Get the free CITY REVENUE SHARING - tax idaho

Show details

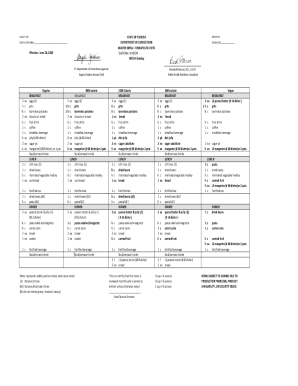

This document presents revenue sharing data for various cities in Idaho, including their estimated populations and market values as of December 2001, along with their respective total shares of revenue.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign city revenue sharing

Edit your city revenue sharing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your city revenue sharing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing city revenue sharing online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit city revenue sharing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out city revenue sharing

How to fill out CITY REVENUE SHARING

01

Determine eligibility for the city revenue sharing program.

02

Gather relevant financial documents and data.

03

Complete the application form provided by the city.

04

Provide necessary supporting documentation, such as budget reports.

05

Review the application for accuracy and completeness.

06

Submit the application by the specified deadline.

07

Follow up with the city office to ensure the application is processed.

Who needs CITY REVENUE SHARING?

01

Local governments seeking additional funding for community projects.

02

Municipalities in need of financial assistance for essential services.

03

Cities looking to invest in infrastructure improvements.

04

Local authorities aiming to support economic development initiatives.

Fill

form

: Try Risk Free

People Also Ask about

Where does profit sharing money come from?

Profit sharing is most commonly a retirement savings plan funded entirely by employers. Participating employees receive a portion of the business's quarterly or annual revenue. The exact amount is subject to the employer's discretion, though the IRS imposes annual contribution limits per employee.

What is a typical revenue sharing percentage?

What Is a Typical Revenue-Sharing Percentage? A revenue-sharing percentage ranges anywhere between 2% to 10%. This will depend on how many stakeholders are involved and the size of the company.

What is a revenue sharing payment?

Revenue sharing is an arrangement between two or more parties sharing a portion of a business's profits and losses. This type of agreement is often seen between companies and partners (e.g., suppliers, distributors, etc.) and within companies themselves.

Where does revenue sharing money come from?

Unlike profit-sharing plans, the revenue share model is based on gross sales and can include operating expenses. The amount distributed to partners depends on their contribution to the company's growth or success over a set period of time.

Where does revenue income come from?

For many companies, revenues are generated from the sales of products or services. For this reason, revenue is sometimes known as gross sales. Revenue can also be earned via other sources. Inventors or entertainers may receive revenue from licensing, patents, or royalties.

What are the downsides of revenue sharing?

Revenue-sharing may limit your ability to compete effectively with other businesses in your industry. You might find it challenging to invest in marketing, innovation or pricing strategies that can help you stay competitive, as a portion of your revenue is consistently allocated to the marketplace.

What is an example of general revenue sharing?

General Revenue Sharing (GRS) pertains to funding with no particular designation. State and local governments can use this money for a variety of purposes including highway improvements, police and fire protection, health services, library books, and constructing or renovating public buildings.

What are some examples of revenue sharing?

Examples of revenue sharing Affiliate marketing: Companies share a portion of their revenue with affiliate marketers who promote their products and drive sales through unique referral links. Franchise businesses: Franchisors often receive royalties based on the revenue generated by their franchisees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CITY REVENUE SHARING?

City Revenue Sharing is a program designed to distribute a portion of state revenue to municipalities to support local services, infrastructure, and improve community welfare.

Who is required to file CITY REVENUE SHARING?

Municipalities that receive revenue from state funding or local government units are required to file for City Revenue Sharing.

How to fill out CITY REVENUE SHARING?

To fill out City Revenue Sharing forms, gather necessary financial data, use the prescribed format for reporting, and submit the completed forms to the designated state agency by the required deadlines.

What is the purpose of CITY REVENUE SHARING?

The purpose of City Revenue Sharing is to provide financial assistance to local governments, enabling them to better manage their budgets, maintain public services, and promote economic growth within their communities.

What information must be reported on CITY REVENUE SHARING?

Cities must report information including estimated revenue, expenditure data, and specific categories of spending that reflect how the shared revenues are utilized within the community.

Fill out your city revenue sharing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

City Revenue Sharing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.