Get the free Financial Institutions - state co

Show details

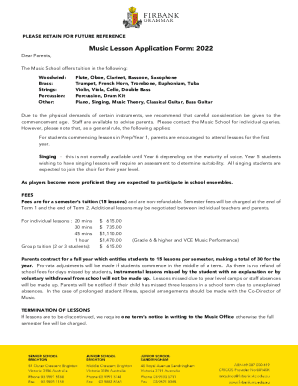

An act concerning the authority of banks to sell annuity contracts in Colorado, detailing regulations and restrictions for banks and bank holding companies regarding the sale of such financial products.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial institutions - state

Edit your financial institutions - state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial institutions - state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial institutions - state online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial institutions - state. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial institutions - state

How to fill out Financial Institutions

01

Gather all necessary financial documents such as income statements, tax returns, and identification.

02

Visit the website of the financial institution or go to a local branch to access the application form.

03

Carefully read the instructions provided for filling out the form.

04

Fill out personal information including name, address, and contact details.

05

Provide financial information such as income sources, assets, and liabilities.

06

Specify the type of account or service you are applying for (e.g., savings account, loan, investment).

07

Review your application for accuracy and completeness.

08

Submit the application form online or in person as instructed.

Who needs Financial Institutions?

01

Individuals seeking to save money or invest.

02

Businesses looking for loans or credit facilities.

03

People needing assistance with mortgage or home financing.

04

Individuals requiring financial advice or wealth management services.

05

Organizations seeking banking services for transactions and fund management.

Fill

form

: Try Risk Free

People Also Ask about

What are financial institutions?

A financial institution (FI) is a company engaged in the business of dealing with financial and monetary transactions such as deposits, loans, investments, and currency exchange. Financial institutions are vital to a functioning capitalist economy in matching people seeking funds with those who can lend or invest it.

What are the four types of financial markets?

The four main types of financial markets are stocks, bonds, forex, and derivatives.

What are the top 5 financial firms?

JPMorgan Chase & Co, Corp, Wells Fargo & Co, Citigroup Inc, and The Goldman Sachs Group Inc are the top 5 banks in the US in 2021 by revenue.

What are the Big 4 financial institutions?

“The Big 4” refers to the four largest accounting and auditing firms in the world, which bring in billions in revenue. Ranked by 2020 revenue figures, the Big 4 are Deloitte LLP (Deloitte), PricewaterhouseCoopers (PwC), Ernst & Young (EY) and Klynveld Peat Marwick Goerdeler (KPMG), respectively.

What are the 6 financial institutions?

Central Banks. Retail and Commercial Banks. Credit Unions. Savings and Loan (S&L) Associations. Investment Banks. Brokerage Firms. Insurance Companies. Mortgage Companies.

What are the 3 types of financial institutions and how are they different?

Banks emphasize business and consumer accounts, and many provide trust services. Credit unions emphasize consumer deposit and loan services. Savings institutions emphasize real estate financing.

What are the 4 types of financial institutions?

There are four main types of financial services: commercial banks, credit unions, insurance companies, and investment firms. Commercial banks are the most common type of financial institution. They offer a full range of services, including checking and savings accounts, loans, mortgages, and credit cards.

What are the 7 major types of financial institutions?

Central Banks. Retail and Commercial Banks. Credit Unions. Savings and Loan (S&L) Associations. Investment Banks. Brokerage Firms. Insurance Companies. Mortgage Companies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Institutions?

Financial Institutions are organizations that provide financial services such as banking, investment, insurance, and asset management, facilitating the flow of money in the economy.

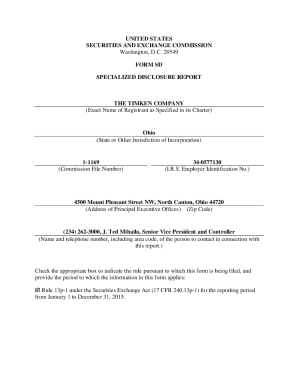

Who is required to file Financial Institutions?

Typically, financial institutions such as banks, credit unions, investment firms, and insurance companies are required to file reports related to their financial activities, especially for regulatory compliance.

How to fill out Financial Institutions?

To fill out forms related to financial institutions, one must gather required financial data, adhere to the specific reporting guidelines provided by regulatory authorities, and ensure all information is accurate and complete.

What is the purpose of Financial Institutions?

The purpose of financial institutions is to provide services that allow individuals and businesses to manage their finances, invest, save, and obtain credit, thus contributing to economic stability and growth.

What information must be reported on Financial Institutions?

Financial institutions must report information such as financial statements, regulatory compliance data, transaction details, client information, and risk assessments to ensure transparency and adherence to laws.

Fill out your financial institutions - state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Institutions - State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.