Get the free Form N-200V, Rev. 2012, Individual Income Tax ... - Hawaii.gov - state hi

Show details

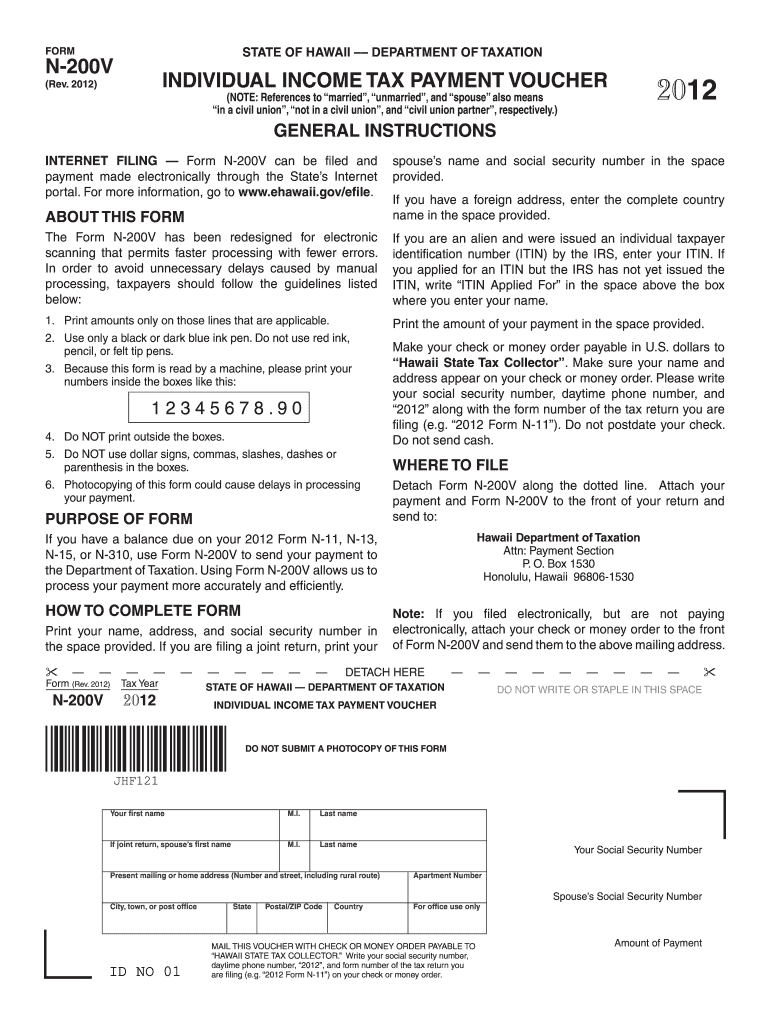

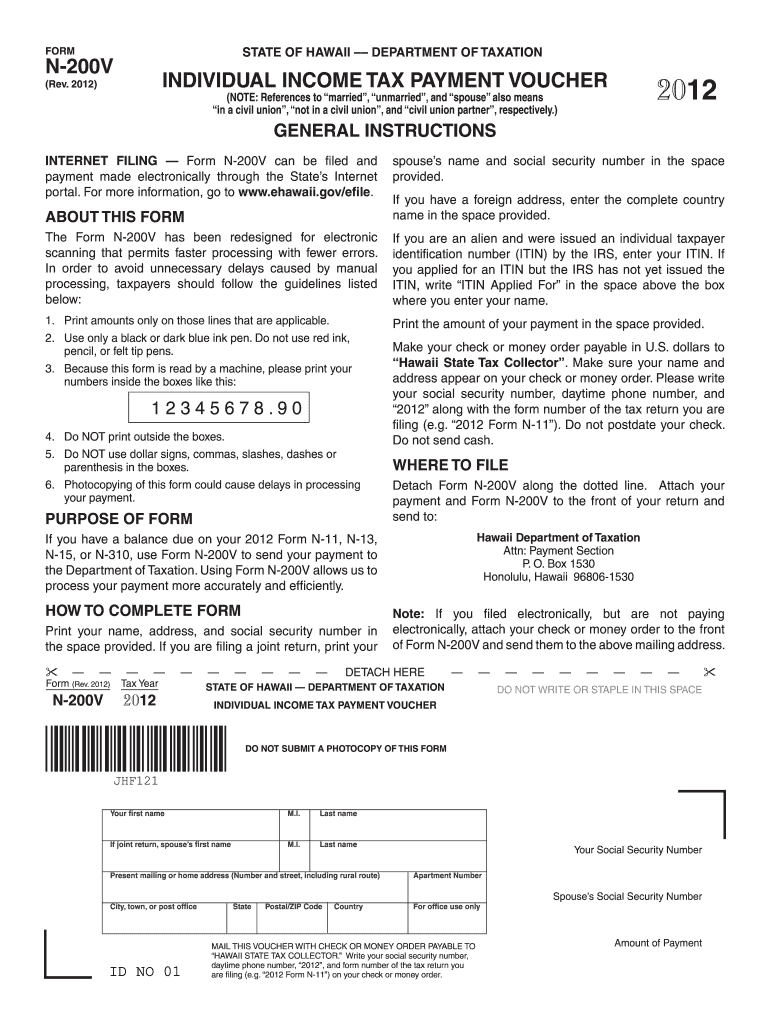

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION FORM N-200V INDIVIDUAL INCOME TAX PAYMENT VOUCHER (NOTE: References to married, unmarried, and spouse also means (Rev. 2012) 2012 in a civil union,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form n-200v rev 2012

Edit your form n-200v rev 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form n-200v rev 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form n-200v rev 2012 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form n-200v rev 2012. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form n-200v rev 2012

How to fill out form n-200v rev 2012:

01

Begin by carefully reading the instructions provided with the form. These instructions will guide you through the process and help you understand the purpose of each section.

02

Gather all the necessary documentation and information required to complete the form. This may include personal identification, employment history, and supporting documents for any claims made.

03

Start with Section 1 of the form, which typically asks for personal information such as your name, address, and contact details. Fill in the required fields accurately and legibly.

04

Proceed to Section 2, where you may be required to provide information about your immigration status or any previous applications you have made. Follow the instructions and provide the requested details.

05

Move on to Section 3, which often requests information about your employment history. Fill in the relevant details, such as your current and past employers, job titles, dates of employment, and income.

06

Continue to Section 4, where you may need to disclose any criminal convictions or immigration violations. If applicable, provide honest and accurate information.

07

Review your completed form thoroughly to ensure all sections are filled out correctly. Check for any missing information or mistakes.

08

Sign and date the form as required, and make a copy for your records before submitting it.

Who needs form n-200v rev 2012:

01

Individuals who are applying for a specific immigration benefit or seeking to change or extend their immigration status may need to fill out form n-200v rev 2012.

02

This form is typically used for various purposes, such as naturalization, adjustment of status, or obtaining a lawful permanent resident card.

03

The specific eligibility criteria and circumstances that require the use of form n-200v rev 2012 may vary, so it is important to consult the relevant legal or immigration resources to determine if this form is necessary for your situation.

Fill

form

: Try Risk Free

People Also Ask about

Which people are legally required to file a tax return?

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

Who needs to file a Hawaii nonresident return?

Any person who is in Hawaiʻi for a temporary or transient purpose and whose permanent residence is not Hawaiʻi is considered a Hawaiʻi nonresident. Each year, a nonresident who earns income from Hawaiʻi sources must file a State of Hawaiʻi tax return and will be taxed only on income from Hawaiʻi sources.

Who is required to file a Hawaii tax return?

Generally, a Hawaii individual income tax return must be filed with the Department of Taxation for each year in which an individual has gross income that exceeds the amount of his or her personal exemptions and standard deduction.

What is the tax form for non residents in Hawaii?

Hawaiʻi nonresidents or part-year residents should file state Form N-15. A completed copy of the federal return must be attached to the Form N-15. Full-year Hawaiʻi residents filing a federal return should file state Form N-11.

How do I get my Hawaii state tax form?

To request a form by mail or fax, you may call our Taxpayer Services Form Request Line at 808-587-4242 or toll-free 1-800-222-3229.

Where can I get Hawaii state tax forms?

Hawaii state tax forms and reproduction specifications are available on the Federation of Tax Administrators (FTA) Secure Exchange System (SES) website. The SES website is a secure way to provide files to those that reproduce our forms.

What is the state income tax in Hawaii for individuals?

The state of Hawaii requires you to pay taxes if you are a resident or nonresident and receive income from a Hawaii source. The state income tax rates range from 1.4% to 11%, and the Aloha State doesn't charge sales tax.

Who must pay Hawaii state income tax?

Generally, a Hawaii individual income tax return must be filed with the Department of Taxation for each year in which an individual has gross income that exceeds the amount of his or her personal exemptions and standard deduction.

How much is Hawaii and federal income tax?

Your Income Taxes Breakdown TaxMarginal Tax RateEffective Tax RateFederal22.00%12.42%FICA7.65%7.65%State8.25%6.90%Local0.00%0.00%4 more rows • Jan 1, 2023

What is form N 200V in Hawaii?

Using Form N-200V allows us to process your payment more accurately and efficiently. Print your name, address, and social security number in the space provided. If you are filing a joint return, print your spouse's name and social security number in the space provided.

What is the non resident income tax form for Hawaii?

How to determine which form to file. Hawaiʻi nonresidents or part-year residents should file state Form N-15.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form n-200v rev 2012 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your form n-200v rev 2012 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute form n-200v rev 2012 online?

pdfFiller makes it easy to finish and sign form n-200v rev 2012 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I edit form n-200v rev 2012 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing form n-200v rev 2012, you can start right away.

What is form n-200v rev?

Form N-200V Rev is a form used by individuals to submit certain requests to the U.S. Citizenship and Immigration Services (USCIS), specifically concerning the processing of applications or petitions.

Who is required to file form n-200v rev?

Individuals filing for specific benefits or who are responding to requests for evidence from USCIS may be required to file Form N-200V Rev.

How to fill out form n-200v rev?

To fill out Form N-200V Rev, you must provide your personal information, details about your request, and any additional required documents as specified in the instructions for the form.

What is the purpose of form n-200v rev?

The purpose of Form N-200V Rev is to streamline communication with USCIS regarding specific requests or applications, ensuring that the agency has all necessary information to make a decision.

What information must be reported on form n-200v rev?

Form N-200V Rev requires personal identification details, information regarding the application or petition it pertains to, and any additional supporting documents as indicated in the form instructions.

Fill out your form n-200v rev 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form N-200v Rev 2012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.