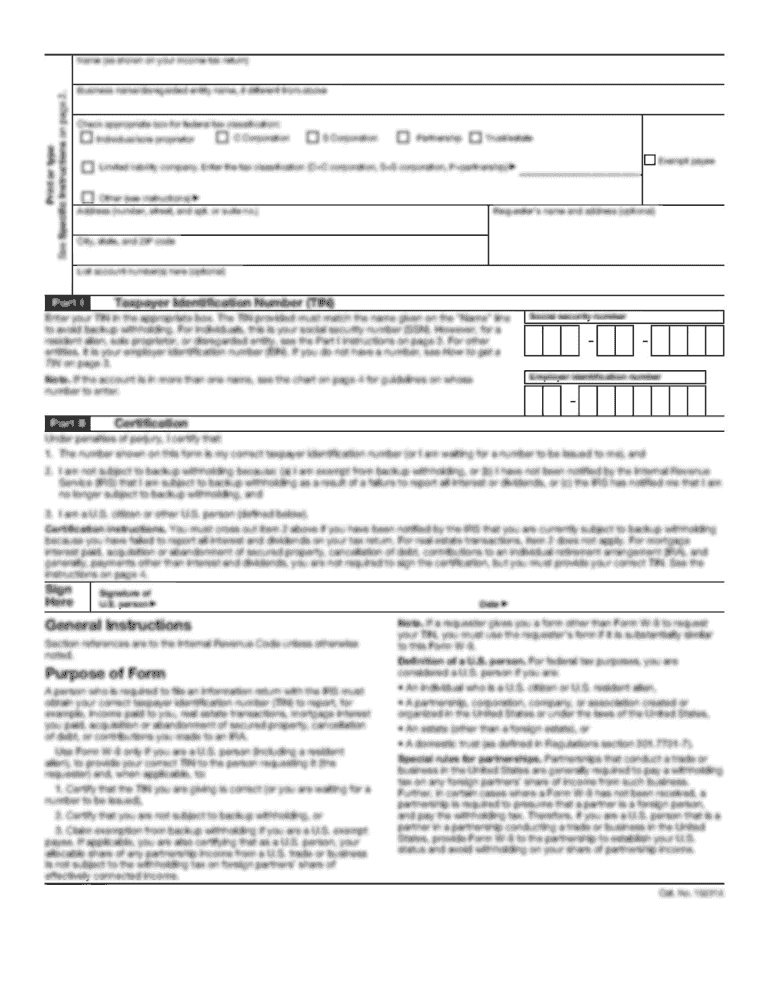

KY 42A741(I) 2008 free printable template

Show details

Este formulario es utilizado para presentar la declaración de impuestos sobre la renta de fideicomisos y bienes fiduciarios en Kentucky, y proporciona instrucciones sobre quién debe presentar y

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY 42A741I

Edit your KY 42A741I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY 42A741I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY 42A741I online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit KY 42A741I. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY 42A741(I) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY 42A741I

How to fill out 42A741(I)

01

Obtain Form 42A741(I) from the official website or relevant office.

02

Read the instructions provided with the form carefully.

03

Fill out the personal information section with your name, address, and contact details.

04

Provide necessary identification details as required on the form.

05

Complete the relevant sections based on the nature of the application or request.

06

Double-check all the information entered for accuracy.

07

Sign and date the form at the designated place.

08

Submit the completed form to the prescribed office or via the specified method.

Who needs 42A741(I)?

01

Individuals applying for a specific benefit or service related to the form.

02

Organizations or agencies that require this form for compliance or reporting purposes.

03

Persons who need to update or correct their information in official records.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from Kentucky income tax?

Individuals Who Are Exempt from Kentucky State Income Taxes This typically occurs when individuals or couples and people with children meet the income tax liability thresholds. For 2022, those thresholds were: $13,590 for single people or married people living apart. $23,030 for families of three.

Is social security taxed in Kentucky?

All Social Security retirement benefits are exempt from the Kentucky state income tax. When you calculate your adjusted gross income (AGI) for Kentucky income taxes, you will be able to subtract all income that you received as Social Security and Railroad Retirement Board benefits.

Who has to file KY state taxes?

Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources.

Do I have to file a Kentucky nonresident tax return?

Form 740-NP is the Kentucky Nonresident or Part-Year Resident Income Tax Return. Who needs to file this form? Full-year nonresidents and part-year residents earning income from Kentucky must file this form. How do I fill out the form correctly?

Who must file Kentucky form PTE?

Who Must File — The owners of a pass-through entity are liable for tax on their share of the Pass-through entity income, whether or not distributed, and must include their share on the applicable Kentucky tax return.

Is a non resident required to file income tax return?

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California. Have income above a certain amount.

Do I need to file a nonresident Kentucky tax return?

Full-year nonresidents earning Kentucky income need this form to report their earnings for tax purposes. Part-year residents who earned income while living in Kentucky must file to comply with tax regulations.

What is the Schedule M in Kentucky?

The purpose of Schedule M is to allow taxpayers in Kentucky to make necessary modifications to their federal adjusted gross income. This ensures that all relevant additions and subtractions are accounted for when determining state tax liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 42A741(I)?

42A741(I) is a specific form used for reporting certain financial or regulatory information as required by a governing body.

Who is required to file 42A741(I)?

Entities or individuals who meet specific criteria set forth by the governing body, typically involving financial transactions or compliance issues, are required to file 42A741(I).

How to fill out 42A741(I)?

To fill out 42A741(I), gather all relevant information as specified in the instructions, complete each section accurately, and ensure all required supporting documents are included before submission.

What is the purpose of 42A741(I)?

The purpose of 42A741(I) is to ensure compliance with regulatory requirements and to provide necessary data for monitoring and oversight by the governing body.

What information must be reported on 42A741(I)?

42A741(I) must report information such as financial figures, identification of the entity or individual filing, compliance details, and any other data specified in the form's instructions.

Fill out your KY 42A741I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY 42A741I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.