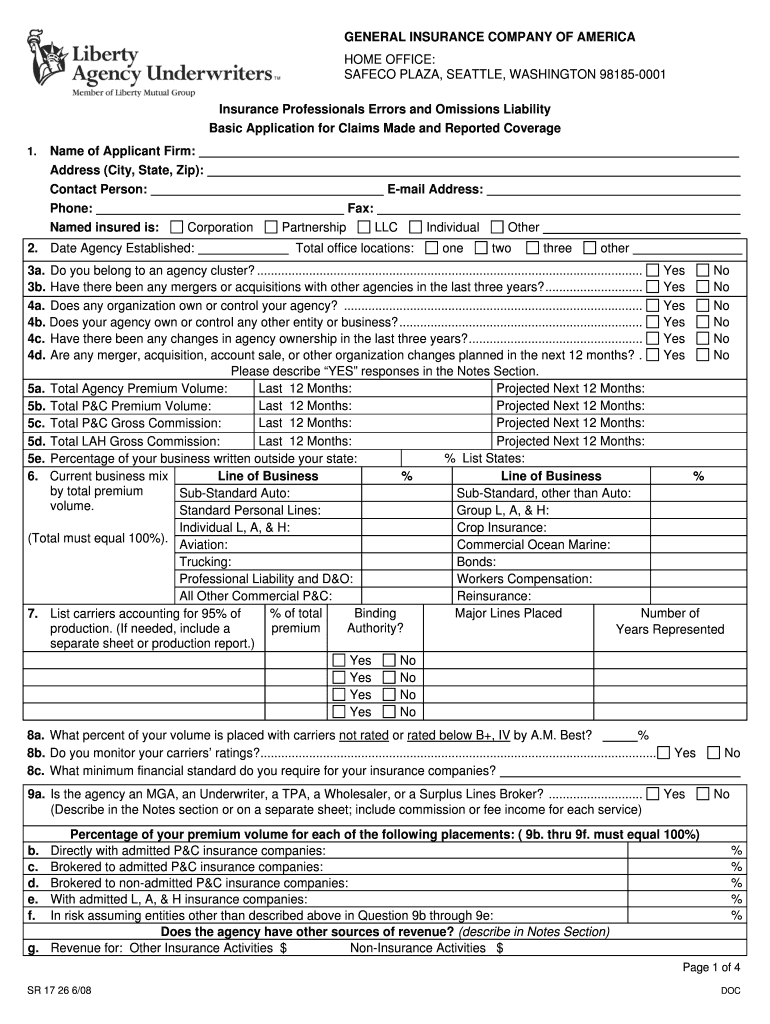

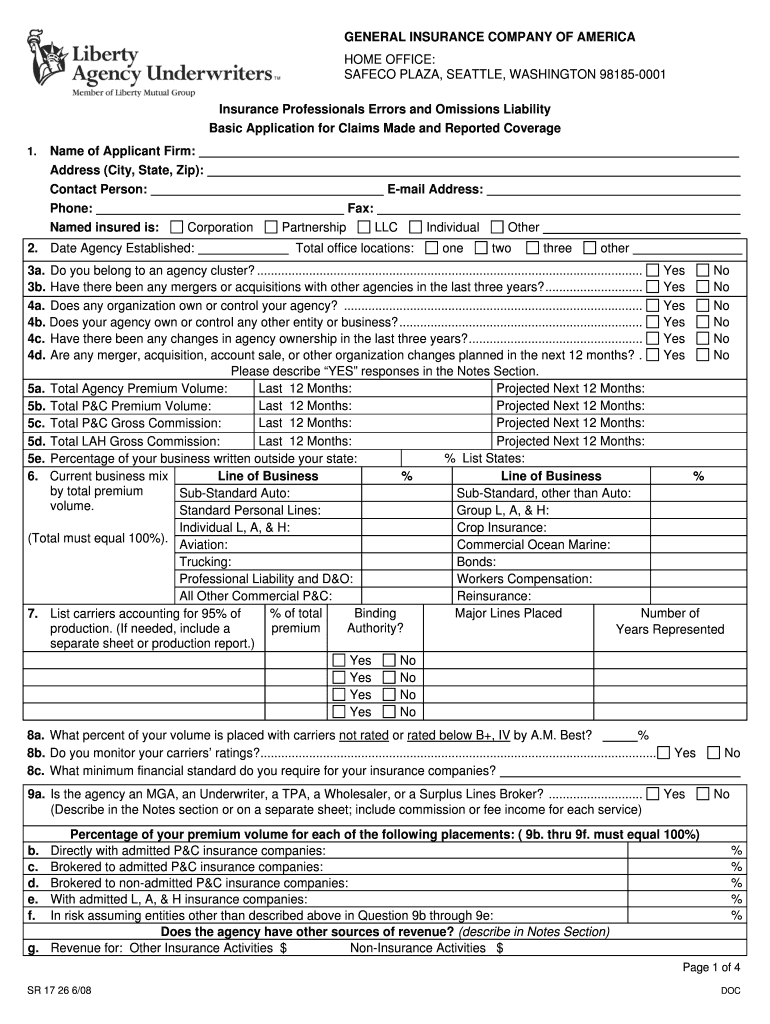

Get the free Insurance Professionals Errors and Omissions Liability Basic Application - iiaba

Show details

Este documento es una solicitud básica para la cobertura de responsabilidad por errores y omisiones de profesionales de seguros, proporcionando información sobre la agencia del solicitante, su volumen

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance professionals errors and

Edit your insurance professionals errors and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance professionals errors and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance professionals errors and online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit insurance professionals errors and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance professionals errors and

How to fill out Insurance Professionals Errors and Omissions Liability Basic Application

01

Begin by gathering all relevant information about your business, including business name, address, and contact details.

02

Identify the type of services you provide and ensure you detail them accurately in the application.

03

Specify the number of years your business has been operational and any relevant professional qualifications or certifications.

04

Fill out the section regarding prior insurance coverage, including any previous errors and omissions insurance policies.

05

Provide details on your claims history, including any past incidents that resulted in claims against your professional services.

06

Review the underwriting questions carefully and answer truthfully, focusing on risk management practices you have in place.

07

Include any additional information or comments that may help the insurer understand your operations better.

08

Double-check all information for accuracy and completeness before submitting the application.

Who needs Insurance Professionals Errors and Omissions Liability Basic Application?

01

Professionals in industries such as finance, accounting, consulting, legal services, and insurance.

02

Individuals or firms that provide professional advice or services and wish to protect themselves against claims of negligence or errors.

03

Any business that requires a license to operate and serves clients on a fee basis or through contracts.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of errors and omissions?

Some errors and omissions claims examples include your: Accountant providing inaccurate financial advice to your clients. As a result, they file a claim against you. Interior designer using the wrong colors to repaint a client's room.

What is the most common errors and omissions claim relates to?

The most common of errors and omissions claims, accounting for nearly 50% of all claims, is inadequate coverage.

What do professional liability and errors and omissions applications require?

Professional liability and errors and omissions applications require detailed information, including the applicant's business details, claims history, projected revenue, desired coverage limits, and risk management practices. This information helps insurers assess risk and determine the appropriate coverage.

Who is usually the most protected by errors and omissions insurance?

Errors and omissions insurance (E&O) is used by professional service providers to protect them from lawsuits and financial losses over claims of unsatisfactory work. This includes those who offer professional advice, such as realtors, insurance professionals, tax preparers, and IT professionals.

How to file an errors and omissions claim against an insurance agent?

How to make an errors and omissions claim Review your E&O / professional liability insurance policy. Contact your insurance agent or carrier. Ask questions. Gather records and documents that relate to the incident. Consult a lawyer. Limit your interactions. Don't beat yourself up.

What is an example of errors and omissions liability?

Some errors and omissions claims examples include your: Accountant providing inaccurate financial advice to your clients. As a result, they file a claim against you. Interior designer using the wrong colors to repaint a client's room.

What is the difference between professional liability and E&O?

Professional Liability insurance, also known as Errors and Omissions (E&O) coverage, is designed to protect your business against claims that professional advice or services you provided caused a customer financial harm due to actual or alleged mistakes or a failure to perform a service.

What is liability for errors and omissions?

Professional Liability insurance, also known as Errors and Omissions (E&O) coverage, is designed to protect your business against claims that professional advice or services you provided caused a customer financial harm due to actual or alleged mistakes or a failure to perform a service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Insurance Professionals Errors and Omissions Liability Basic Application?

The Insurance Professionals Errors and Omissions Liability Basic Application is a form used by professionals in the insurance industry to apply for liability coverage that protects them against claims arising from errors or omissions in the services they provide.

Who is required to file Insurance Professionals Errors and Omissions Liability Basic Application?

Individuals or entities providing insurance-related services, including agents, brokers, and consultants, are typically required to file the Insurance Professionals Errors and Omissions Liability Basic Application to obtain coverage.

How to fill out Insurance Professionals Errors and Omissions Liability Basic Application?

To fill out the application, applicants must provide detailed information about their professional services, business operations, claims history, and any relevant partners or associates. It is essential to be thorough and accurate in providing all requested information.

What is the purpose of Insurance Professionals Errors and Omissions Liability Basic Application?

The purpose of the Insurance Professionals Errors and Omissions Liability Basic Application is to assess the risk associated with provided services and to determine eligibility for liability insurance coverage that protects against potential legal claims.

What information must be reported on Insurance Professionals Errors and Omissions Liability Basic Application?

Applicants must report their business structure, services offered, past insurance claims or liabilities, professional qualifications, and any other relevant operational details that could influence risk assessment and coverage decisions.

Fill out your insurance professionals errors and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Professionals Errors And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.