Get the free PAYMENT AND PERFORMANCE BOND - denvergov

Show details

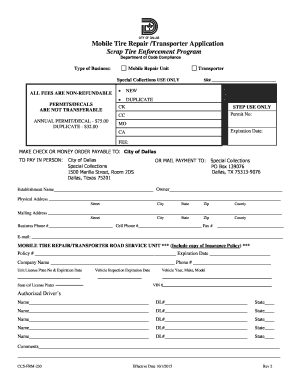

This document serves as a legal agreement binding the Permittee and Surety to ensure compliance with the terms of a permit granted by the City and County of Denver, including the payment for labor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payment and performance bond

Edit your payment and performance bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment and performance bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payment and performance bond online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payment and performance bond. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

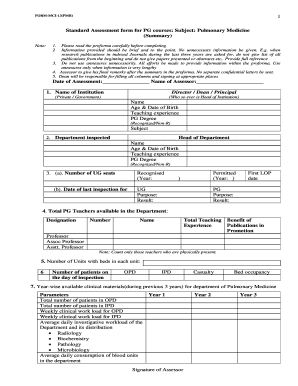

How to fill out payment and performance bond

How to fill out PAYMENT AND PERFORMANCE BOND

01

Obtain the PAYMENT AND PERFORMANCE BOND form from the relevant authority or agency.

02

Fill in the principal's name and address, which is the party responsible for the contract.

03

Provide the surety company's name and address, ensuring they are authorized to issue bonds in your state.

04

Include the obligee's name and address, which is typically the project owner or the entity requiring the bond.

05

State the penal sum of the bond, which is the total amount of financial protection being provided.

06

Detail the description of the project or contract related to the bond.

07

Sign and date the bond in the appropriate sections.

08

Obtain any necessary signatures from the surety and witness.

09

Submit the completed bond form to the obligee as proof of securing the payment and performance obligations.

Who needs PAYMENT AND PERFORMANCE BOND?

01

Contractors engaged in construction projects that require financial assurance.

02

Subcontractors working under main contractors.

03

Businesses entering contracts with government entities.

04

Suppliers or vendors supplying goods or services under a contract.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a payment and performance bond?

Performance bonds are refundable, but it depends on the situation. Performance bonds guarantee the successful completion of contracts, ensuring that a project will be finished, particularly if the contractor fails to fulfill their obligations.

How long does it take to get a payment and performance bond?

It takes 24-72 hours to complete the performance bond process. This is a major factor in turnaround time so it's important that you make sure of this beforehand!

Do you get your money back from a performance bond?

Performance bonds are refundable, but it depends on the situation. Performance bonds guarantee the successful completion of contracts, ensuring that a project will be finished, particularly if the contractor fails to fulfill their obligations.

What is a performance bond in English?

It takes 24-72 hours to complete the performance bond process. This is a major factor in turnaround time so it's important that you make sure of this beforehand!

How does a payment and performance bond work?

A payment bond guarantees that subcontractors, suppliers, and laborers will be paid for their work. A performance bond ensures the contractor completes the project ing to the contract terms. Payment bonds protect the people doing the work. Performance bonds protect the project owner.

What is a payment & performance bond?

A performance bond, also known as a contract bond, is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor. The term is also used to denote a collateral deposit of good faith money, intended to secure a futures contract, commonly known as margin.

Who holds a payment and performance bond?

Three parties play a role with a performance bond: the primary contractor or principal, the surety (the company offering the bond) and the obligee (a third party, usually the owner). If the contractor fails to adequately perform, the surety has a choice of different options to ensure project completion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PAYMENT AND PERFORMANCE BOND?

A Payment and Performance Bond is a type of surety bond that ensures a contractor fulfills their contractual obligations and pays subcontractors and suppliers for their work.

Who is required to file PAYMENT AND PERFORMANCE BOND?

Contractors working on public projects or certain private projects may be required to file a Payment and Performance Bond to guarantee their performance and payment obligations.

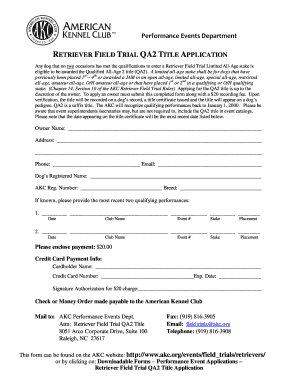

How to fill out PAYMENT AND PERFORMANCE BOND?

To fill out a Payment and Performance Bond, the contractor must provide details such as project information, bond amount, contractor details, and signatures from both the contractor and the surety company.

What is the purpose of PAYMENT AND PERFORMANCE BOND?

The purpose of a Payment and Performance Bond is to protect project owners and subcontractors by ensuring that the contractor completes the project as stipulated and pays all involved parties.

What information must be reported on PAYMENT AND PERFORMANCE BOND?

The information that must be reported on a Payment and Performance Bond includes the bond amount, project owner and contractor details, scope of work, contract number, and any specific terms or conditions.

Fill out your payment and performance bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment And Performance Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.