Get the free FAS-35 - sco idaho

Show details

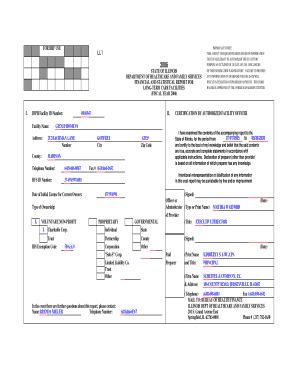

This document is a data entry form used for recording information related to state agency assets in Idaho, specifically for the FAS (Fixed Asset System) tracking.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fas-35 - sco idaho

Edit your fas-35 - sco idaho form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fas-35 - sco idaho form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fas-35 - sco idaho online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fas-35 - sco idaho. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fas-35 - sco idaho

How to fill out FAS-35

01

Start by gathering all necessary documentation related to your expenses that will be reported on the FAS-35 form.

02

Open the FAS-35 form on your computer or obtain a physical copy.

03

Fill in your personal information at the top of the form, including your name, address, and contact information.

04

Carefully complete each section of the form, ensuring that you accurately report the expenses as outlined in the guidelines.

05

Double-check all entries for accuracy and completeness to ensure that no information is omitted.

06

Sign and date the form where indicated.

07

Submit the completed FAS-35 form via the prescribed method (e.g., online submission or mailing it to the relevant authority).

Who needs FAS-35?

01

Individuals or businesses that have incurred eligible expenses and require reimbursement or tax deductions may need to fill out the FAS-35 form.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between GAAP and FASB?

GAAP refers to a set of accounting principles, standards, and procedures used to prepare and present financial statements. They provide a framework that governs how financial information should be recorded, reported, and disclosed. FASB is the organization responsible for setting accounting guidelines laid out in GAAP.

What is FAS 150?

This Statement establishes standards for how an issuer classifies and measures certain financial instruments with characteristics of both liabilities and equity. It requires that an issuer classify a financial instrument that is within its scope as a liability (or an asset in some circumstances).

What is the fas level in finance?

Financial Accounting Standard 157 (FAS 157) established a single consistent framework for estimating fair value in the absence of quoted prices, based on the notion of an “exit price” and a 3-level hierarchy to reflect the level of judgment involved in estimating fair values, ranging from market-based prices to

What does FAS stand for in banking?

FAS. Financial Accounting Standards. The official accounting standards setting body in the US, FASB, issues Financial Accounting Standards (FAS), which companies must follow if their accounts are to show a true and fair view. Break down the jargon barrier further with one of our online course or virtual courses.

What is the full meaning of FASB?

Financial Accounting Standards Board (FASB) Since 1973, the Financial Accounting Standards Board (FASB) has been the designated organisation in the private sector for establishing standards of financial accounting and reporting in the United States of America.

What is a Fas 150 redemption?

A financial instrument issued in the form of shares that is mandatorily redeemable — that embodies an unconditional obligation requiring the issuer to redeem it by transferring its assets at a specified or determinable date (or dates) or upon an event that is certain to occur.

What is FAS 34?

FAS 34 Summary This Statement establishes standards for capitalizing interest cost as part of the historical cost of acquiring certain assets. To qualify for interest capitalization, assets must require a period of time to get them ready for their intended use.

What is the FAS 151 adjustment?

FAS 151 summary This Statement amends the guidance in ARB No. 43, Chapter 4, “Inventory Pricing,” to clarify the accounting for abnormal amounts of idle facility expense, freight, handling costs, and wasted material (spoilage).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FAS-35?

FAS-35 is a financial reporting form used by certain entities to disclose their financial activities and compliance with specific accounting standards.

Who is required to file FAS-35?

Entities that meet certain criteria, such as those that engage in financial reporting under specific regulatory frameworks, are required to file FAS-35.

How to fill out FAS-35?

To fill out FAS-35, entities must gather their financial data, follow the provided guidelines and formats, and ensure all required information is accurately reported.

What is the purpose of FAS-35?

The purpose of FAS-35 is to ensure transparency and consistency in financial reporting among entities, facilitating better analysis and comparison of financial performance.

What information must be reported on FAS-35?

FAS-35 requires entities to report financial statements, disclosures on accounting policies, and any relevant supplementary information as dictated by regulatory requirements.

Fill out your fas-35 - sco idaho online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fas-35 - Sco Idaho is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.