentation is attached.

What is the purpose of HOUSE BILL 11-1265?

The purpose of HOUSE BILL 11-1265 is to implement changes in law or policy that promote better governance or address specific issues affecting the community or state.

What information must be reported on HOUSE BILL 11-1265?

The information that must be reported on HOUSE BILL 11-1265 typically includes identifying information, details about the issue being addressed, and any required data or documentation as outlined in the bill.

Fill out your house bill 11-1265 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

House Bill 11-1265 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.