KY 12A200 2000 free printable template

Show details

This form allows taxpayers to request an installment agreement for paying their individual income tax due when unable to pay the full amount.

pdfFiller is not affiliated with any government organization

Instructions and Help about KY 12A200

How to edit KY 12A200

How to fill out KY 12A200

Instructions and Help about KY 12A200

How to edit KY 12A200

To edit the KY 12A200 tax form, you can utilize tools like pdfFiller, which allow you to directly modify the text fields of the PDF document. This software supports various features including signing and adding electronic signatures. Make sure to save your changes after editing to maintain the integrity of your submission.

How to fill out KY 12A200

Filling out the KY 12A200 tax form involves several steps. Begin by downloading the form from an official source. Use the following guidelines:

01

Enter your details in the appropriate fields, ensuring accuracy.

02

Provide any necessary documentation to support your claims.

03

Review the form for completeness before submission.

About KY 12A previous version

What is KY 12A200?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About KY 12A previous version

What is KY 12A200?

KY 12A200 is a tax form utilized by Kentucky taxpayers to report specific transactions and income for a given tax year. This form ensures proper documentation of earnings and is used by both individuals and businesses.

What is the purpose of this form?

The primary purpose of the KY 12A200 tax form is to report income that is subject to state taxation. This includes details related to various impressions of money received that must be declared according to state tax laws.

Who needs the form?

Individuals, business owners, and tax professionals who handle transactions requiring tax reporting in Kentucky must complete the KY 12A200 form. This applies particularly to those involved in certain types of income-generating activities.

When am I exempt from filling out this form?

You may be exempt from filling out the KY 12A200 if your reported income falls below the minimum threshold set by the state. Additionally, certain one-time transactions or small business transactions may not require this form.

Components of the form

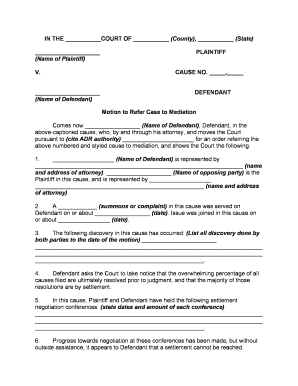

The KY 12A200 form includes various sections that require detailed information, such as personal identification, income sources, and any additional documentation needed to support your claims. Make sure to read the instructions carefully to ensure all components are adequately addressed.

What are the penalties for not issuing the form?

Failing to issue the KY 12A200 can result in penalties akin to those imposed for other tax forms. These may include monetary fines or interest accrued on unpaid taxes in conjunction with an audit by the state. It is crucial to file timely and accurately to avoid such complications.

What information do you need when you file the form?

When filing the KY 12A200 form, you will need personal identification details, income documentation, and any relevant tax identification numbers. Prepare all supporting documents in advance to streamline the filing process.

Is the form accompanied by other forms?

The KY 12A200 may require additional supporting forms depending on the complexity of your tax situation. Check the official guidelines to determine if other forms are necessary for your specific case.

Where do I send the form?

Once completed, the KY 12A200 form must be mailed to the appropriate Kentucky Department of Revenue address specified in the form instructions. Ensure you use the correct mailing method to avoid delays in processing.

See what our users say