GA GSEPS 401k Plan free printable template

Show details

Complete this form to Opt Out of (decline participation in) the GREPS 401(k) Plan. ... GREPS 401(k) Plan by completing of this form, you are Automatically ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign employee opt out form

Edit your 401k contribution form template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your opt out 401k form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ga gseps 401 opt out create online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit georgia 401k opt out blank form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401k opt out template form

How to fill out GA GSEPS 401(k) Plan

01

Gather necessary personal information including Social Security number, date of birth, and employment details.

02

Complete the GA GSEPS enrollment form with accurate and up-to-date information.

03

Choose your contribution level, keeping in mind the annual limits set by the IRS.

04

Select investment options available in the 401(k) plan that align with your financial goals.

05

Provide required documentation, such as proof of employment or identification if needed.

06

Review the completed form for accuracy before submission.

07

Submit the enrollment form to your HR department or through the designated online platform.

08

Monitor your account regularly after enrollment to track contributions and investment performance.

Who needs GA GSEPS 401(k) Plan?

01

State employees in Georgia who are eligible for participation in the Georgia State Employees' Pension and Savings Plan (GSEPS).

02

Employees looking to save for retirement through tax-advantaged accounts.

03

Individuals seeking to take advantage of employer matching contributions if offered.

04

Anyone aiming to secure their financial future with retirement savings plans.

Fill

ga gseps 401k opt out form create

: Try Risk Free

People Also Ask about

How do I opt out my 401k fidelity?

You may change your contributions or opt out at any time by contacting Fidelity at 1-800-835-5097 or logging in to your Fidelity NetBenefits® account online.

Can you opt out of 401k with job?

Generally, no. You can't just cancel your 401k and cash out the money while still employed. You may be able to take a loan against the balance of your 401k, but you are required to pay it back within five years, and there are additional tax implications associated with that option.

What is a letter of proof of termination?

A letter of termination typically includes information regarding the reason for dismissal, benefits or severance pay they may receive, date of their final paycheck, and other details that are relevant to the termination.

Can I opt out of 401k and get my money?

Generally, no. You can't just cancel your 401k and cash out the money while still employed. You may be able to take a loan against the balance of your 401k, but you are required to pay it back within five years, and there are additional tax implications associated with that option.

How much does it cost to remove 401k from Fidelity?

If you are under age 59½, your earnings may be subject to the 10% early withdrawal penalty. If you are over age 59½, you may withdraw before-tax funds (excluding your TVA matching funds) from the 401(k) Plan. You will not pay an early withdrawal penalty; however, your distribution will be taxed as ordinary income.

What is a sample termination letter of 401k plan?

This notice is to inform you that [name of the plan] (the Plan) has been terminated and we are in the process of winding it up. We have determined that you have an interest in the Plan, either as a plan participant or beneficiary. Your account balance in the Plan on [date] is/was [account balance].

How do you write a termination letter?

How to write a termination letter Choose your tone carefully. Gather all necessary details. Start with basic information. Notify the employee of their termination date. State the reason(s) for termination. Explain compensation and benefits going forward. Outline next steps and disclaimers.

How do I opt out of my 401k?

Simply go to your human resources department and make a request to stop paycheck contributions. There is no penalty for doing so. When the paperwork is completed, you aren't cashing out the account, you're just not contributing to it through your weekly paycheck.

How do you terminate a 401k plan?

Generally, the process of terminating a 401(k) plan includes amending the plan document, distributing all assets, notifying employees, filing a final 5500-series form and possibly filing a Form 5310, Application for Determination for Terminating PlanPDF, to ask the IRS to make a determination on the plan's

Is there a way to opt out of 401k?

If you decide your 401(k) plan no longer suits your business, consult with your financial institution or benefits practitioner to determine if another type of retirement plan might be a better match. As a general rule, you can terminate your 401(k) plan at your discretion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 401k opt out form without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your 401k opt out form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I edit 401k opt out form on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing 401k opt out form right away.

Can I edit 401k opt out form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share 401k opt out form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

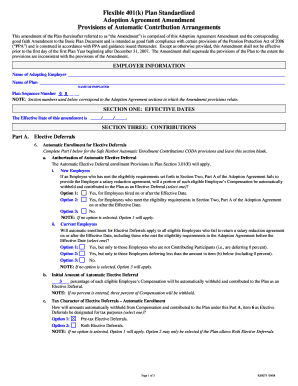

What is GA GSEPS 401(k) Plan?

The GA GSEPS 401(k) Plan is a retirement savings plan designed for employees of the Georgia State Employees Pension System, allowing them to save and invest a portion of their income on a tax-deferred basis.

Who is required to file GA GSEPS 401(k) Plan?

Employees who participate in the GA GSEPS 401(k) Plan are required to file the necessary documentation to ensure compliance with contribution and distribution rules.

How to fill out GA GSEPS 401(k) Plan?

To fill out the GA GSEPS 401(k) Plan paperwork, individuals should provide personal information, contribution amounts, and investment choices on the designated forms provided by the plan administrator.

What is the purpose of GA GSEPS 401(k) Plan?

The purpose of the GA GSEPS 401(k) Plan is to offer state employees a tax-advantaged way to save for retirement, promoting long-term financial security.

What information must be reported on GA GSEPS 401(k) Plan?

The information that must be reported includes employee contributions, employer matching contributions, investment performance, and account balances.

Fill out your 401k opt out form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Opt Out Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.