Get the free USD Budget Information - ksde

Show details

A comprehensive budget document providing information about the budget estimates, expenditures, and related tax levies for Unified School District 110 for the fiscal year 2010-2011.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign usd budget information

Edit your usd budget information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

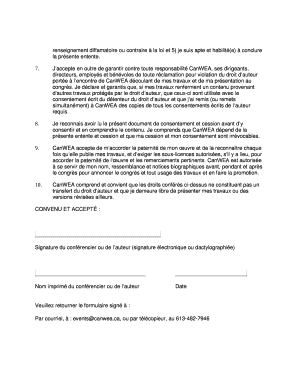

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usd budget information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit usd budget information online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit usd budget information. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out usd budget information

How to fill out USD Budget Information

01

Gather all necessary financial documents and data.

02

Begin by entering the organization name and contact information at the top of the form.

03

Indicate the funding period for the budget being submitted.

04

List all anticipated revenues and categorize them as required.

05

Calculate total revenue by adding all listed sources.

06

Detail expenditures in the appropriate categories, ensuring clarity on each item.

07

Include indirect costs if applicable, following the guidelines provided.

08

Review the budget for accuracy and completeness.

09

Sign and date the document where required.

10

Submit the completed budget information by the specified deadline.

Who needs USD Budget Information?

01

Non-profit organizations applying for grants.

02

Government agencies seeking funding.

03

Educational institutions requesting financial support.

04

Businesses applying for federal contracts that require a budget submission.

Fill

form

: Try Risk Free

People Also Ask about

What are the 3 largest expenses for the federal government?

In FY 2024, about 55% of federal spending, or $3.8 trillion, went to Social Security, defense, and payments to states. Social Security and Medicare are two of the largest individual programs funded by the federal government. In FY 2024, 22% of the federal budget went to Social Security and 14% went to Medicare.

What is the breakdown of the US budget?

What does the government buy? 21 % Social Security. 14 % Medicare. 14 % Net Interest. 13 % Health. 13 % National Defense. 11 % Income Security. 5 % Veterans Benefits and Services. 2 % Education, Training, Employment, and Social Services.

What are 5 of the major expenses of the United States government?

To set the federal budget, Congress passes two kinds of laws that set the budget for our country. The first are called authorization. These are necessary for both mandatory and discretionary spending. There are also appropriations, which legislate what is known as discretionary spending.

What are the top 5 expenditures of local government?

Local Government Spending FunctionTotal local U.S. government 2021 spending estimates in trillions of dollars Pensions 0.1 Health Care 0.2 Education 0.8 Welfare 0.13 more rows

What is the major expense of state governments?

What do state and local governments spend money on? State and local governments spend most of their resources on education and health care programs. In 2021, about one-third of state and local spending went toward combined elementary and secondary education (21 percent) and higher education (8 percent).

What are the three main expenses for state governments?

The State Budget Directs Dollars to California Communities Through Three Funding Categories Local Assistance (79.9%) Capital Outlay (1.4%) State Operations (18.7%)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is USD Budget Information?

USD Budget Information refers to the financial data and forecasts related to the budget allocated by the United States Department of Defense or other governmental entities for specific purposes, which ensures effective management and tracking of expenditures.

Who is required to file USD Budget Information?

Organizations or entities that receive funds from the U.S. government, including contractors, grant recipients, and federal agencies, are required to file USD Budget Information.

How to fill out USD Budget Information?

To fill out USD Budget Information, one must gather the necessary financial data, complete the required forms accurately, detail the projected expenses and sources of funding, and ensure compliance with the specific guidelines set forth by the filing authority.

What is the purpose of USD Budget Information?

The purpose of USD Budget Information is to provide transparency and accountability regarding the allocation and utilization of federal funds, facilitate oversight, and ensure that spending aligns with legislative requirements and policy goals.

What information must be reported on USD Budget Information?

The information that must be reported includes estimated costs, funding sources, budget justifications, performance metrics, and any relevant financial details that reflect the proposed usage of funds.

Fill out your usd budget information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Usd Budget Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.