Get the free KPERS-10LR - kpers

Show details

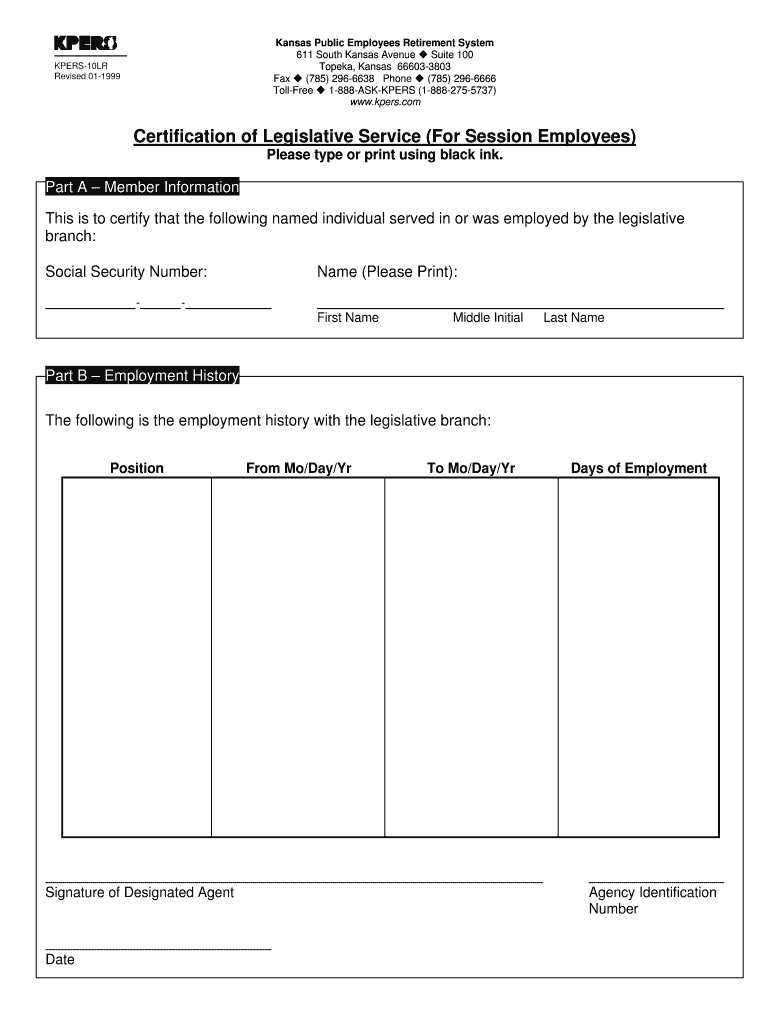

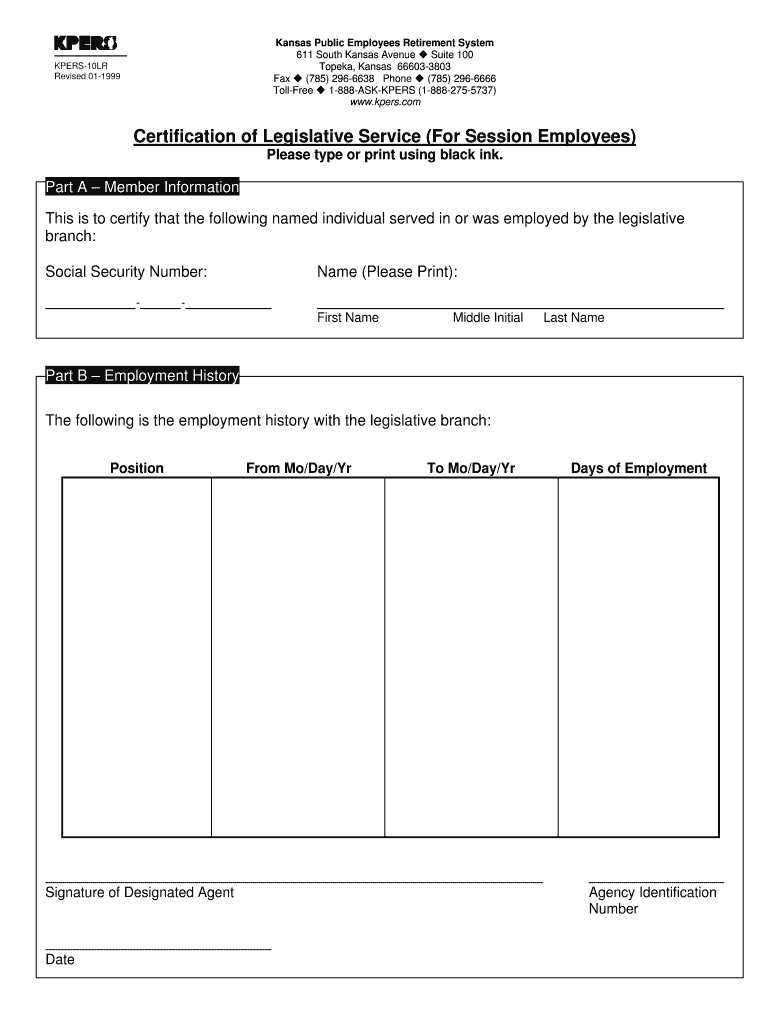

This form is used to certify the employment of an individual within the legislative branch, including details such as position, duration of employment, and agency identification.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kpers-10lr - kpers

Edit your kpers-10lr - kpers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kpers-10lr - kpers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kpers-10lr - kpers online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit kpers-10lr - kpers. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kpers-10lr - kpers

How to fill out KPERS-10LR

01

Begin by gathering all necessary personal information such as your full name, address, and Social Security number.

02

Fill out the sections regarding your employment history, including job titles, dates of employment, and employer names.

03

Input your hours worked and any sick leave or vacation days relevant to your KPERS membership.

04

Complete the areas related to your contributions to the retirement plan, specifying the amount deducted from your pay.

05

Review all entries for accuracy before signing and dating the form at the designated section.

Who needs KPERS-10LR?

01

KPERS-10LR is needed by members of the Kansas Public Employees Retirement System (KPERS) who are applying for retirement benefits.

02

It is required by employees who are transitioning from active employment to retirement status.

Fill

form

: Try Risk Free

People Also Ask about

Can I pull money out of my kpers?

You'll need to withdraw your money within 5 years of ending employment. Your account earns interest for 5 years (2 years for KPERS 3 members). There's a 31-day waiting period after you end employment before you can withdraw. When it's time, submit the withdrawal form and we'll send your refund within 4-6 weeks.

How long does it take to be vested in Kpers?

After five years of service, you become vested and are guaranteed a retirement benefit even if you leave covered employment. You can receive reduced benefits from KPERS beginning as early as age 55 if you have 10 years of service.

Can I collect KPERS and Social Security?

The average KPERS member retires at age 62 with 20 years of service. At age 62 with a final salary of $40,000, he will receive full KPERS benefits and a reduced benefit for early retirement from Social Security.

How many years to be fully vested in KPERS?

After five years of service, you become vested and are guaranteed a retirement benefit even if you leave covered employment. You can receive reduced benefits from KPERS beginning as early as age 55 if you have 10 years of service.

How long until I'm fully vested?

Key Takeaways The maximum time limits for becoming fully vested are six years with graded vesting and three years with cliff vesting. Employer contributions made to safe harbor 401(k) and SIMPLE 401(k) plans must be fully vested immediately.

Is KPERS considered a pension?

The Kansas Public Employees Retirement System (KPERS) was established in 1961 for State of Kansas public employees to provide a defined benefit pension plan. KPERS membership is mandatory for all employees in eligible positions regardless of age.

What is the KPERS 5 year rule?

You'll need to withdraw your money within 5 years of ending employment. Your account earns interest for 5 years (2 years for KPERS 3 members). There's a 31-day waiting period after you end employment before you can withdraw.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is KPERS-10LR?

KPERS-10LR is a reporting form used by employers in Kansas to provide information about retirement contributions and employee data related to the Kansas Public Employees Retirement System (KPERS).

Who is required to file KPERS-10LR?

Employers who participate in the Kansas Public Employees Retirement System and have employees who are enrolled in KPERS are required to file the KPERS-10LR.

How to fill out KPERS-10LR?

To fill out KPERS-10LR, employers must provide necessary details such as employee names, Social Security numbers, hours worked, salary information, and any deductions. Employers typically need to follow the instructions provided by KPERS for accurate completion.

What is the purpose of KPERS-10LR?

The purpose of KPERS-10LR is to ensure that accurate and timely information is reported to the Kansas Public Employees Retirement System regarding employee contributions and to facilitate the administration of retirement benefits.

What information must be reported on KPERS-10LR?

The information that must be reported on KPERS-10LR includes employee identification details (names and Social Security numbers), salary amounts, hours worked, contributions made, and any changes in employment status.

Fill out your kpers-10lr - kpers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kpers-10lr - Kpers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.