Get the free SCHEDULE J - state hi

Show details

This form is used to compute the taxable part of distributions from pensions and other annuities received during the year, as well as to determine the taxable portion of lump-sum distributions from

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule j - state

Edit your schedule j - state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule j - state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule j - state online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule j - state. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

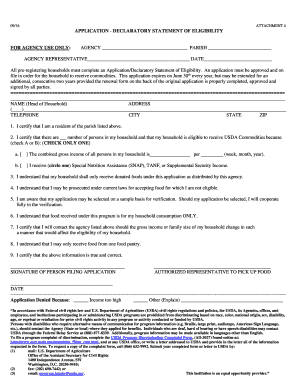

How to fill out schedule j - state

How to fill out SCHEDULE J

01

Obtain the SCHEDULE J form from the IRS website or tax preparation service.

02

Enter your name and taxpayer identification number at the top of the form.

03

Identify the applicable year for which you are reporting.

04

List the total income received in the relevant period in the designated section.

05

Itemize any allowable deductions as specified on the schedule.

06

Calculate your total income and deductions to arrive at the net amount.

07

Review all entries for accuracy to ensure you report correct figures.

08

Sign and date the form before submission.

Who needs SCHEDULE J?

01

Individuals who are required to report certain types of income or expenses that do not fall under other schedules.

02

Taxpayers claiming deductions or credits that necessitate the use of SCHEDULE J.

Fill

form

: Try Risk Free

People Also Ask about

Why is schedule J important?

Schedule J in bankruptcy is a crucial form that lists your current monthly expenses. It provides a snapshot of your household budget after filing for bankruptcy. Here's why it's important: It helps determine your disposable income — money left after paying necessary expenses.

Why is schedule J so important?

Electing to use Schedule J to average your income allows you to balance your current tax rate with the rates from previous years, so you're not taxed at a significantly higher rate in the current year.

What is a Schedule J on a 990?

Purpose of Schedule Schedule J (Form 990) is used by an organization that files Form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization.

Is Schedule J required?

Who must file Schedule J? An organization that answered “Yes” on Form 990, Part IV, Checklist of Required Schedules line 23, must complete and attach Schedule J along with its 990 return.

What is the purpose of Schedule J?

Use Schedule J (Form 1040) to elect to figure your 2024 income tax by averaging, over the previous 3 years (base years), all or part of your 2024 taxable income from your trade or business of farming or fishing.

What is the federal income tax code J?

Code J indicates that there was an early distribution from a ROTH IRA. The amount may or may not be taxable depending on the amount distributed and the taxpayer's basis in ROTH IRA Contributions. This information must be entered for the software to calculate the taxable amount.

What is a Schedule J?

Schedule J (Form 1040) provides a valuable option for farmers and fishermen to level out their income and manage their tax liabilities effectively. By averaging income over a three-year period, eligible individuals can benefit from lower tax rates and improved financial stability.

When to use schedule J?

The purpose of Schedule J is to allow qualifying farmers and fishermen to average their income over a period of up to three years. This income averaging provision is designed to provide tax relief for individuals whose income can vary significantly from year to year due to the nature of their occupation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SCHEDULE J?

SCHEDULE J is a form used by certain entities and individuals to report additional income and adjustment information, specifically pertaining to the calculation of taxable income, deductions, or credits.

Who is required to file SCHEDULE J?

Individuals and entities that have income adjustments, such as farmers or ranchers who need to report income from farming operations over multiple years, are typically required to file SCHEDULE J.

How to fill out SCHEDULE J?

To fill out SCHEDULE J, taxpayers must provide detailed information regarding their income streams, deductions, and adjustments. It typically requires completion of specific sections that detail income, expenses, and any adjustments that apply to the reporting period.

What is the purpose of SCHEDULE J?

The purpose of SCHEDULE J is to allow for a more accurate representation of taxable income and to accommodate special circumstances, such as income that varies significantly from year to year for specific enterprises.

What information must be reported on SCHEDULE J?

SCHEDULE J requires reporting of income details from businesses or farms, adjustments related to taxable income, and any pertinent deductions that affect the filer’s overall tax situation for that year.

Fill out your schedule j - state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule J - State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.