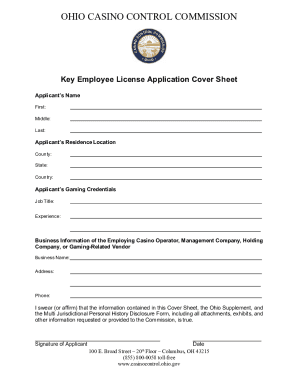

Get the free PURCHASE AND ASSUMPTION OF A FEDERAL CHARTERED OR OUT-OF-STATE CHARTERED CREDIT UNIO...

Show details

This document outlines the process and requirements for a Georgia state chartered credit union to purchase the assets and assume the liabilities of a federal or out-of-state chartered credit union,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign purchase and assumption of

Edit your purchase and assumption of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your purchase and assumption of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit purchase and assumption of online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit purchase and assumption of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out purchase and assumption of

How to fill out PURCHASE AND ASSUMPTION OF A FEDERAL CHARTERED OR OUT-OF-STATE CHARTERED CREDIT UNION BY A STATE CHARTERED CREDIT UNION

01

Gather required documents including your state charter credit union's financial statements and member data.

02

Review the specific federal or out-of-state chartered credit union's purchase and assumption agreement.

03

Complete the application form included in the purchase agreement with accurate information.

04

Prepare the required disclosures and notifications for your members regarding the transaction.

05

Submit the application along with all necessary documentation to the relevant regulatory authority for approval.

06

Wait for verification and approval from regulatory agencies.

07

Once approved, proceed with the transaction by executing the purchase and assumption agreement.

08

Notify your members and stakeholders of the successful transaction and any changes that will occur.

Who needs PURCHASE AND ASSUMPTION OF A FEDERAL CHARTERED OR OUT-OF-STATE CHARTERED CREDIT UNION BY A STATE CHARTERED CREDIT UNION?

01

State chartered credit unions looking to acquire assets and liabilities from a federal chartered or out-of-state chartered credit union.

02

Credit unions interested in expanding their services or membership base through acquisitions.

03

Financial institutions seeking to strengthen their market position by merging with or acquiring another credit union.

Fill

form

: Try Risk Free

People Also Ask about

Why would a bank prefer to be state chartered instead of federally chartered?

California state-chartered financial institutions have closer geographical proximity to their primary regulator; therefore, communication is more direct, timelier, and more effective.

What is the difference between a state-chartered and federally-chartered credit union?

The main difference is whether the permit to do business as a credit union was granted by the state government or the federal government. Whenever a new credit union is established, the organizers apply for either a state or national (federal) credit union charter.

What is a federal charter credit union?

Even though they include the word "federal" in their name, federal credit unions (FCUs) are not operated by the federal government. Not only are all of these organizations regulated by the NCUA but they are also insured by the National Credit Union Share Insurance Fund (NCUSIF).

How to tell if a credit union is federally chartered?

National banks are chartered and regulated under federal laws and are supervised by a central agency. State banks are chartered and regulated under state laws and are supervised by a state agency.

Why would a bank prefer to be state chartered instead of federally chartered?

California state-chartered financial institutions have closer geographical proximity to their primary regulator; therefore, communication is more direct, timelier, and more effective.

Does the Federal Credit Union Act apply to state chartered credit unions?

In some cases, NCUA regulation of FISCUs is congressionally mandated. The Federal Credit Union Act, 12 U.S.C. ~1751 et seq. (the "Act") requires FISCUs to comply with certain provisions of the Act and NCUA's Rules and Regulations, 12 C.F.R. ~700 et seq. (the "Regulations").

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PURCHASE AND ASSUMPTION OF A FEDERAL CHARTERED OR OUT-OF-STATE CHARTERED CREDIT UNION BY A STATE CHARTERED CREDIT UNION?

The Purchase and Assumption of a Federal Chartered or Out-of-State Chartered Credit Union by a State Chartered Credit Union is a process through which a state-chartered credit union acquires assets and liabilities of a federally chartered or out-of-state credit union, enabling continuity of services for members and the preservation of credit union operations.

Who is required to file PURCHASE AND ASSUMPTION OF A FEDERAL CHARTERED OR OUT-OF-STATE CHARTERED CREDIT UNION BY A STATE CHARTERED CREDIT UNION?

The state-chartered credit union planning to engage in the purchase and assumption process is required to file the necessary documentation with the appropriate regulatory authorities, such as the state’s credit union division or federal regulatory agencies.

How to fill out PURCHASE AND ASSUMPTION OF A FEDERAL CHARTERED OR OUT-OF-STATE CHARTERED CREDIT UNION BY A STATE CHARTERED CREDIT UNION?

To fill out the Purchase and Assumption documentation, the state-chartered credit union must provide detailed information regarding the terms of the purchase, including financial statements, member data, and the due diligence process, ensuring compliance with regulatory requirements.

What is the purpose of PURCHASE AND ASSUMPTION OF A FEDERAL CHARTERED OR OUT-OF-STATE CHARTERED CREDIT UNION BY A STATE CHARTERED CREDIT UNION?

The purpose of this transaction is to strengthen the state-chartered credit union's position in the market, expand its membership base, and enhance services while ensuring a smooth transition for affected members from the acquired credit union.

What information must be reported on PURCHASE AND ASSUMPTION OF A FEDERAL CHARTERED OR OUT-OF-STATE CHARTERED CREDIT UNION BY A STATE CHARTERED CREDIT UNION?

Required information includes the acquiring credit union's financial health, the valuation of assets and liabilities, details of the member outreach plan, and how the acquisition will meet regulatory requirements and benefit members.

Fill out your purchase and assumption of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Purchase And Assumption Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.