Get the free Decision of the Tax Commission of the State of Idaho - tax idaho

Show details

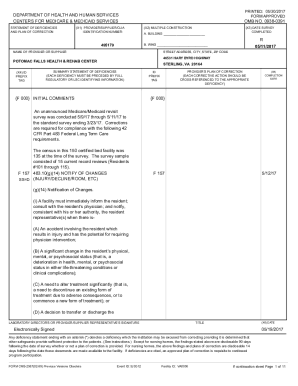

This document outlines the decision made by the Idaho State Tax Commission regarding a tax deficiency determination for income tax, penalties, and interest for the taxpayers covering the taxable years

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign decision of form tax

Edit your decision of form tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your decision of form tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit decision of form tax online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit decision of form tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out decision of form tax

How to fill out Decision of the Tax Commission of the State of Idaho

01

Obtain the necessary forms from the Idaho State Tax Commission website or office.

02

Read the instructions carefully to understand the requirements for filling out the Decision of the Tax Commission.

03

Provide accurate information regarding your tax situation, including relevant dates, amounts, and personal details.

04

Include any supporting documentation that may be required to support your claim or appeal.

05

Review your completed form for accuracy and completeness before submission.

06

Submit the filled form through the designated method outlined by the Tax Commission, whether online or via mail.

Who needs Decision of the Tax Commission of the State of Idaho?

01

Taxpayers who are appealing the decision made by the Idaho State Tax Commission.

02

Individuals or businesses seeking clarification on their tax obligations in Idaho.

03

Those who have received an adverse ruling and wish to contest or challenge the tax assessment.

Fill

form

: Try Risk Free

People Also Ask about

At what age do seniors stop paying property tax in Idaho?

Eligibility. 65 or older, blind, widowed, disabled, a former POW or hostage, or a motherless or fatherless child under 18 years old, as of January 1, 2025.

Why would I get a letter from the Idaho State Tax Commission?

To help protect taxpayer information and keep taxpayer dollars from going to criminals, we might send you: An Identity Verification letter that asks you to take a short online quiz, provide copies of documents to verify your identity, or state that you didn't file a return.

Is Idaho getting rid of state income tax?

By: Clark Corbin - March 6, 2025 5:16 pm ing to a news release issued Thursday afternoon, Little signed House Bill 40 into law. The bill makes a few changes. It reduces both the individual income tax rate and corporate income tax rate down from the current level of 5.695% to 5.3%.

What does the Idaho State Tax Commission do?

The commission enforces Idaho's tax laws and works to educate the public about their role in the state tax structure. There are four divisions of tax commission: audit and collections, revenue operations, property tax and general services.

Why would the Idaho Supreme Court take my tax refund?

The Idaho Supreme Court can also intercept your tax refund for unpaid court fines.

What does the state tax board do?

The California Franchise Tax Board (FTB) is available to help taxpayers file their state tax returns timely and accurately and pay the correct amount to fund services important to Californians. FTB can provide residents with resources for free tax help, answers to questions, and 24/7 access to your tax account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Decision of the Tax Commission of the State of Idaho?

The Decision of the Tax Commission of the State of Idaho refers to the formal resolutions or rulings made by the Idaho State Tax Commission regarding tax disputes, assessments, or interpretations of tax law within the state.

Who is required to file Decision of the Tax Commission of the State of Idaho?

Individuals or entities involved in a tax dispute or assessment decision made by the Idaho State Tax Commission are required to file a review or appeal of the decision.

How to fill out Decision of the Tax Commission of the State of Idaho?

To fill out the Decision of the Tax Commission of the State of Idaho, one must provide the necessary details including the taxpayer's information, the tax type, the disputed amounts, and the specifics of the case along with any supporting documentation.

What is the purpose of Decision of the Tax Commission of the State of Idaho?

The purpose of the Decision of the Tax Commission of the State of Idaho is to resolve tax disputes, clarify tax laws, and ensure compliance with tax regulations while providing taxpayers with a formal avenue for appeal.

What information must be reported on Decision of the Tax Commission of the State of Idaho?

The information that must be reported includes the taxpayer's identification details, the tax period in question, the nature of the dispute, findings of the Tax Commission, and any ruling outcomes or adjustments.

Fill out your decision of form tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Decision Of Form Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.