Get the free 2006 ANNUAL PREMIUM TAX AND FEES REPORT - delawareinsurance

Show details

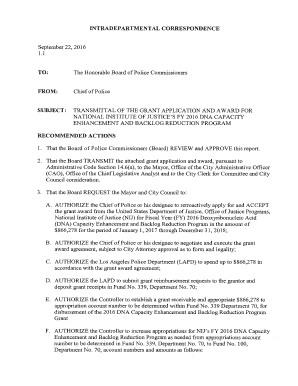

This document is an annual report required by the Delaware Department of Insurance for insurers to report their premium taxes and fees for the calendar year 2006, along with necessary payment information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2006 annual premium tax

Edit your 2006 annual premium tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2006 annual premium tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2006 annual premium tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2006 annual premium tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2006 annual premium tax

How to fill out 2006 ANNUAL PREMIUM TAX AND FEES REPORT

01

Gather necessary information such as premiums collected, claims paid, and any applicable deductions.

02

Obtain the 2006 Annual Premium Tax and Fees Report form from the appropriate regulatory agency.

03

Fill out your business information in the designated fields, including name, address, and tax identification number.

04

Input the total premium amounts collected for the year in the corresponding section of the form.

05

Calculate and enter any allowable deductions as specified by the guidelines.

06

Calculate the total premium tax owed based on your reported premiums and applicable rates.

07

Review all entries for accuracy and completeness.

08

Sign and date the report where required.

09

Submit the completed report by the deadline, either electronically or by mail, as determined by the regulatory agency.

Who needs 2006 ANNUAL PREMIUM TAX AND FEES REPORT?

01

Insurance companies and businesses that collect premiums and are required to report premium taxes and fees to the state.

Fill

form

: Try Risk Free

People Also Ask about

What is the IPT tax in the UK?

Insurance Premium Tax (IPT) is a tax on general insurance premiums, including car insurance, home insurance, and pet insurance. There are two rates of IPT: a standard rate of 12% and a higher rate of 20%, which applies to travel insurance, electrical appliance insurance and some vehicle insurance.

Is IPT applicable in the Isle of Man?

If you live in the Channel Islands or on the Isle of Man you don't need to pay Insurance Premium Tax (IPT) on your policy.

Is the isle of man subject to IPT?

Contracts which cover a risk outside the UK are exempt. For IPT purposes the UK : consists of Great Britain, Northern Ireland and waters within 12 nautical miles of their coastline. excludes the Isle of Man and the Channel Islands.

Is the Isle of Man subject to UK law?

The Island is a self-governing British Crown Dependency - as are Jersey and Guernsey in the Channel Islands - with its own parliament, government and laws. The UK government, on behalf of the Crown, is ultimately responsible for its international relations.

Do you charge VAT to the Isle of Man?

Value-added tax (VAT) For VAT purposes, the Isle of Man forms a single territory with the United Kingdom (UK), and the VAT rules are broadly identical. This means that VAT is charged on supplies between Isle of Man and UK businesses as if they were domestic supplies.

What is the insurance tax in Newfoundland?

What is the RST rate imposed on premiums for insurance? A tax rate of 15% will be applied to the taxable premiums for contracts of insurance relating to property, risk, peril or events in the province.

What is the insurance premium tax in Finland?

Percentage rate of the tax and the tax base Up to 31 August 2024, the rate of the tax on insurance premiums is 24% and starting 1 September 2024, it will be 25.5%.

Is the Isle of Man still a tax haven?

The Isle of Man is a low-tax economy with no capital gains tax, wealth tax, stamp duty, or inheritance tax; and a top rate of income tax of 22%. A tax cap is in force: the maximum amount of tax payable by an individual is £200,000; or £400,000 for couples if they choose to have their incomes jointly assessed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2006 ANNUAL PREMIUM TAX AND FEES REPORT?

The 2006 Annual Premium Tax and Fees Report is a document that insurance companies use to report their premium income and associated fees for the year 2006 to regulatory authorities.

Who is required to file 2006 ANNUAL PREMIUM TAX AND FEES REPORT?

All insurance companies that collect premium taxes and fees within the jurisdiction must file the 2006 Annual Premium Tax and Fees Report.

How to fill out 2006 ANNUAL PREMIUM TAX AND FEES REPORT?

The report must be filled out by accurately entering the total premium income, applicable fees, and other necessary financial information as specified in the reporting guidelines provided by the regulatory authority.

What is the purpose of 2006 ANNUAL PREMIUM TAX AND FEES REPORT?

The purpose of the report is to ensure compliance with state insurance tax laws, facilitate the collection of taxes and fees, and provide transparency regarding the earnings of insurance companies.

What information must be reported on 2006 ANNUAL PREMIUM TAX AND FEES REPORT?

The report must include total premiums collected, types of insurance offered, applicable deductions, fees owed, and any other relevant financial data as required by state regulations.

Fill out your 2006 annual premium tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2006 Annual Premium Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.