Get the free Notice of Deficiency Determination - tax idaho

Show details

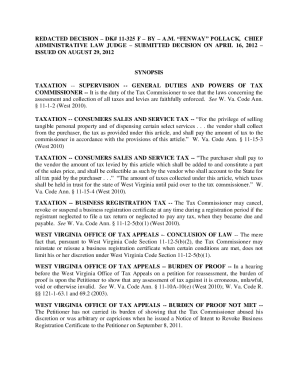

This document outlines the decision of the Idaho State Tax Commission regarding a protest filed by a taxpayer against a Notice of Deficiency Determination issued for additional income tax owed for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of deficiency determination

Edit your notice of deficiency determination form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of deficiency determination form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice of deficiency determination online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit notice of deficiency determination. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice of deficiency determination

How to fill out Notice of Deficiency Determination

01

Obtain the Notice of Deficiency Determination form from your local tax authority's website or office.

02

Fill in your personal information including your name, address, and tax identification number.

03

Indicate the tax year or period for which the deficiency is being determined.

04

Provide a detailed explanation of the discrepancies noted by the tax authority.

05

Attach any supporting documentation that substantiates your position, such as receipts or prior tax returns.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to the designated office by the specified deadline.

Who needs Notice of Deficiency Determination?

01

Individuals or businesses that receive a notice from their tax authority indicating a discrepancy or underpayment in taxes owed.

02

Taxpayers seeking to contest a deficiency assertion made by the tax authority.

03

Anyone who wishes to formally respond to an assessment that they believe is incorrect.

Fill

form

: Try Risk Free

People Also Ask about

What is the deficiency letter?

A deficiency letter is a letter that is issued by the Securities and Exchange Commission (SEC) and indicates a significant deficiency or omission in a registration statement or prospectus.

Who are deficiency letters sent to?

A deficiency letter is a letter sent by the IRS or SEC to a taxpayer or registrant, respectively, that outlines the ways in which a tax return or registration statement appears to be incomplete or not in compliance with federal requirements. It is also known as a letter of comment or letter of comments.

What is the letter from the IRS audit?

What is an IRS Audit Letter? An IRS audit letter is a notice from the IRS informing you that your tax return has been selected for review, a formal tax audit. This letter verifies the accuracy of your tax return and ensures all reported income, deductions, and credits are correct.

What is a 3219?

With a 0.9m roll out extension deck, the SJ 3219 scissor lift gives you a platform height of 5.8m and working height of up to 7.8m.

What is the meaning of deficiency note?

Meaning of deficiency notice in English an official document saying that the amount of tax recorded in someone's financial records is less than the tax they actually owe: The court trimmed the total of his untaxed fraudulent income to $31,500 from the $53,000 listed by the IRS in its deficiency notice.

What is letter 3219?

The Letter 3219 is the IRS's way of notifying you they are proposing to make changes to the return you filed and those changes will result in additional taxes being owed. Generally, this Letter is sent to a taxpayer whose audit was conducted by mail and is called a statutory notice of deficiency.

Why am I getting a letter from the auditor?

If the IRS sends you an audit letter, it means they need more information or receipts to check your tax filing. Think of the IRS agent as a teacher checking your math; they might need to see your work (or receipts) to give you the full marks you deserve.

What is the deficiency letter?

A deficiency letter is a letter that is issued by the Securities and Exchange Commission (SEC) and indicates a significant deficiency or omission in a registration statement or prospectus.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice of Deficiency Determination?

A Notice of Deficiency Determination is an official document issued by a tax authority, notifying a taxpayer that there are discrepancies or deficiencies in their tax filings.

Who is required to file Notice of Deficiency Determination?

Typically, it is issued by the tax authority to individuals or businesses that have failed to report accurate tax information or owed taxes.

How to fill out Notice of Deficiency Determination?

The form usually requires the taxpayer to provide personal information, details of the deficiency, and any supporting documentation to contest the deficiency.

What is the purpose of Notice of Deficiency Determination?

The purpose is to formally inform the taxpayer of the detected tax issues and to allow them an opportunity to respond or contest the findings.

What information must be reported on Notice of Deficiency Determination?

Information that must be reported includes taxpayer identification details, the amount of reported deficiency, the tax periods involved, and any relevant supporting information or documentation.

Fill out your notice of deficiency determination online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Deficiency Determination is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.