Get the free Financial Statements With Independent Auditors' Report - da ks

Show details

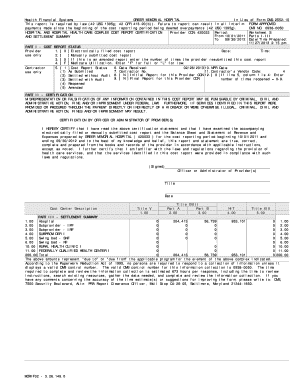

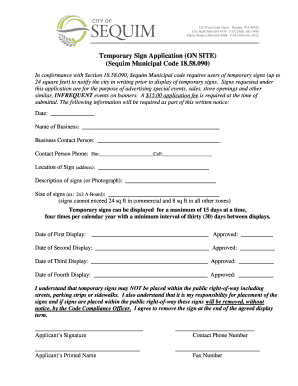

This document provides the financial statements of the City of Hillsboro, Kansas for the year ended December 31, 2011, along with the independent auditors' report and detailed statements of cash receipts,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial statements with independent

Edit your financial statements with independent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial statements with independent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial statements with independent online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial statements with independent. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial statements with independent

How to fill out Financial Statements With Independent Auditors' Report

01

Gather financial records including balance sheets, income statements, and cash flow statements.

02

Organize data in accordance with accounting principles and standards relevant to the industry.

03

Ensure that all financial data is accurate and complete, checking for discrepancies.

04

Prepare notes to the financial statements, providing additional context and explanations for figures.

05

Engage an independent auditor to review the financial statements.

06

Provide the auditor with access to all necessary financial documents for their assessment.

07

Work with the auditor to address any adjustments or concerns they may raise.

08

Once the audit is complete, obtain the Independent Auditors' Report detailing their opinion on the financial statements.

09

Review the report and ensure it is included with the final financial statements.

10

Distribute the completed financial statements and audit report to stakeholders.

Who needs Financial Statements With Independent Auditors' Report?

01

Business owners seeking to validate their financial records.

02

Investors looking for transparency and assurance of financial health.

03

Lenders and banks assessing creditworthiness for loans.

04

Regulatory bodies requiring compliance with financial reporting standards.

05

Shareholders needing insight into company performance.

06

Potential buyers conducting due diligence during mergers and acquisitions.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a tax audit report and an independent audit report?

A statutory audit focuses on the entire financial statements of a company to provide an independent opinion on their accuracy and fairness. In contrast, a tax audit focuses on verifying the correctness of income, expenses, and deductions claimed in the tax return.

What is an unmodified audit report?

An unmodified opinion (also referred to as unqualified opinion) is an opinion issued when the auditor concludes that the financial statements are prepared, in all material respects, in ance with the applicable financial reporting framework (i.e., PFRS, IPSAS).

What is the difference between audit report and independent audit report?

Look for the company's annual report which is called Form 10-K. Within that report, the audit report is included under Item 8.

What are the 5 C's of audit report writing?

An Independent Review provides limited assurance, whereas an audit provides reasonable assurance that the financial statements are represented fairly and free from material misstatements. The difference in assurance obtained from an independent review versus an audit is due to the scope of work performed.

What does independent audit report mean?

An independent Auditor's Report is an official opinion issued by an external or internal auditor as to the quality and accuracy of the financial statements prepared by a company. The report is a primary source of communication between the auditor and users of financial statements.

What are the two types of audit reports?

The 4 types of audit opinions OpinionType of audit report Unqualified Clean report Qualified Qualified report Disclaimer of opinion Disclaimer report Adverse Adverse audit report Sep 22, 2023

What are the 5 financial statements in the audited report?

The balance sheet. Income statement. Statement of cash flows. Statement of changes in equity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Statements With Independent Auditors' Report?

Financial Statements With Independent Auditors' Report are formal records of the financial activities of a business, accompanied by an independent auditor's assessment that verifies the accuracy and fairness of the statements in accordance with generally accepted accounting principles (GAAP).

Who is required to file Financial Statements With Independent Auditors' Report?

Typically, publicly traded companies, certain large private companies, and organizations required by regulatory bodies to provide audited financial statements are required to file Financial Statements With Independent Auditors' Report.

How to fill out Financial Statements With Independent Auditors' Report?

To fill out Financial Statements With Independent Auditors' Report, companies must prepare their financial statements in accordance with accounting standards, have them audited by an independent auditor, and include the auditor's opinion, notes to the financial statements, and required disclosures.

What is the purpose of Financial Statements With Independent Auditors' Report?

The purpose of Financial Statements With Independent Auditors' Report is to provide stakeholders with an assurance that the financial statements are free from material misstatement and accurately represent the financial position and performance of the organization.

What information must be reported on Financial Statements With Independent Auditors' Report?

The information that must be reported includes the auditor's opinion on the fairness of the financial statements, the financial statements themselves (balance sheet, income statement, cash flow statement, and statement of changes in equity), and notes that offer additional context and disclosures.

Fill out your financial statements with independent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statements With Independent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.