Get the free LOAN DISCHARGE APPLICATION: FALSE CERTIFICATION (UNAUTHORIZED SIGNATURE / UNAUTHORIZ...

Show details

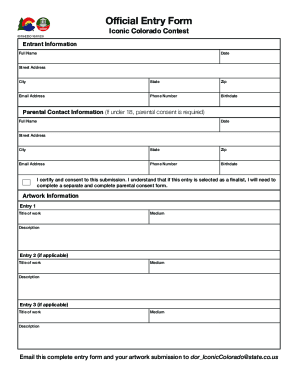

This document is an application form for loan discharge under circumstances of false certification, specifically for unauthorized signatures and payments related to federal student loans.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan discharge application false

Edit your loan discharge application false form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan discharge application false form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan discharge application false online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit loan discharge application false. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan discharge application false

How to fill out LOAN DISCHARGE APPLICATION: FALSE CERTIFICATION (UNAUTHORIZED SIGNATURE / UNAUTHORIZED PAYMENT)

01

Read the instructions for the LOAN DISCHARGE APPLICATION carefully.

02

Gather relevant documents such as loan agreements and identification.

03

Complete the application form with accurate personal information.

04

Clearly explain the details of the false certification, including how the unauthorized signature or payment occurred.

05

Attach any supporting documentation, including evidence of the unauthorized actions.

06

Review the completed application for accuracy and completeness.

07

Sign and date the application before submission.

08

Submit the application to the appropriate loan servicer or agency.

Who needs LOAN DISCHARGE APPLICATION: FALSE CERTIFICATION (UNAUTHORIZED SIGNATURE / UNAUTHORIZED PAYMENT)?

01

Individuals who believe they have been a victim of fraud regarding their loan.

02

Borrowers who did not authorize a signature or payment related to their loan.

03

Persons seeking relief from repayment due to false certification issues.

Fill

form

: Try Risk Free

People Also Ask about

How to remove discharged student loans from credit report?

If you got the discharge letter, just dispute the loan on your credit report with EACH of the three bureaus (Equifax, Experian, and Transunion), attaching the discharge letter with the dispute and indicating that the loan is paid in full.

What is a false certification discharge?

An employee or affiliate of the school signed your name on the loan application or promissory note without your authorization or endorsed your loan check or signed your authorization for electronic funds transfer without your knowledge, and the loan money wasn't given to you or applied to charges you owed to the school

Is the student loan forgiveness program real?

Public Service Loan Forgiveness (PSLF) The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of 120 qualifying monthly payments while working full time for a qualifying employer.

What is loan discharge false certification?

If student loans were issued in your name that shouldn't have been, you may be able to have those loans canceled through a False Certification discharge. You may be eligible for a False Certification discharge if: you didn't have a high school diploma or GED when you enrolled in college (Ability to Benefit); or.

How many discharge options are included under the false certification discharge?

That means you won't have to pay back some or all of your loan(s). The terms “forgiveness,” “cancellation,” and “discharge” mean essentially the same thing.

What happens when a loan is discharged?

you no longer have further obligation to repay the loan, you will receive a reimbursement of payments made voluntarily or through forced collection, and. the discharge will be reported to credit bureaus to delete any adverse credit history associated with the loan.

What does loan discharge mean?

You have to apply for a False Certification discharge to get your loans canceled for one of the reasons above. There are three categories of False Certification: Ability to Benefit, Disqualifying Status, and Unauthorized Signature/Payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LOAN DISCHARGE APPLICATION: FALSE CERTIFICATION (UNAUTHORIZED SIGNATURE / UNAUTHORIZED PAYMENT)?

The LOAN DISCHARGE APPLICATION: FALSE CERTIFICATION (UNAUTHORIZED SIGNATURE / UNAUTHORIZED PAYMENT) is a formal request submitted by borrowers to discharge their loans due to circumstances where they believe that their signature was unauthorized or that payments were made inappropriately without their consent.

Who is required to file LOAN DISCHARGE APPLICATION: FALSE CERTIFICATION (UNAUTHORIZED SIGNATURE / UNAUTHORIZED PAYMENT)?

Individuals who have experienced unauthorized loan transactions or have had a loan discharged due to false certification, such as unauthorized signatures or unauthorized payments, are required to file this application.

How to fill out LOAN DISCHARGE APPLICATION: FALSE CERTIFICATION (UNAUTHORIZED SIGNATURE / UNAUTHORIZED PAYMENT)?

To fill out the LOAN DISCHARGE APPLICATION, individuals must provide personal information, details about the loan, explanation of the unauthorized signature or payment, and any supporting documentation that validates their claim.

What is the purpose of LOAN DISCHARGE APPLICATION: FALSE CERTIFICATION (UNAUTHORIZED SIGNATURE / UNAUTHORIZED PAYMENT)?

The purpose of the LOAN DISCHARGE APPLICATION is to allow borrowers to seek relief from their loan obligations when they believe their loans were fraudulently acquired or processed without their knowledge or consent.

What information must be reported on LOAN DISCHARGE APPLICATION: FALSE CERTIFICATION (UNAUTHORIZED SIGNATURE / UNAUTHORIZED PAYMENT)?

Report essential information including borrower identification, loan details, the nature of the unauthorized signature or payment, dates of occurrences, and any evidence or documents supporting the claim.

Fill out your loan discharge application false online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Discharge Application False is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.