Get the free Tax Commission Decision - tax idaho

Show details

This document outlines the decision made by the Idaho State Tax Commission regarding a taxpayer's appeal against a Notice of Deficiency Determination for the tax years 1995 and 1996.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax commission decision

Edit your tax commission decision form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax commission decision form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax commission decision online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax commission decision. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax commission decision

How to fill out Tax Commission Decision

01

Gather all necessary documents, including tax returns and any relevant correspondence.

02

Carefully read the instructions provided with the Tax Commission Decision form.

03

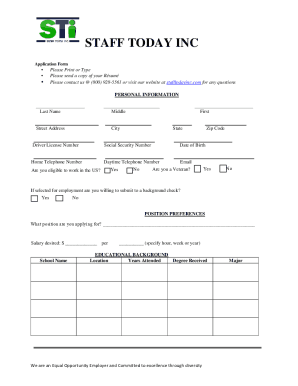

Fill out your personal information accurately, including name, address, and taxpayer identification number.

04

Provide details of the tax year or period in question.

05

Explain the reason for your appeal or request for a decision clearly and concisely.

06

Attach any supporting documentation that substantiates your case.

07

Review the form for completeness and accuracy before submission.

08

Submit the form to the appropriate tax authority by the designated deadline.

Who needs Tax Commission Decision?

01

Taxpayers contesting a decision made by a tax authority regarding their tax liability.

02

Individuals or businesses seeking clarification or modification of a prior tax ruling.

03

Taxpayers wishing to appeal decisions related to audits, assessments, or penalties.

Fill

form

: Try Risk Free

People Also Ask about

Are European Commission decisions binding?

A decision is legally binding act in its entirety. Unless explicitly stated otherwise, a decision is binding for the EU as a whole. Decisions can address specific legal entities, in which case a decision is binding only to them.

Where are European Commission decisions published?

The Official Journal of the European Union is the official publication (gazette) for EU legal acts, other acts and official information from EU institutions, bodies, offices and agencies.

Where are EU decisions made?

The 3 main institutions involved in EU decision-making are: the European Parliament, representing EU citizens. the Council of the European Union, representing governments of EU countries. the European Commission, representing the EU's overall interests.

Where does the European Commission site?

The departments and executive agencies of the Commission are based in Brussels and Luxembourg. Weekly meetings of the Commissioners take place in the Brussels headquarters and in Strasbourg.

How do I reference the European Commission?

To be made up of: Name of EU institution. Year of publication (in round brackets). Title (in italics). Place of publication: publisher.

Who is the publisher of European Commission?

The Publications Office of the European Union is the official provider of publishing services to all EU institutions, bodies and agencies.

What is a council implementing decision?

Implementing decisions take precedent over national legislation in case the two contradict one another. Implementing decisions can only be issued when European legislation stipulates further measures are called for to ensure proper (and often uniform) implementation of said legislation by the member states.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Commission Decision?

A Tax Commission Decision is a ruling or determination made by a tax commission regarding tax disputes, assessments, or interpretations of tax law.

Who is required to file Tax Commission Decision?

Individuals or entities who wish to appeal a tax assessment or who seek a ruling on a tax matter are required to file a Tax Commission Decision.

How to fill out Tax Commission Decision?

To fill out a Tax Commission Decision, one must complete the required forms with accurate information regarding the taxpayer's identification, the nature of the dispute, and supporting documentation.

What is the purpose of Tax Commission Decision?

The purpose of a Tax Commission Decision is to provide a formal resolution to tax disputes, ensuring clarity and fairness in tax assessments and compliance.

What information must be reported on Tax Commission Decision?

The Tax Commission Decision must report information such as the taxpayer's name and identification, details of the tax issue, relevant laws or regulations, findings, and the decision made by the commission.

Fill out your tax commission decision online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Commission Decision is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.