Get the free Premium Tax and Fees Report - delawareinsurance

Show details

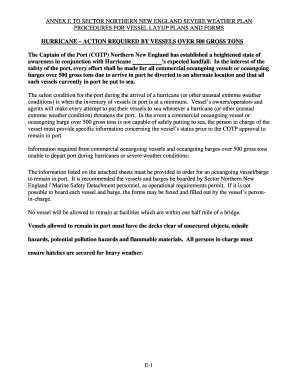

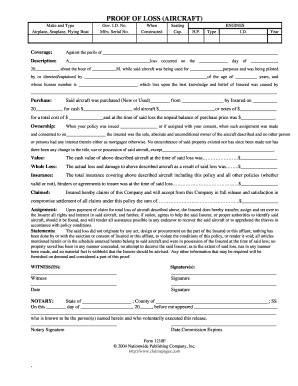

This document is an amended premium tax and fees report for captive insurance companies in Delaware for the calendar year 2005, detailing tax obligations, calculation instructions, and filing guidelines.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign premium tax and fees

Edit your premium tax and fees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your premium tax and fees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing premium tax and fees online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit premium tax and fees. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out premium tax and fees

How to fill out Premium Tax and Fees Report

01

Gather all necessary documentation, including your insurance policies and financial records.

02

Review the reporting period for which you are completing the report.

03

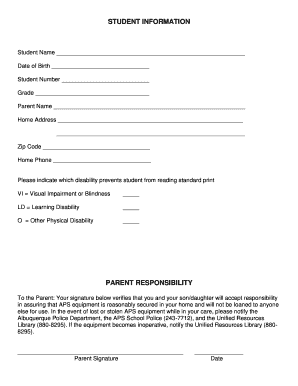

Fill out your organization’s information in the designated sections, including name, address, and contact details.

04

Enter the total premiums collected during the reporting period in the appropriate field.

05

Calculate any applicable fees based on your state or jurisdiction's requirements.

06

Deduct any exclusions or exemptions that apply to your situation, if applicable.

07

Double-check all calculations for accuracy.

08

Sign and date the report to certify its accuracy.

09

Submit the report to the relevant tax authority by the specified deadline.

Who needs Premium Tax and Fees Report?

01

Insurance companies and agencies that collect premiums for various types of insurance.

02

Entities required to report premium taxes and fees as part of their regulatory obligations.

03

Businesses offering insurance services to clients.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to report 1095-A on my tax return?

You do not have to send your Form 1095-A to the IRS with your tax return when you file and claim the premium tax credit. However, using the information on your Form 1095-A you must complete and file Form 8962, Premium Tax Credit.

What is the 1095 C form for premium tax credit?

Form 1095-C provides information about the health coverage offered by your employer and, in some cases, about whether you enrolled in this coverage. Use Form 1095-C to help determine your eligibility for the premium tax credit.

Is the premium tax credit based on AGI or Magi?

Financial eligibility for the premium tax credit, most categories of Medicaid, and the Children's Health Insurance Program (CHIP) is determined using a tax-based measure of income called modified adjusted gross income (MAGI). The following Q&A explains what income is included in MAGI.

Why do I owe taxes for health insurance?

Whether you get financial help or not, health insurance is part of filing your taxes. Unless you report that you had health insurance, you may have to pay a state tax penalty. If you received federal or state financial help, you'll report that as well.

How do I know if I received APTC?

You will receive a 1095-A form, which shows how much Covered California paid to your insurance company to help with the cost of your health coverage. You will use the information on your 1095-A to fill out IRS Form 8962. The IRS will use this to ensure the amount of APTC you received is correct.

What form do I use to report premium tax credit?

Form 8962, Premium Tax Credit Use IRS Form 8962 to find out if you used the right amount of premium tax credit during the year. Use the form to compare the advance amount you use to the amount you qualify for based on your final income. If you used too much, you'll repay it via taxes.

Do I have to pay back an aptc?

The amount of APTC you'll have to repay will depend on how much excess APTC was paid on your behalf, your household income, and your tax filing status. If your household income (MAGI) is at least 400% of the previous year's federal poverty level (FPL), you'll have to repay all of the excess APTC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Premium Tax and Fees Report?

The Premium Tax and Fees Report is a financial document that insurers must submit to report the premiums collected and the associated taxes and fees owed to governmental entities.

Who is required to file Premium Tax and Fees Report?

Insurers that collect premiums for insurance policies are typically required to file the Premium Tax and Fees Report within the designated time frame set by regulatory authorities.

How to fill out Premium Tax and Fees Report?

To fill out the Premium Tax and Fees Report, insurers should gather data on premiums collected, calculate the tax amounts based on applicable rates, and provide necessary organizational information as specified in the report form.

What is the purpose of Premium Tax and Fees Report?

The purpose of the Premium Tax and Fees Report is to ensure compliance with tax regulations by providing a transparent account of the premium income and the corresponding taxes and fees that insurers are obligated to pay.

What information must be reported on Premium Tax and Fees Report?

The Premium Tax and Fees Report must include information such as total premiums collected, tax rates applied, total taxes due, fee assessments, and any other relevant financial data as required by state or federal regulations.

Fill out your premium tax and fees online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Premium Tax And Fees is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.