Get the free Decision of the Tax Commission of the State of Idaho - tax idaho

Show details

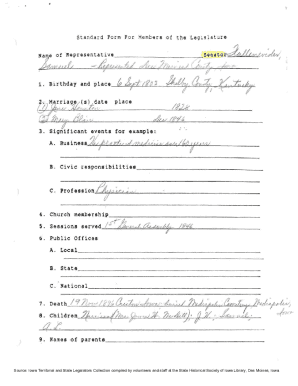

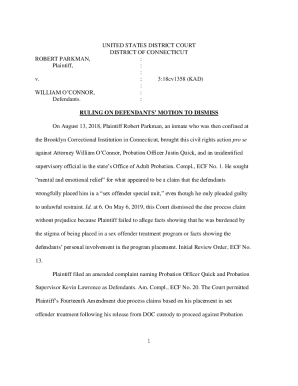

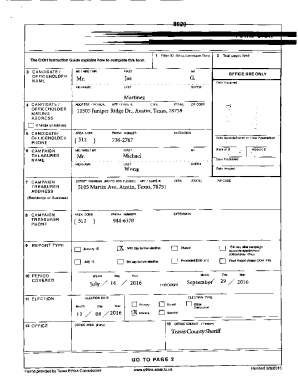

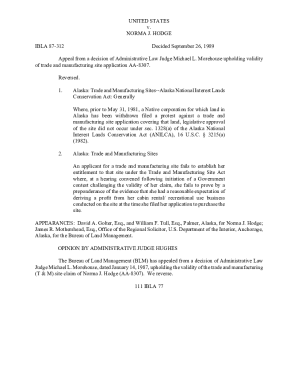

This document presents the Tax Commission's decision regarding a protest by a taxpayer against a Notice of Deficiency Determination issued for income tax for the year 2004, detailing the amounts due

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign decision of form tax

Edit your decision of form tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your decision of form tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing decision of form tax online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit decision of form tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out decision of form tax

How to fill out Decision of the Tax Commission of the State of Idaho

01

Obtain the official form for the Decision of the Tax Commission from the Idaho State Tax Commission website.

02

Review the form instructions carefully to understand the requirements and necessary information.

03

Fill out your personal information accurately, including your name, address, and contact details.

04

Provide specific details regarding the tax issue or appeal, including relevant dates and amounts.

05

Include any supporting documentation that backs up your claims or arguments.

06

Review your completed form for accuracy and completeness before submission.

07

Submit the form either electronically via the Idaho State Tax Commission's portal or via mail to the designated address.

Who needs Decision of the Tax Commission of the State of Idaho?

01

Individuals or businesses who have a dispute with the Idaho State Tax Commission or seek an official decision on a tax issue.

02

Taxpayers who believe they have been incorrectly assessed or want to appeal a tax decision.

Fill

form

: Try Risk Free

People Also Ask about

Is Idaho getting rid of state income tax?

By: Clark Corbin - March 6, 2025 5:16 pm ing to a news release issued Thursday afternoon, Little signed House Bill 40 into law. The bill makes a few changes. It reduces both the individual income tax rate and corporate income tax rate down from the current level of 5.695% to 5.3%.

Why would the Idaho Supreme Court take my tax refund?

The Idaho Supreme Court can also intercept your tax refund for unpaid court fines.

Why would the Idaho Supreme Court take my taxes?

Unpaid court fines If you have an unpaid court-ordered fine, fee, or restitution, the Idaho Supreme Court may have taken all or part of your Idaho income tax refund to divert it to an Idaho Court. (See Idaho Code section 1-1624). This includes unpaid court debts that date back to the 1990s or earlier.

Can the courts take my federal tax refund?

A successful debt-related lawsuit could lead to a wage garnishment or liens placed against personal property. Could a creditor in California even seek to intercept someone's tax return? As a general rule, the only debts that can lead to the state intercepting someone's federal or state tax refund are government debts.

Why did my tax refund get taken?

If you owe money to a federal or state agency, the federal government may use part or all of your federal tax refund to repay the debt. This is called a tax refund offset.

Why would the state take my tax refund?

State tax-collecting departments (often called the Department of Revenue) send information about delinquent state income tax debt to TOP. By law, TOP may offset a federal tax refund to collect that money owed to the states.

What does the Idaho State Tax Commission do?

The commission enforces Idaho's tax laws and works to educate the public about their role in the state tax structure. There are four divisions of tax commission: audit and collections, revenue operations, property tax and general services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Decision of the Tax Commission of the State of Idaho?

The Decision of the Tax Commission of the State of Idaho is an official ruling or determination made by the Idaho State Tax Commission regarding tax-related issues, disputes, or appeals.

Who is required to file Decision of the Tax Commission of the State of Idaho?

Taxpayers or entities that dispute tax assessments or wish to appeal decisions made by the Idaho State Tax Commission are required to file a Decision of the Tax Commission.

How to fill out Decision of the Tax Commission of the State of Idaho?

To fill out a Decision of the Tax Commission, taxpayers must provide accurate information regarding their identity, tax matters being appealed, relevant evidence or documents, and comply with the form's specific instructions.

What is the purpose of Decision of the Tax Commission of the State of Idaho?

The purpose of the Decision of the Tax Commission is to resolve disputes between taxpayers and the state regarding tax liabilities, ensuring fair application of tax laws.

What information must be reported on Decision of the Tax Commission of the State of Idaho?

The information that must be reported includes taxpayer identification, details of the tax assessment in dispute, grounds for the appeal, and any supporting documents or evidence pertinent to the case.

Fill out your decision of form tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Decision Of Form Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.