Get the free APPLICATION FOR PREFERENTIAL AGRICULTURAL ASSESSMENT - etax dor ga

Show details

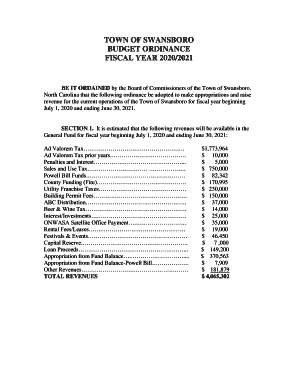

This document serves as an application for preferential assessment of bona fide agricultural property at a reduced value, complying with state laws and requiring specific information about the property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for preferential agricultural

Edit your application for preferential agricultural form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for preferential agricultural form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for preferential agricultural online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for preferential agricultural. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for preferential agricultural

How to fill out APPLICATION FOR PREFERENTIAL AGRICULTURAL ASSESSMENT

01

Obtain the APPLICATION FOR PREFERENTIAL AGRICULTURAL ASSESSMENT form from your local tax assessor's office or website.

02

Fill in your personal information, including name, address, and contact details.

03

Provide details about the property you are applying for, including its location and any identifying information.

04

Describe the agricultural activities being conducted on the property.

05

Attach any required documentation, such as proof of agricultural use or income statements.

06

Review the application for completeness and accuracy.

07

Submit the application to your local tax assessor's office by the designated deadline.

Who needs APPLICATION FOR PREFERENTIAL AGRICULTURAL ASSESSMENT?

01

Farmers and landowners who engage in agricultural activities and wish to benefit from reduced property tax assessments.

02

Individuals owning land actively used for farming or agricultural production.

03

Those looking to qualify for tax incentives aimed at promoting agriculture in their area.

Fill

form

: Try Risk Free

People Also Ask about

What is an agricultural assessment?

An agricultural assessment allows land utilized for agricultural purposes to be assessed based on its agricultural value as opposed to its commercial value.

What is agricultural assessment?

An agricultural assessment allows land utilized for agricultural purposes to be assessed based on its agricultural value as opposed to its commercial value.

What does an agricultural appraiser do?

As an agricultural appraiser, your job is to evaluate the value of agricultural land for loans and real estate transactions. In this role, you may estimate the overall value of a farm or group of livestock, price the equipment the farm owns, and inspect large properties to understand their unique characteristics.

How do you qualify for an AG exemption in NY?

Eligibility requirements The annual gross sales of agricultural products generally must average $10,000 or more for the preceding two years. If an agricultural enterprise is less than seven acres, it may quality if average annual gross sales equal $50,000 or more.

How to qualify for farmland assessment in NJ?

To be eligible for Farmland Assessment, land actively devoted to an agricultural or horticultural use must have not less than 5 acres devoted to the production of crops; livestock or their products; and/or forest products under a woodland management plan.

What is the preferential agricultural assessment in Georgia?

Preferential Agricultural Property This means that this type of property is assessed at 30% of fair market value rather than 40%. Property that qualifies for this special assessment must be maintained in its current use for a period of 10 years.

What are the rules for Cuva in Georgia?

Can You Build a House on CUVA Land? With restrictions, you can build on CUVA land. Certain farm structures — such as silos, barns, or homes — may be permitted. However, significant development could violate the covenant, triggering financial penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR PREFERENTIAL AGRICULTURAL ASSESSMENT?

The APPLICATION FOR PREFERENTIAL AGRICULTURAL ASSESSMENT is a document submitted by landowners to receive a tax assessment reduction for properties used for agricultural purposes.

Who is required to file APPLICATION FOR PREFERENTIAL AGRICULTURAL ASSESSMENT?

Landowners who wish to qualify for preferential tax treatment on agricultural land are required to file this application.

How to fill out APPLICATION FOR PREFERENTIAL AGRICULTURAL ASSESSMENT?

To fill out the APPLICATION FOR PREFERENTIAL AGRICULTURAL ASSESSMENT, landowners must provide details about the property, its use for agricultural purposes, and any related income or production details, following the specific guidelines provided by their local tax authority.

What is the purpose of APPLICATION FOR PREFERENTIAL AGRICULTURAL ASSESSMENT?

The purpose of the application is to allow agricultural landowners to receive a lower property tax assessment to promote and support agricultural activities.

What information must be reported on APPLICATION FOR PREFERENTIAL AGRICULTURAL ASSESSMENT?

The application must report information such as the property owner's details, a description of the property, the type of agricultural use, production details, and any supporting documents that verify the agricultural use.

Fill out your application for preferential agricultural online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Preferential Agricultural is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.