Get the free Payment Voucher (PV CORP) - etax dor ga

Show details

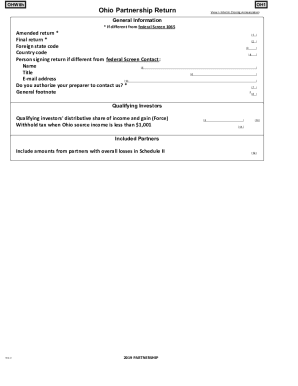

This document provides instructions for completing the Corporate Payment Voucher (PV CORP) for tax payments owed, detailing mailing procedures and required information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payment voucher pv corp

Edit your payment voucher pv corp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment voucher pv corp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payment voucher pv corp online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit payment voucher pv corp. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payment voucher pv corp

How to fill out Payment Voucher (PV CORP)

01

Obtain the Payment Voucher (PV CORP) form from your finance department or download it from the company's intranet.

02

Fill out the date at the top of the form where indicated.

03

Provide your name and department in the appropriate sections.

04

List the purpose of the payment clearly, detailing what the payment is for.

05

Enter the total amount to be paid, ensuring it's accurate and matches any supporting documentation.

06

Attach any required receipts or invoices that substantiate the payment request.

07

Include the account number to which the payment should be charged.

08

Sign and date the form, ensuring you have all necessary approvals before submission.

09

Submit the completed Payment Voucher to the finance department for processing.

Who needs Payment Voucher (PV CORP)?

01

Employees seeking reimbursement for business-related expenses.

02

Department heads requiring payment for services or materials.

03

Anyone needing to submit a request for payment to vendors or contractors.

04

Finance team members handling employee reimbursements or vendor payments.

Fill

form

: Try Risk Free

People Also Ask about

What is a PV voucher?

A Payment Voucher (PV) is used to record the approval of payment and the accounting entries made in the General Ledger / Cash Book (Sub-section 3.4. 4).

What is a housing voucher in VA?

The Housing Choice Voucher (HCV) Program is a federally funded program designed to assist low-income families with their housing needs. Participants in the HCV program receive assistance to rent private market apartments. Participants find their own apartment, inium, townhouse or single-family homes.

What is a payment voucher in English?

A payment voucher is a record of payments made by a business to suppliers for various purchase orders. Payment vouchers consist of a purchase order, shipping receipt, and invoice. They are prepared by the accounting department, which matches a supplier's invoice with an order of purchase and the receiving report.

What is a PV payment?

PV, one of the financial functions, calculates the present value of a loan or an investment, based on a constant interest rate. You can use PV with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment goal.

What is Georgia PV Corp?

Corporate Payment Voucher is used when you owe taxes. Note: Please make checks and money orders payable to the Georgia Department of Revenue.

What is a payment voucher for taxes?

Key Takeaways. Form 1040-V is a payment voucher used to pay a balance owed to the IRS for various tax forms. Personal information, including the SSN, owed amount, name, and address, needs to be included on the form, and it should not be stapled to a payment check or money order.

What is PV voucher?

A Payment Voucher (PV) is used to record the approval of payment and the accounting entries made in the General Ledger / Cash Book (Sub-section 3.4. 4).

What is the point of an accounts payable voucher?

Accounts payable are the short-term bills owed by companies to vendors and suppliers. The voucher is important because it's an internal accounting control mechanism that ensures that every payment is properly authorized and that the goods or services purchased are actually received.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Payment Voucher (PV CORP)?

A Payment Voucher (PV CORP) is a document used by corporations to authorize the payment of funds to vendors, suppliers, or contractors for goods or services received.

Who is required to file Payment Voucher (PV CORP)?

Corporations or businesses that need to make payments for expenses or services rendered typically are required to file a Payment Voucher (PV CORP).

How to fill out Payment Voucher (PV CORP)?

To fill out a Payment Voucher (PV CORP), one typically needs to provide the payee's information, payment amount, description of services or goods, date of transaction, and authorization signatures.

What is the purpose of Payment Voucher (PV CORP)?

The purpose of a Payment Voucher (PV CORP) is to document and facilitate the approval and processing of payment transactions within an organization.

What information must be reported on Payment Voucher (PV CORP)?

On a Payment Voucher (PV CORP), the information that must be reported typically includes the payee's name, invoice number, payment amount, date of payment, reason for payment, and approving signatures.

Fill out your payment voucher pv corp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment Voucher Pv Corp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.