Get the free KPERS-1 - kpers

Show details

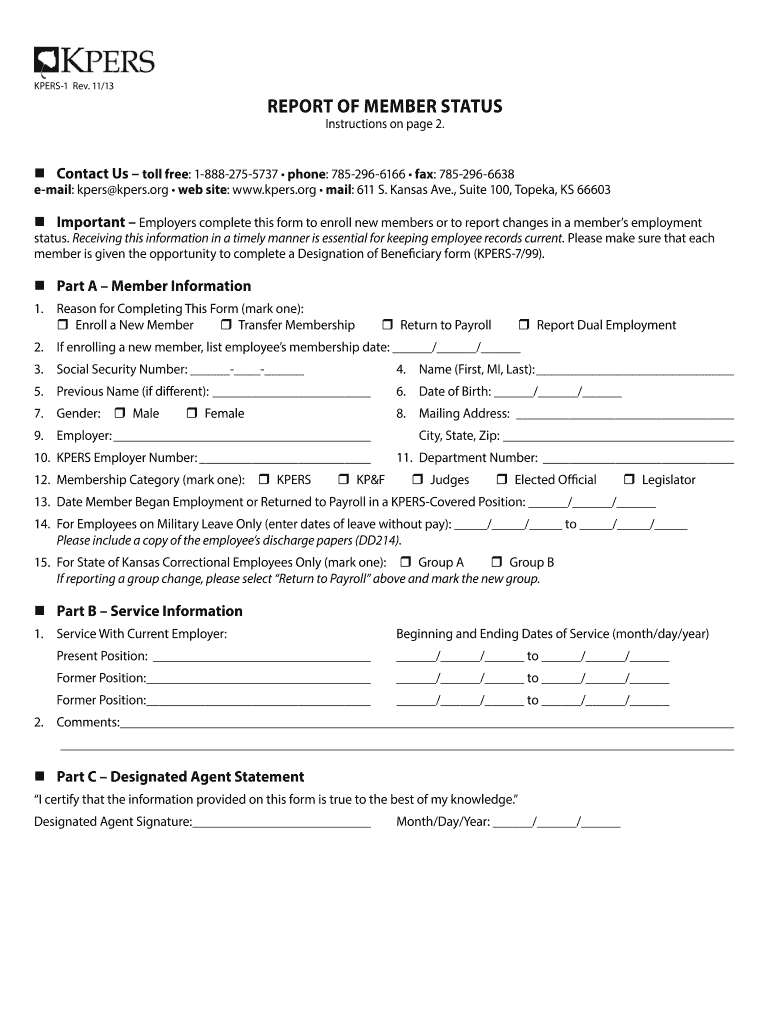

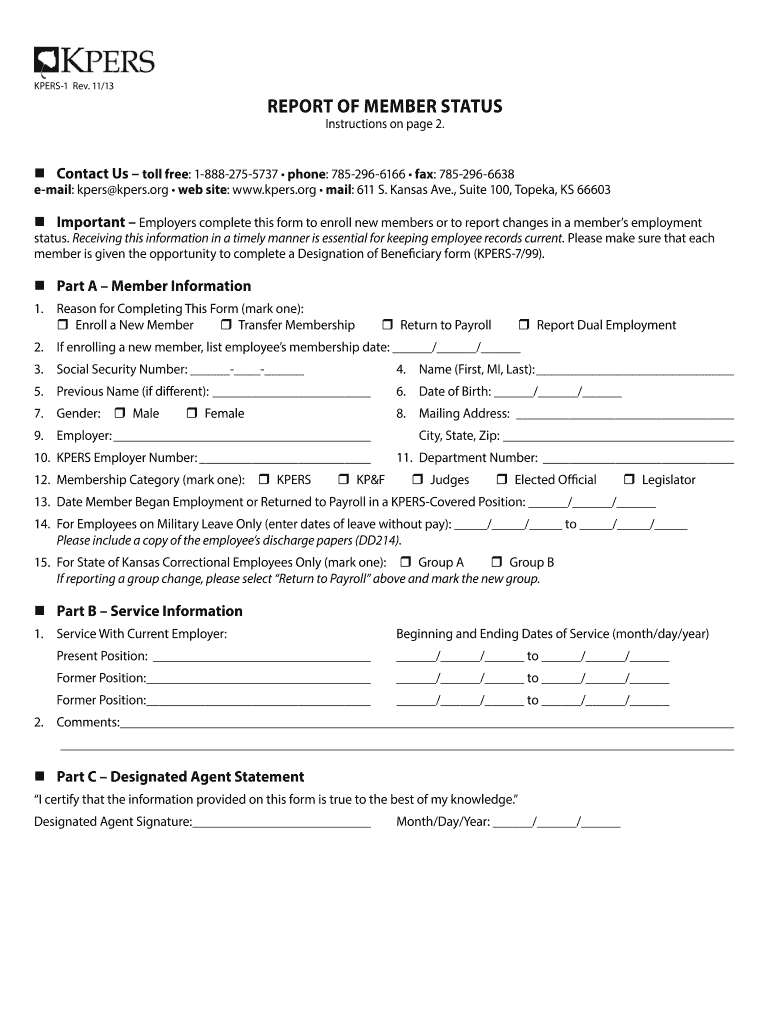

This document is used by employers to enroll new members or to report changes in a member’s employment status within the Kansas Public Employees Retirement System (KPERS).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kpers-1 - kpers

Edit your kpers-1 - kpers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kpers-1 - kpers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kpers-1 - kpers online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit kpers-1 - kpers. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kpers-1 - kpers

How to fill out KPERS-1

01

Obtain the KPERS-1 form from the official KPERS website or your employer.

02

Fill out your personal information including your name, contact details, and Social Security number.

03

Enter your employment information, including your job title, department, and dates of employment.

04

Review the eligibility requirements and check any applicable boxes.

05

Sign and date the form confirming all information is accurate.

06

Submit the completed form to the appropriate personnel or department.

Who needs KPERS-1?

01

New employees seeking retirement benefits through KPERS.

02

Employees who wish to update their information for retirement account purposes.

03

Individuals looking to apply for retirement services or benefits.

Fill

form

: Try Risk Free

People Also Ask about

Can I take money out of my retirement account without penalty?

Can I borrow money from my KPERS account? No. State law does not allow us to administer a loan program for our members.

Is KPERS enough to retire?

No, really. KPERS and Social Security won't be enough for a secure retirement. You need to do your part to "fill the gap" by saving on your own. One of the easiest ways to save is through an employer plan, like a 457 or 403(b).

What is the retirement age for KPERS 1?

AgeYears of ServicePoints At least 65 1 year or (2 or more quarters)* n/a At least 62 10 years (38 or more quarters)* n/a Age + Years of Service = 85 Retire with full benefits

Can I pull money out of my kpers?

You'll need to withdraw your money within 5 years of ending employment. Your account earns interest for 5 years (2 years for KPERS 3 members). There's a 31-day waiting period after you end employment before you can withdraw. When it's time, submit the withdrawal form and we'll send your refund within 4-6 weeks.

Can I withdraw money from my pension fund?

You can only cash out your pension fund if you withdraw from the pension fund, in other words, when you resign or lose your job. Losing your job and retiring, however, are two different scenarios: If you retire, you can only cash out up to one-third, and the balance must be used to purchase an annuity.

How does KPERS figure final average salary?

Your final average salary is an average of your highest 5 years of salary, excluding additional compensation, such as payments for unused sick and annual leave.

Can you withdraw money from KPERS?

You will return as a KPERS 3 member. You can apply to withdraw your contributions any time 31 days after you end employment. If you withdraw, you will give up all Retirement System rights, benefits and service credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is KPERS-1?

KPERS-1 is a form used by employers to report contributions to the Kansas Public Employees Retirement System (KPERS).

Who is required to file KPERS-1?

Employers participating in the Kansas Public Employees Retirement System are required to file KPERS-1 to report retirement contributions for their employees.

How to fill out KPERS-1?

To fill out KPERS-1, employers must provide accurate payroll data, including employee contributions, employer contributions, and any relevant personal information for each employee covered under KPERS.

What is the purpose of KPERS-1?

The purpose of KPERS-1 is to ensure proper reporting and remittance of retirement contributions, which are critical for the funding and management of members' retirement benefits.

What information must be reported on KPERS-1?

KPERS-1 must report employee names, Social Security numbers, contribution amounts, pay periods, and employer identification information.

Fill out your kpers-1 - kpers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kpers-1 - Kpers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.