Get the free Insurance - state co

Show details

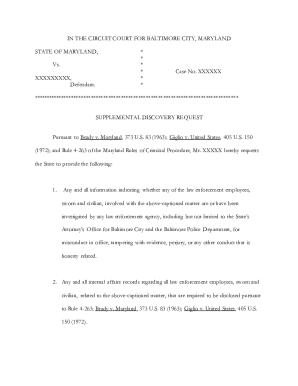

An act concerning the elimination of requirements for approval by the commissioner of insurance for certain types of insurance in Colorado, aimed at promoting open competition among insurers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance - state co

Edit your insurance - state co form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance - state co form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing insurance - state co online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit insurance - state co. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance - state co

How to fill out Insurance

01

Gather necessary documents: Collect personal identification, proof of income, and any existing insurance policies.

02

Choose the type of insurance: Determine whether you need health, auto, home, life, or another type of insurance.

03

Research providers: Compare different insurance companies and their policies online or through a broker.

04

Complete application: Fill out the insurance application form with accurate personal and financial information.

05

Provide required documentation: Submit any requested documents to support your application.

06

Review policy options: Look over the coverage options, limits, and premiums provided by the insurer.

07

Ask questions: Clarify any doubts with the insurance agent to ensure you understand the terms.

08

Make your selection: Choose the policy that best fits your needs and budget.

09

Submit payment: Pay your premium to activate the policy.

10

Keep a copy: Save a copy of your policy documents for future reference.

Who needs Insurance?

01

Individuals: Anyone wanting financial protection from various risks such as health issues, accidents, or property damage.

02

Families: Households need insurance to safeguard their loved ones and assets.

03

Homeowners: Individuals who own homes require property insurance to protect against damages and liabilities.

04

Vehicle owners: People who drive cars often need auto insurance to cover liabilities and potential damages.

05

Business owners: Enterprises require insurance to protect against business-related risks and liabilities.

06

Renters: Even those who rent need insurance to cover personal belongings within the rental property.

07

Professionals: Individuals like doctors, consultants, and contractors may need professional liability insurance.

Fill

form

: Try Risk Free

People Also Ask about

What is insurance in American English?

0:03 0:10 Insurance insurance.MoreInsurance insurance.

What are the 3 DS of insurance?

The Short Answer The 3 D's of insurance are “delay, deny, and defend.” They represent the 3-part strategy insurance companies use to avoid paying policyholders what they may be owed.

What are the three main types of insurance?

There are many forms of insurance available to consumers today, offering protection for everything from our health, vehicles, and homes, even our pets and travel plans. Most Americans have at least one of these coverages, with health, life, homeowners, and auto among the most common.

What is the term insurance in English?

Key Takeaways. Term insurance is a type of life insurance policy that provides coverage for a certain period of time, such as 30 years. If the insured dies during the time period specified in a term policy and the policy is active, then a death benefit will be paid.

What is the most popular type of insurance plan?

Preferred provider organization (PPO) plans The preferred provider organization (PPO) plan is the most common type of health plan.

What are the 4 most important insurances?

Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have. Employer coverage is often the best option, but if that is unavailable, obtain quotes from several providers as many provide discounts if you purchase more than one type of coverage.

What is insurer English?

Meaning of insurer in English. a person or company that insures someone or something: Please contact your insurer if you have any questions.

What are the top 3 types of insurance?

Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have. Employer coverage is often the best option, but if that is unavailable, obtain quotes from several providers as many provide discounts if you purchase more than one type of coverage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

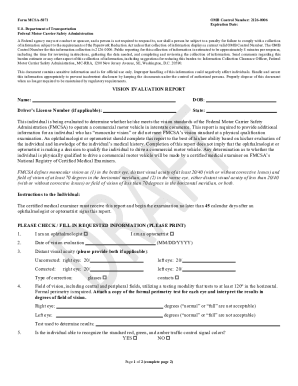

What is Insurance?

Insurance is a financial product that provides protection against financial loss or risk. It involves the transfer of risk from an individual or entity to an insurance company in exchange for premium payments.

Who is required to file Insurance?

Individuals, businesses, and organizations are required to file insurance based on specific legal or contractual obligations, such as owning a vehicle, real estate, or operating a business.

How to fill out Insurance?

To fill out insurance, one must complete an application form provided by the insurance company, providing accurate information about personal details, property, desired coverage, and any relevant disclosures.

What is the purpose of Insurance?

The purpose of insurance is to mitigate financial risk by providing compensation for loss or damages, ensuring financial security and peace of mind for individuals and businesses.

What information must be reported on Insurance?

Information that must be reported includes personal details (name, address, date of birth), type of coverage sought, property details, prior claims history, and any material facts that could affect the risk assessment.

Fill out your insurance - state co online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance - State Co is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.