Get the free Short Term Activity Exemption Work Sheet - itd idaho

Show details

A worksheet to apply for an exemption for short-term activities affecting the environment, detailing project information and requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short term activity exemption

Edit your short term activity exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short term activity exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing short term activity exemption online

Follow the guidelines below to benefit from a competent PDF editor:

1

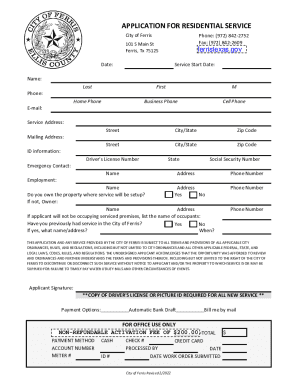

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit short term activity exemption. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out short term activity exemption

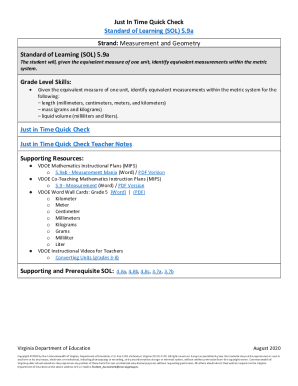

How to fill out Short Term Activity Exemption Work Sheet

01

Gather all necessary information related to your short-term activities.

02

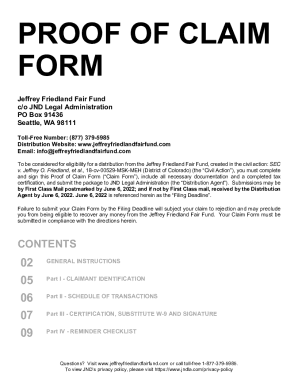

Download or obtain a copy of the Short Term Activity Exemption Work Sheet.

03

Review the instructions provided at the top of the sheet.

04

Fill out your name and contact information in the designated section.

05

List the specific short-term activities for which you are requesting exemption.

06

Provide detailed descriptions for each activity, including dates and locations.

07

Indicate the reasons for requesting the exemption for each activity.

08

Attach any supporting documents that reinforce your request, if applicable.

09

Review the completed work sheet for accuracy.

10

Submit the work sheet to the appropriate authority as directed.

Who needs Short Term Activity Exemption Work Sheet?

01

Individuals or organizations planning short-term activities that may require exemption from standard regulations.

02

Professionals conducting temporary work or events that fall under specific exemption categories.

03

Anyone seeking clarification or formal acknowledgment of short-term activity status.

Fill

form

: Try Risk Free

People Also Ask about

What is the 25k allowance?

The deduction is income-sensitive. Here's how it works: If your modified adjusted gross income (MAGI) is $100,000 or less, you may deduct up to $25,000 in passive losses. Between $100,000 and $150,000, the allowance phases out, meaning you can deduct a reduced amount.

What is the 25000 passive loss limitation?

At its core, the $25,000 rental passive loss limitation is a tax provision that allows real estate investors to deduct up to $25,000 of losses from passive rental activities against their non-passive income. Generally, passive losses are only allowed to offset passive gains.

What is the 750 hour rule for real estate professional?

You must meet both requirements to receive the tax status: 50% or more of your time is spent in real estate activities than non-real estate activities and. You spend at least 750 hours a year performing real estate activities.

What is the special allowance for rental real estate activities?

You may be able to deduct up to $25,000 in passive losses from your rental real estate each year against non-passive income. Generally, the $25,000 special allowance is reduced by 50% when AGI exceeds $100,000 and to zero when AGI reaches $150,000.

What is the special $25,000 allowance in pub 925?

Phaseout rule. The maximum special allowance of $25,000 ($12,500 for married individuals filing separate returns and living apart at all times during the year) is reduced by 50% of the amount of your modified adjusted gross income that is more than $100,000 ($50,000 if you're married filing separately).

What is a passive activity for tax purposes?

The IRS defines passive income as activities where the taxpayer does not materially participate, such as limited partnerships or rental activities (unless the taxpayer qualifies as a real estate professional). It's important to distinguish passive income from portfolio income, such as stock investments.

What is the 25000 special allowance?

Special $25,000 Allowance for Real Estate Nonprofessionals This means you can deduct up $25,000 of rental losses from your nonpassive income, such as wages, salary, dividends, interest and income from a nonpassive business that you own.

What is the 25,000 rental loss allowance?

The rental real estate loss allowance is a tax deduction of up to $25,000 a year for taxpayers who take a loss on rental property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

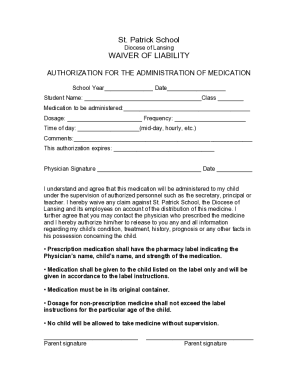

What is Short Term Activity Exemption Work Sheet?

The Short Term Activity Exemption Work Sheet is a document used to determine which short-term activities are exempt from certain regulations or requirements, helping organizations assess compliance.

Who is required to file Short Term Activity Exemption Work Sheet?

Organizations or individuals engaging in short-term activities that may qualify for exemptions are typically required to file the Short Term Activity Exemption Work Sheet.

How to fill out Short Term Activity Exemption Work Sheet?

To fill out the Short Term Activity Exemption Work Sheet, individuals should provide detailed information about the specific short-term activities, relevant dates, and any supporting documentation to justify the exemption.

What is the purpose of Short Term Activity Exemption Work Sheet?

The purpose of the Short Term Activity Exemption Work Sheet is to streamline the process of determining which short-term activities can be exempted from certain regulatory obligations, ensuring compliance while facilitating efficient operations.

What information must be reported on Short Term Activity Exemption Work Sheet?

Information required on the Short Term Activity Exemption Work Sheet typically includes the nature of the activity, timeframe of the activity, justification for the exemption, and any relevant compliance details.

Fill out your short term activity exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short Term Activity Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.