Get the free House Bill 99-1152 - state co

Show details

An act concerning clarification of affiliation requirements for electors in the state of Colorado.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign house bill 99-1152

Edit your house bill 99-1152 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your house bill 99-1152 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing house bill 99-1152 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit house bill 99-1152. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

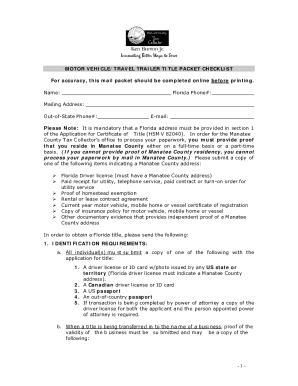

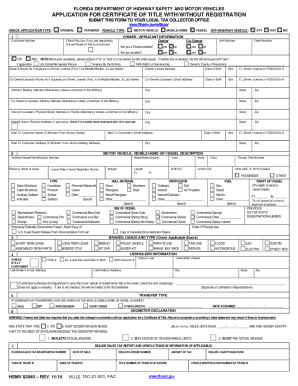

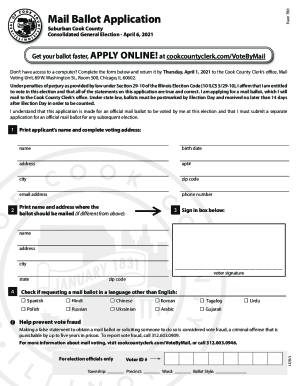

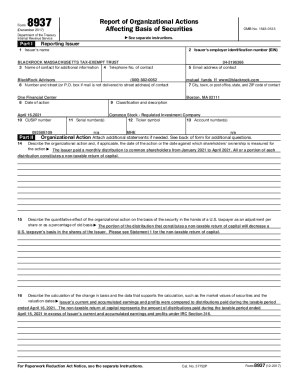

How to fill out house bill 99-1152

How to fill out House Bill 99-1152

01

Obtain a copy of House Bill 99-1152 from the appropriate legislative website or office.

02

Read the bill thoroughly to understand its provisions and implications.

03

Locate the designated sections where your personal information is required.

04

Fill in your details as requested, ensuring accuracy and completeness.

05

Review the completed form for any errors or omissions.

06

Submit the filled-out House Bill 99-1152 to the relevant authority or department.

Who needs House Bill 99-1152?

01

Individuals impacted by the provisions of House Bill 99-1152.

02

Organizations or entities that are required to comply with the regulations outlined in the bill.

03

Legal representatives or advocates assisting affected parties.

Fill

form

: Try Risk Free

People Also Ask about

What is the HR 1152 Electronic Filing and payment Fairness Act?

Summary. H.R. 1152, the Electronic Filing and Payment Fairness Act, would require the IRS to consider a document or payment as having been made on time if the date on which it is sent electronically is on or before the due date, regardless of the date the document is marked as received.

What is the Electronic Filing and Payment Fairness Act?

The reform proposed in the TAS Act and the Electronic Filing and Payment Fairness Act would create a fairer, more efficient tax system. It removes the current inconsistency between paper and electronic submissions, aligning the treatment of digital and traditional methods.

What is the HR 1152 Electronic Filing and Payment Fairness Act as amended?

Electronic Filing and Payment Fairness Act This bill provides that a federal tax document or payment that is electronically submitted to the Internal Revenue Service (IRS) shall be considered delivered to the IRS on the date such document or payment is sent.

What is House Bill 1301?

New House Bill H.R. 1301 has been introduced in Congress, proposing the elimination of estate and generation-skipping transfer taxes. This bill, if passed, would completely change the estate planning for individuals with taxable estates.

What is the HR 17 Paycheck Fairness Act?

The bill directs the Department of Labor to (1) establish and carry out a grant program to provide training in negotiation skills related to compensation and equitable working conditions, (2) conduct studies to eliminate pay disparities between men and women, and (3) make available information on wage discrimination to

What is the Electronic Filing and payment Fairness Act?

The reform proposed in the TAS Act and the Electronic Filing and Payment Fairness Act would create a fairer, more efficient tax system. It removes the current inconsistency between paper and electronic submissions, aligning the treatment of digital and traditional methods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is House Bill 99-1152?

House Bill 99-1152 is a legislative bill that provides specific regulations and guidelines related to certain activities or requirements, as determined by its text and intended purpose.

Who is required to file House Bill 99-1152?

Individuals or entities specified within the bill's stipulations, typically those who engage in the activities governed by the bill, are required to file House Bill 99-1152.

How to fill out House Bill 99-1152?

To fill out House Bill 99-1152, one must carefully complete the provided forms by entering the required information accurately, following any accompanying instructions for submission.

What is the purpose of House Bill 99-1152?

The purpose of House Bill 99-1152 is to establish legal frameworks and procedures that govern specific practices or policies, ensuring compliance and regulation within the designated area.

What information must be reported on House Bill 99-1152?

The information that must be reported on House Bill 99-1152 includes personal and organizational details, specifics regarding the activities covered by the bill, and any relevant compliance data as required by the legislation.

Fill out your house bill 99-1152 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

House Bill 99-1152 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.