Get the free APPLICATION FOR RECORDS RETENTION SCHEDULE - sos georgia

Show details

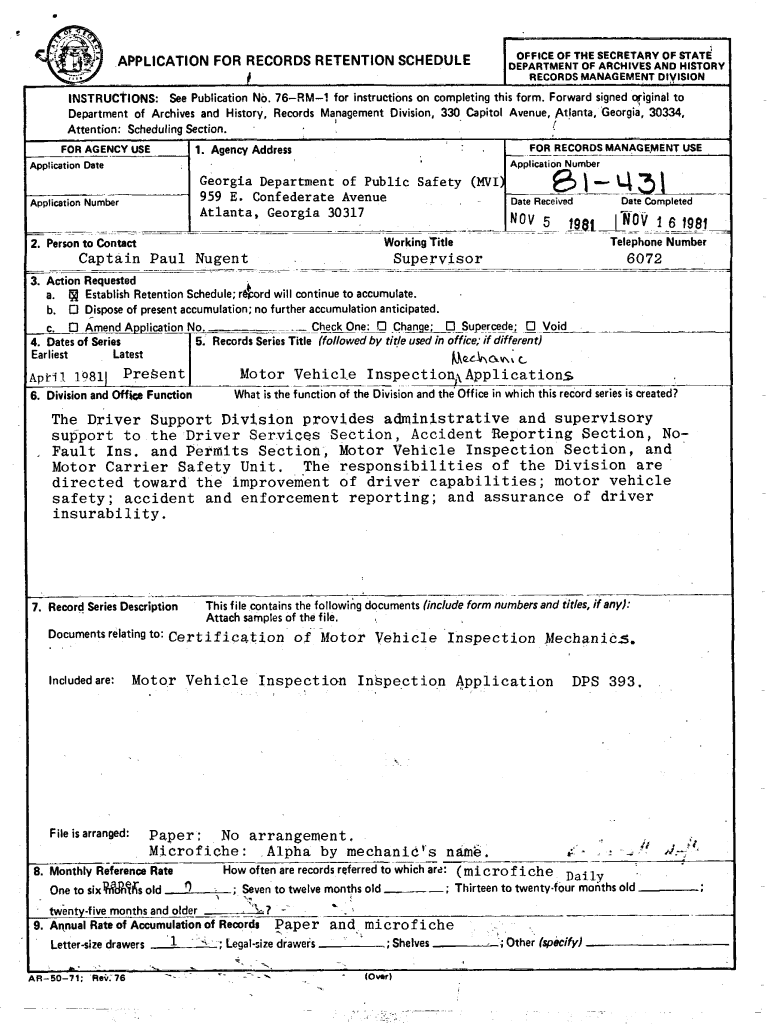

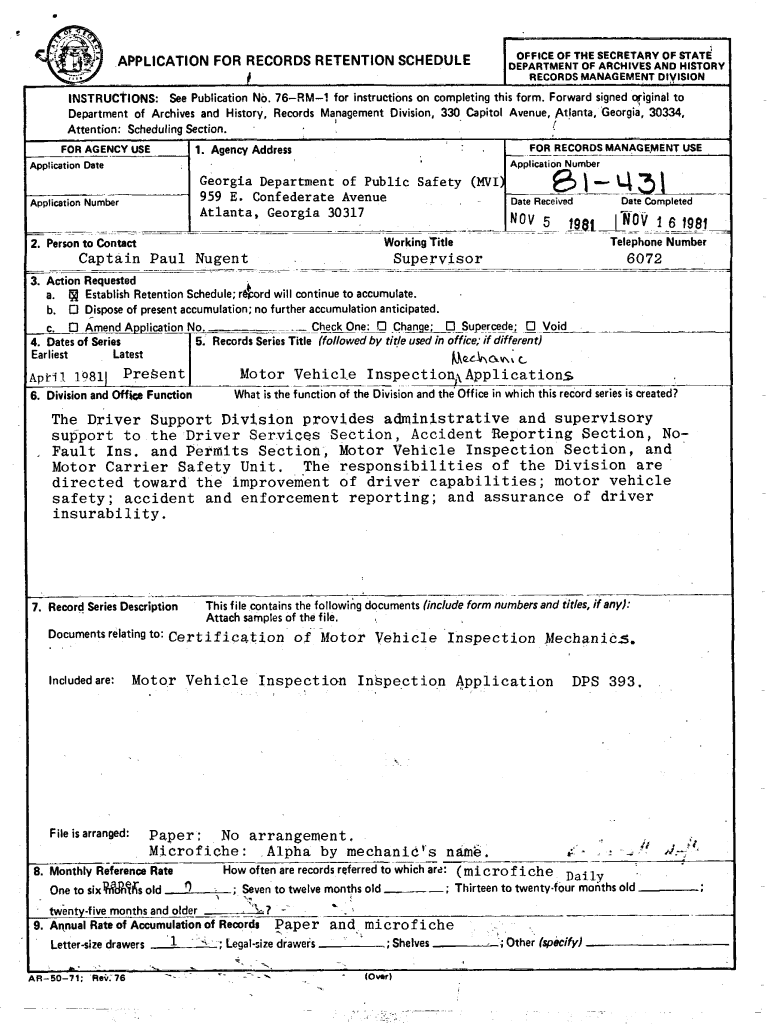

This document is an application form for establishing a records retention schedule for records maintained by the Georgia Department of Public Safety, focusing on motor vehicle inspection applications

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for records retention

Edit your application for records retention form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for records retention form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for records retention online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for records retention. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for records retention

How to fill out APPLICATION FOR RECORDS RETENTION SCHEDULE

01

Gather all necessary information about the records that need to be retained.

02

Review the specific requirements for your organization regarding records retention.

03

Obtain the APPLICATION FOR RECORDS RETENTION SCHEDULE form from the appropriate governing body.

04

Fill out the form, providing details such as the record series title, description, legal authority, retention period, and method of disposal.

05

Ensure accuracy by double-checking all entries for correctness.

06

Seek input or approval from relevant stakeholders or management, if required.

07

Submit the completed application to the designated authority for review and approval.

Who needs APPLICATION FOR RECORDS RETENTION SCHEDULE?

01

Organizations required to maintain records for compliance purposes.

02

Departments within organizations that manage significant quantities of records.

03

Employees responsible for record management and retention.

04

Regulatory bodies and auditors concerned with compliance and accountability.

Fill

form

: Try Risk Free

People Also Ask about

What is the 7 year retention rule?

Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return. Keep records indefinitely if you do not file a return.

What are the FDA requirements for records retention?

(ii) Records related to postmarket reports, including both periodic and adverse experience reports, must be retained for a period of at least 4 years from the date the report was submitted to FDA or until FDA inspects the records, whichever occurs sooner. (b) Record retention by FDA.

What records need to be kept for 7 years?

How long to keep records. Records must be kept for 6 years from the end of the financial year they relate. In essence this means you need to keep all records for 7 years (as it's 6 years plus a year to count for the financial year). HMRC has begun a compliance check into your Company Tax Return.

What is the standard retention period for documentation?

Document retention guidelines typically require businesses to store records for one, three, or seven years. In some cases, you need to keep the records forever. If you're unsure what to keep and what to shred, your accountant, lawyer, and state recordkeeping agency may provide guidance.

What is the first step required in establishing a records retention program?

As there is no one-size-fits-all, you have to tailor these policies to each individual business. STEP 1: Identify Types of Records & Media. STEP 2: Identify Business Needs for Records & Appropriate Retention Periods. STEP 3: Addressing Creation, Distribution, Storage & Retrieval of Documents.

What are the 117.315 requirements for record retention?

§ 117.315 Requirements for record retention. (1) All records required by this part must be retained at the plant or facility for at least 2 years after the date they were prepared.

What is the GAAP record retention policy?

CPAs must retain tax records for 6 years under AICPA guidelines, while GAAP may require 7+ years for financial reports. Permanent retention applies to audit reports, corporate charters, deeds, and year-end financial statements.

How long should documentation be kept for?

It's largely agreed across the profession that the minimum legal document retention period should be at least six years for most types of record, as this is the primary limitation period under the Limitation Act 1980. However, other legal documents need to be kept for 15 years or more.

How long do I need to retain documents?

Documents that define your personal and financial life — like your birth certificate, marriage license and tax returns — should be kept forever. Hold on to records that support information on your tax returns for seven years. Digitizing and shredding your paper documents can cut the risk of fraud and identity theft.

How do I create a record retention schedule?

Create a Basic Retention Schedule in 5 Steps Step one: identify the records you are keeping. Step two: describe your business need for the records. Step three: determine the length of time to keep your records to meet your needs. Step four: assess how your records are disbursed, accessed and stored.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR RECORDS RETENTION SCHEDULE?

The APPLICATION FOR RECORDS RETENTION SCHEDULE is a formal request submitted by an organization to establish a systematic approach for retaining and disposing of records in compliance with legal and regulatory requirements.

Who is required to file APPLICATION FOR RECORDS RETENTION SCHEDULE?

Organizations and institutions that generate or manage records, including businesses, government agencies, and non-profits, are required to file an APPLICATION FOR RECORDS RETENTION SCHEDULE.

How to fill out APPLICATION FOR RECORDS RETENTION SCHEDULE?

To fill out the APPLICATION FOR RECORDS RETENTION SCHEDULE, one must provide details such as the types of records, their retention periods, the reasons for retention, and any relevant legal or regulatory requirements that apply to those records.

What is the purpose of APPLICATION FOR RECORDS RETENTION SCHEDULE?

The purpose of the APPLICATION FOR RECORDS RETENTION SCHEDULE is to ensure that records are maintained for an appropriate period, to comply with laws and regulations, to manage risks, and to improve operational efficiency by aiding in timely disposal of unnecessary records.

What information must be reported on APPLICATION FOR RECORDS RETENTION SCHEDULE?

The information that must be reported includes the title of the record, a description of the content, the recommended retention period, the legal basis for retention, and any specific disposal methods to be used once the retention period expires.

Fill out your application for records retention online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Records Retention is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.