Get the free Senate Bill 06-033 - state co

Show details

This document is a legislative act that details the repeal of obsolete statutory provisions in the Colorado Revised Statutes, concerning various aspects of state governance and funding mechanisms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign senate bill 06-033

Edit your senate bill 06-033 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your senate bill 06-033 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit senate bill 06-033 online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit senate bill 06-033. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

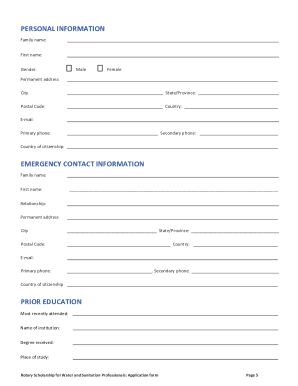

How to fill out senate bill 06-033

How to fill out Senate Bill 06-033

01

Obtain a copy of Senate Bill 06-033 from the official state website or your local legislative office.

02

Read through the entire bill to understand its purpose and implications.

03

Gather all necessary information and documentation required to complete the bill.

04

Fill out the designated sections of the bill accurately, ensuring that all information is legible.

05

Review your entries for completeness and correctness before submission.

06

Submit the completed form to the appropriate legislative office or designated department as specified in the bill.

Who needs Senate Bill 06-033?

01

Individuals or organizations impacted by the provisions outlined in Senate Bill 06-033.

02

Citizens seeking to participate in the legislative process related to the bill.

03

Lobbyists or advocacy groups aiming to influence outcomes related to the bill.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between a house bill and a senate bill?

Only the House can originate revenue legislation, and only the Senate confirms presidential nominations and approves treaties, but the enactment of law always requires both chambers to separately agree to the same bill in the same form before presenting it to the President.

What is the bill to reduce property taxes in Colorado?

Colorado Lawmakers Approve Bipartisan Bill to Lower Property Taxes for Homes and Businesses. Governor Jared Polis signed into law House Bill 24B-1001, a bill Colorado lawmakers successfully passed designed to reduce property taxes for homeowners and businesses, wrapping up a special four-day legislative session.

At what age do you stop paying property tax in Colorado?

Eligibility Requirements The applicant is at least 65 years old on January 1 of the year in which he/she applies; and.

What is the Senate Bill 33 in Colorado about alcohol?

Senate Bill 33 was brought in response to the recent expansion of beer and wine sales in grocery stores, which has dramatically reduced the sales of Colorado's independent alcohol retailers. Colorado law limits the number of grocery stores that can sell hard liquor, like vodka, tequila and whiskey.

What is the lodging property tax treatment bill in Colorado?

The bill establishes that, for property tax years commencing on or after January 1, 2026, a short-term rental unit, which is an improvement that is designated and used as a place of residency by a person, family, or families, but that is also leased for overnight lodging for less than 30 consecutive days in exchange

What is the Senate Bill 6 in CT?

AN ACT CONCERNING RESOURCES AND SUPPORTS FOR INFANTS, TODDLERS AND DISCONNECTED YOUTHS. To provide support for children from birth to age five and address challenges faced by disconnected youths.

Who is exempt from property taxes in Colorado?

The Colorado Constitution establishes a property tax exemption for senior citizens, surviving spouses of senior citizens, disabled veterans and gold star spouses. For those who qualify, 50 percent of the first $200,000 in actual value of their primary residence is exempted.

Did SB24 233 pass in Colorado?

Jared Polis signed bill SB24-233 into law at Boettcher Mansion in Denver on Tuesday, May 14, 2024. Based largely on recommendations from the state's Commission on Property Tax, Colorado lawmakers passed SB24-233 at the end of the 2024 legislative session.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Senate Bill 06-033?

Senate Bill 06-033 is a legislative bill proposed in a specific state that addresses certain regulations or policies, typically related to government funding, education, healthcare, or social issues.

Who is required to file Senate Bill 06-033?

Individuals or organizations that are impacted by the regulations set forth in Senate Bill 06-033 are typically required to file. This may include public agencies, educational institutions, or businesses that fall under the bill's jurisdiction.

How to fill out Senate Bill 06-033?

To fill out Senate Bill 06-033, the filer should follow the specific instructions provided in the bill documentation, which usually includes providing relevant personal or organizational information, and responding to specific sections or questions outlined in the bill.

What is the purpose of Senate Bill 06-033?

The purpose of Senate Bill 06-033 is to implement or modify regulations, allocate funding, or introduce new policies that aim to address specific issues within the state, as outlined in the introductory section of the bill.

What information must be reported on Senate Bill 06-033?

The information that must be reported on Senate Bill 06-033 typically includes details such as the name of the filer, contact information, the nature of the report, and any relevant data or statistics that pertain to the subject matter of the bill.

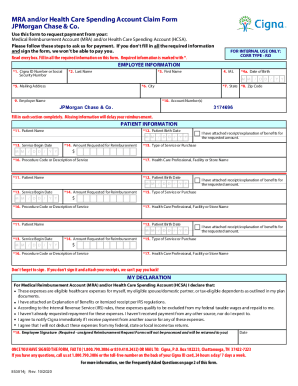

Fill out your senate bill 06-033 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Senate Bill 06-033 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.