Get the free Special Financial Statements - da ks

Show details

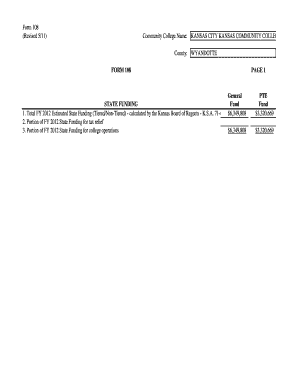

This document provides the financial statements for the City of Florence, Kansas, as of December 31, 2010, including independent auditor's report, summaries of cash receipts, expenditures, governmental

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign special financial statements

Edit your special financial statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your special financial statements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit special financial statements online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit special financial statements. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out special financial statements

How to fill out Special Financial Statements

01

Gather all necessary financial documents including income statements, balance sheets, and expense reports.

02

Identify the purpose of the Special Financial Statements, whether for loan applications, investor pitching, or other purposes.

03

List all revenue streams and expenditures in detail, adhering to relevant accounting standards.

04

Fill out the Special Financial Statements form systematically, ensuring accuracy in all calculations.

05

Review the completed statements for any discrepancies or omissions.

06

If required, have the statements audited or reviewed by a certified accountant for credibility.

07

Submit the completed Special Financial Statements to the relevant stakeholders or institutions.

Who needs Special Financial Statements?

01

Businesses seeking financing from banks or investors.

02

Companies undergoing mergers or acquisitions.

03

Organizations applying for grants or funding.

04

Nonprofits needing to demonstrate financial health.

05

Individuals requiring proof of financial status for personal loans or mortgages.

Fill

form

: Try Risk Free

People Also Ask about

What are special items in financial statements?

Special Items are significant transactions or other events within the control of management that are either unusual in nature or infrequent in occurrence and are reported on the operating statement before extraordinary items.

What are the 5 types of financial statements?

The usual order of financial statements is as follows: Income statement. Cash flow statement. Statement of changes in equity. Balance sheet. Note to financial statements.

What is the difference between GPFs and SPFs?

A charity's financial statements must be either General Purpose Financial Statements (GPFS) or Special Purpose Financial Statements (SPFS). The type of financial statements a charity must prepare depends on whether it is classed as a reporting entity.

What is the difference between general purpose and special purpose financial reporting?

Audit and Assurance: General Purpose Financial Statements often undergo an external audit to provide independent assurance on their accuracy and compliance. Special Purpose Financial Statements may or may not require an audit, depending on the specific requirements of the intended users or regulatory authorities.

What is the difference between general purpose and special purpose table?

General Purpose Table has no special importance as it is used by different persons in a different manner. Generally, it is given on the back of reports or circulars etc. Special Purpose Table are given for specific purposes. They serve the purpose of that particular group for which they have been prepared.

What is the difference between GPFS and HDFS?

For starters, GPFS is POSIX compliant, which enables any other applications running atop the Hadoop cluster to access data stored in the file system in a straightforward manner. With HDFS, only Hadoop applications can access the data, and they must go through the Java-based HDFS API.

What is a special purpose financial statement?

A special- purpose financial statement is a financial report that is intended for presentation to specific users, and it may accompany a complete set of financial statements that is intended for general use, or it may be presented separately. The audits of such statements are conducted in ance with all the SAs.

What is the difference between general purpose and special purpose?

A general purpose item is less specialized than a special purpose one, but covers more. This is also the main difference between these governments. The former provides the taxpayer with general use services, while the latter provides them with very specific use services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Special Financial Statements?

Special Financial Statements are financial reports that are prepared for specific purposes or to meet unique regulatory or contractual requirements, often different from general financial statements.

Who is required to file Special Financial Statements?

Organizations or individuals that have specific legal, regulatory, or contractual obligations, such as public companies, non-profits, or businesses seeking loans or investment can be required to file Special Financial Statements.

How to fill out Special Financial Statements?

To fill out Special Financial Statements, gather relevant financial data, follow the specific format and guidelines provided by the governing authority or stakeholder, and ensure all required disclosures and details are accurately reported.

What is the purpose of Special Financial Statements?

The purpose of Special Financial Statements is to provide detailed and relevant financial information for specific users or purposes, helping stakeholders assess an entity's financial situation under certain conditions.

What information must be reported on Special Financial Statements?

The information reported on Special Financial Statements typically includes detailed income statements, balance sheets, cash flow statements, and additional notes or disclosures as required by the specific purpose or governing body.

Fill out your special financial statements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Special Financial Statements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.