Get the free Employee Group Insurance Handbook — Flexible Spending Account (FSA) Plan

Show details

This document outlines the Flexible Spending Account (FSA) Plan for employees of the State of Idaho, detailing provisions for eligibility, benefits, claims procedures, and other related policies.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee group insurance handbook

Edit your employee group insurance handbook form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee group insurance handbook form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employee group insurance handbook online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit employee group insurance handbook. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

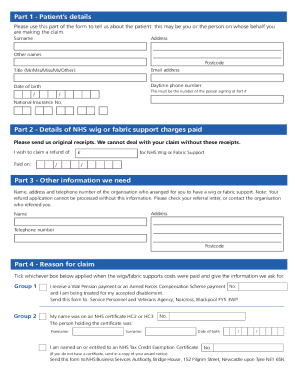

How to fill out employee group insurance handbook

How to fill out Employee Group Insurance Handbook — Flexible Spending Account (FSA) Plan

01

Obtain a copy of the Employee Group Insurance Handbook for the FSA Plan.

02

Read the introduction to understand the purpose of the FSA.

03

Locate the section that outlines eligibility requirements.

04

Fill in your personal information, including name, address, and employee ID.

05

Review the list of qualified medical expenses to understand what the FSA covers.

06

Complete the section on contribution amounts based on your budget and FSA limits.

07

Sign and date the form to confirm your enrollment in the FSA Plan.

08

Submit the completed handbook as instructed, either online or via mail.

Who needs Employee Group Insurance Handbook — Flexible Spending Account (FSA) Plan?

01

Employees enrolled in the Employee Group Insurance Plan.

02

Individuals seeking to manage healthcare expenses with pre-tax dollars.

03

Anyone interested in reducing taxable income through flexible spending.

Fill

form

: Try Risk Free

People Also Ask about

Who cannot participate in an FSA?

By law, annuitants (other than reemployed annuitants) cannot participate in any flexible spending account (FSA) programs, including FSAFEDS. FSAs are a way of setting aside pre-tax salary for reimbursement of eligible expenses. Annuitants receive annuities, which are not salary.

What is the FSA Flexible Spending Account?

A Flexible Spending Account is an employee benefit that allows you to set aside money from your paycheck, pre-tax, to pay for healthcare and dependent care expenses. Unlike a Health Savings Account (HSA), an FSA is not administered by your health insurance. However, it can still help you save money on income taxes.

Is it good to have a FSA account?

If you have any ongoing or expected medical needs you might have to pay for in the upcoming year, an FSA is a great use of your money. The funds can also be used for over-the-counter items such as allergy and sinus drugs, first-aid supplies, digestive health products and home COVID-19 tests.

How do I know if I am eligible for FSA?

Categories of FSA-eligible expenses Remember to check with your plan administrator to confirm the expense is eligible with your specific FSA. For even more services you may be able to use your FSA funds toward, check out the search feature of the FSA Store's comprehensive list of eligible expenses.

What is the difference between a FSA and HSA account?

FSAs are available to all employees, while the HSA is available only to those on the High Deductible Health Plan (HDHP) with HSA. HSA funds roll over year to year. Some FSA funds carry over to the next year and some are “use it or lose it” (see FSA). HSA offers higher contribution limits than FSAs.

Who is eligible for an FSA account?

An employee must be eligible for group medical plan (not enrolled, only eligible) in order to be eligible for Medical FSA. Generally, pre-tax benefits may only be afforded to the employee, their spouses and dependents.

Can you use FSA for anyone?

You can use funds in your FSA to pay for certain medical and dental expenses for you, your spouse if you're married, and your dependents. You can spend FSA funds to pay deductibles and copayments, but not for insurance premiums.

Who is eligible for FSA account?

Who is eligible to enroll in an FSA plan? Most full-time employees are eligible to participate in an FSA if their employer offers health insurance. Employees who already have a health savings account (HSA) should not enroll in a health care FSA. They may still enroll in a dependent care FSA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employee Group Insurance Handbook — Flexible Spending Account (FSA) Plan?

The Employee Group Insurance Handbook — Flexible Spending Account (FSA) Plan is a tax-advantaged financial account that allows employees to set aside a portion of their earnings to pay for eligible healthcare expenses, reducing their taxable income.

Who is required to file Employee Group Insurance Handbook — Flexible Spending Account (FSA) Plan?

Typically, employees who choose to participate in the Flexible Spending Account (FSA) Plan are required to fill out necessary documentation and forms to enroll in the plan during the open enrollment period.

How to fill out Employee Group Insurance Handbook — Flexible Spending Account (FSA) Plan?

To fill out the Employee Group Insurance Handbook — Flexible Spending Account (FSA) Plan, employees need to complete an enrollment form which usually requires personal information, the amount to contribute, and acknowledgment of terms and conditions outlined in the handbook.

What is the purpose of Employee Group Insurance Handbook — Flexible Spending Account (FSA) Plan?

The purpose of the Employee Group Insurance Handbook — Flexible Spending Account (FSA) Plan is to provide employees with a financially advantageous way to pay for qualified medical expenses while reducing their overall tax burden.

What information must be reported on Employee Group Insurance Handbook — Flexible Spending Account (FSA) Plan?

The information that must be reported typically includes the employee's election amount, any claims for reimbursement submitted, and any changes in personal circumstances or eligibility during the plan year.

Fill out your employee group insurance handbook online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Group Insurance Handbook is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.