Get the free HB 541/CA

Show details

A bill to amend Article 3 of Chapter 9 of Title 15 of the Official Code of Georgia Annotated, relating to costs and compensation for the probate courts, revising costs and fees, and repealing conflicting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hb 541ca

Edit your hb 541ca form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hb 541ca form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hb 541ca online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hb 541ca. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

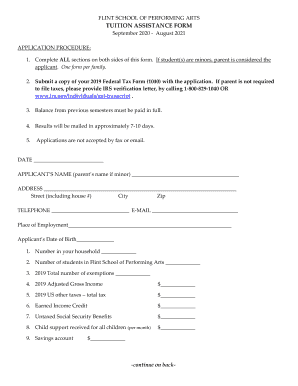

How to fill out hb 541ca

How to fill out HB 541/CA

01

Obtain the HB 541/CA form from the appropriate governmental website or office.

02

Read the instructions provided with the form to understand the requirements.

03

Fill out your personal information in the designated fields, including your name, address, and contact information.

04

Provide any necessary financial information as requested on the form.

05

If applicable, include additional documentation that supports your application.

06

Review your completed form for accuracy and completeness.

07

Submit the form by the specified deadline, following the submission guidelines outlined.

Who needs HB 541/CA?

01

Individuals seeking financial assistance or benefits related to HB 541/CA.

02

Applicants who meet specific eligibility criteria outlined in the form.

03

Residents of the state or jurisdiction where HB 541/CA is applicable.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a California fiduciary tax return?

Trust. The fiduciary (or one of the fiduciaries) must file Form 541 for a trust if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $100.

What are the disadvantages of a trust in California?

Here are the top four common complaints regarding trusts. Paperwork Overload. Establishing and maintaining a living trust often involves a substantial amount of paperwork. Record Keeping Challenges. Maintaining accurate records is crucial for the success of a living trust. Transfer Taxes and Refinancing. Creditor Concerns.

What is California Form 541?

Use Form 541 if any of the following apply to report: Income received by an estate or trust. Income that is accumulated or currently distributed to the beneficiaries. An applicable tax liability of the estate or trust.

What is the fiduciary tax in California?

The fiduciary (or one of the joint fiduciaries) must file Form 541 and pay an annual tax of $800 for a REMIC that is governed by California law, qualified to do business in California, or has done business in California at any time during the year.

Are trustee fees taxable in California?

Taking a trustee fee is not mandatory and may be waived if desired. This compensation is considered taxable income for the Trustee. Some trustees choose to waive their right to a fee in order to keep more funds in the trust and avoid unnecessary income tax.

What is the income tax rate for a trust in California?

Trusts are subject to a highly compressed tax bracket, reaching the highest federal income tax rate (37% as of 2024) once income exceeds $14,450. California's state income tax also applies to trust income, with rates as high as 13.3%.

Is inheritance from a trust taxable in California?

In California, there is no state-level estate or inheritance tax. If you are a California resident, you do not need to worry about paying an inheritance tax on the money you inherit from a deceased individual. As of 2023, only six states require an inheritance tax on people who inherit money.

Can form 541 be filed electronically?

Fiduciary / Estates - Taxpayers must complete an amended Form 541 and electronically file it with the amended return indicator marked. To mark California Form 541 as an amended return, from the main menu of the California return, select Heading Information > Amended Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HB 541/CA?

HB 541/CA is a legislative bill that outlines specific regulations and requirements for various entities in California, typically related to tax reporting and compliance.

Who is required to file HB 541/CA?

Individuals and businesses that meet certain criteria set by the law, usually those engaged in specific financial activities or transactions, are required to file HB 541/CA.

How to fill out HB 541/CA?

To fill out HB 541/CA, filers must complete the designated forms with accurate information, following the instructions provided by the regulatory authority, including the submission of any required documentation.

What is the purpose of HB 541/CA?

The purpose of HB 541/CA is to ensure compliance with state regulations, enhance accountability, and improve the collection of taxes and other relevant information from entities operating within California.

What information must be reported on HB 541/CA?

The information that must be reported on HB 541/CA typically includes financial data, personal identification details, and specifics regarding the nature of the transactions or activities conducted by the filer.

Fill out your hb 541ca online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hb 541ca is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.