Get the free Tax Item - revenue delaware

Show details

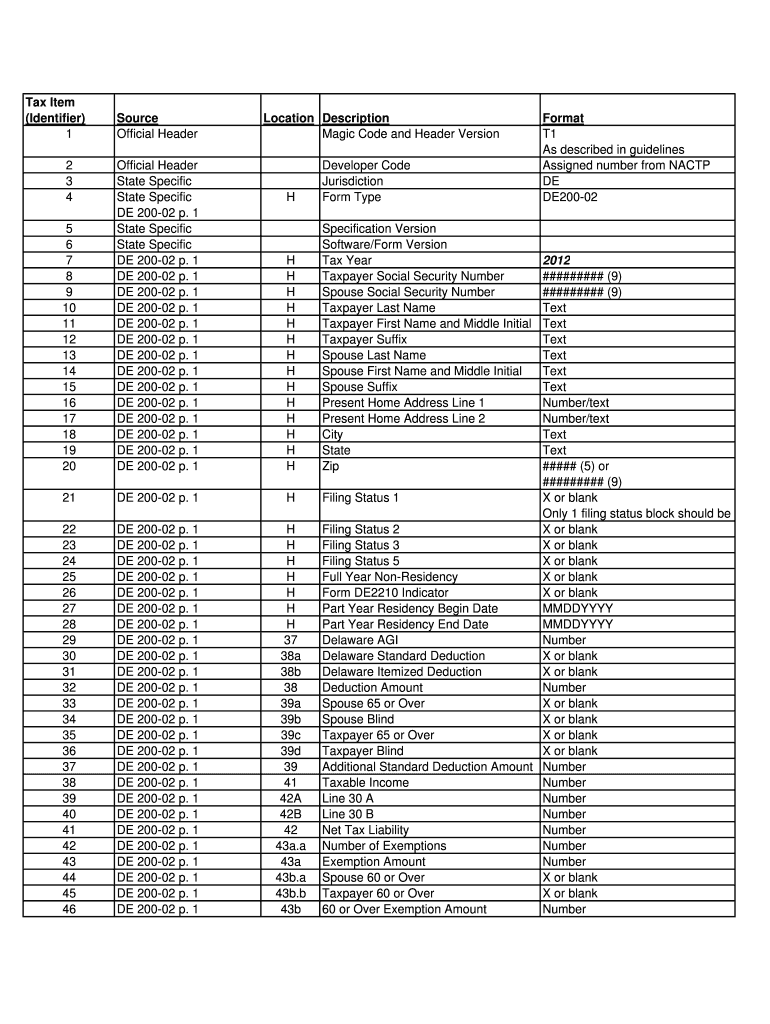

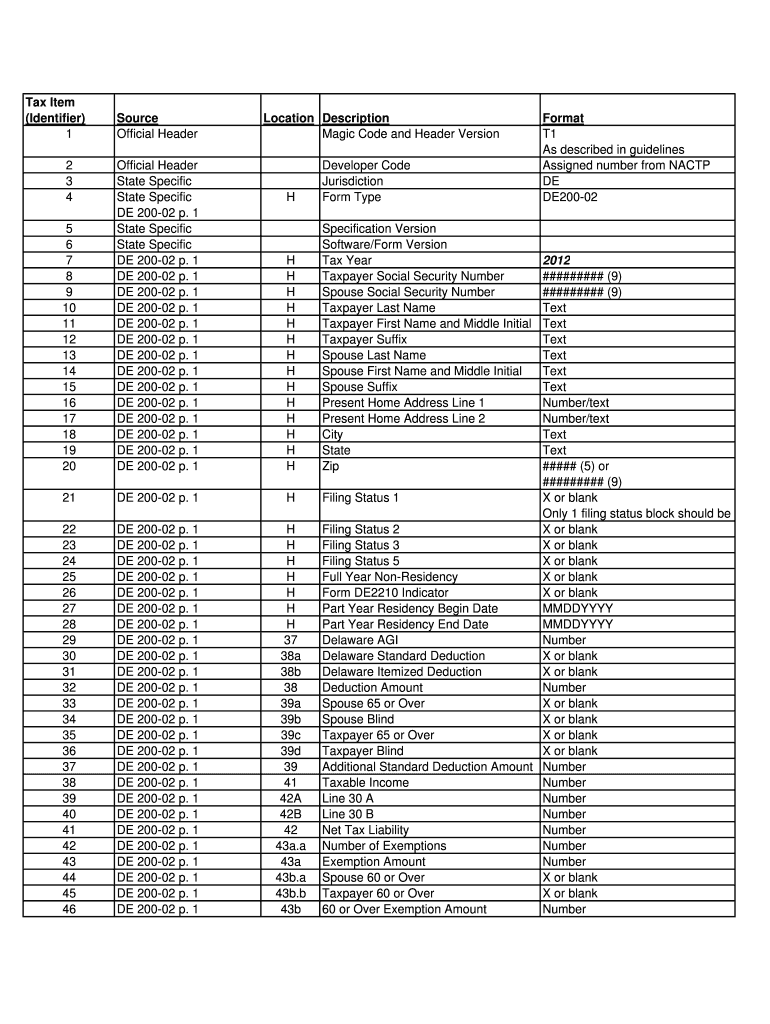

This document contains fields and specifications for filing state income taxes in Delaware, including information on taxpayer identification, deductions, and credits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax item - revenue

Edit your tax item - revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax item - revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax item - revenue online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax item - revenue. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax item - revenue

How to fill out Tax Item

01

Gather all necessary documents such as W-2s, 1099s, and other income statements.

02

Access the taxation software or form where the Tax Item needs to be filled out.

03

Start with personal information such as your name, address, and Social Security number.

04

Enter your total income from all sources in the appropriate section.

05

Deductions: Identify any deductions such as student loan interest or mortgage interest and fill them in.

06

Credits: Check for any applicable tax credits and input the information.

07

Review your entries for accuracy and completeness before finalizing.

08

Submit the filled-out Tax Item electronically or print it for mailing.

Who needs Tax Item?

01

Individuals with taxable income.

02

Self-employed individuals needing to report earnings.

03

Students who may be eligible for education-related tax credits.

04

Homeowners looking to deduct mortgage interest or property taxes.

05

Individuals claiming various tax credits like earned income credit or child tax credit.

Fill

form

: Try Risk Free

People Also Ask about

Do you get more money back if you itemize?

Standard vs. itemized deductions If your deductible expenses and losses are more than the standard deduction, you can save money by deducting them one-by-one from your income (itemizing). Tax software can walk you through your expenses and losses to show the option that gives you the lowest tax.

Should I bother itemizing?

Comments Section Any time your itemized deductions are higher than your standard deduction, you itemize. So of course you should if it is higher than the standard. There's often very few reasons not to. Most tax softwares will compute both ways, then suggest the lower tax choice.

What is tax included in English?

Tax Inclusive refers to the tax amount included in the purchase price. An example would be if a merchant wanted to charge $100.00 for a service and there is a 10% tax, they would offer that service for $110.00, tax included.

What is another word for tax in English?

What is another word for tax? dutylevy assessment impost tariff toll charge contribution excise tithe136 more rows

What are the benefits of itemizing?

Itemizing deductions allow taxpayers to subtract certain expenses from their Adjusted Gross Income (AGI), reducing their taxable income.

What is a tax item?

Tax Item means any item of income, gain, loss, deduction, expense or credit, or other attribute that may have the effect of increasing or decreasing any Tax.

Is it better to itemize or take the standard deduction?

For most people, the standard deduction is the easiest option and saves you the most money and time — but it doesn't hurt to add up your potential itemized deductions because, depending on your situation, itemizing could save you even more.

Is it better to itemize or not?

Depending on your situation, you could save more by not itemizing and taking the standard deduction. A tax deduction reduces your taxable income, which in turn can lower your tax bill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Item?

A Tax Item refers to a specific line item or entry on a tax return that details an individual's or entity's taxable income, deductions, credits, or other tax-related information.

Who is required to file Tax Item?

Individuals or entities that have taxable income or are subject to taxation according to their local tax laws are required to file a Tax Item.

How to fill out Tax Item?

To fill out a Tax Item, you generally need to gather your financial records, determine your income and deductions, and follow the instructions on the tax form to accurately report the required information.

What is the purpose of Tax Item?

The purpose of a Tax Item is to enable the appropriate tax authorities to assess the tax liability of individuals or entities based on their financial activities and compliance with tax regulations.

What information must be reported on Tax Item?

Information that must be reported on a Tax Item typically includes total income, deductions, credits, tax liability calculations, and any other relevant tax-related data as required by tax laws.

Fill out your tax item - revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Item - Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.