Get the free Form 740 Schedule J

Show details

This form is used to elect to figure Kentucky income tax by averaging income from farming or fishing over the previous three years, potentially lowering tax liability.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 740 schedule j

Edit your form 740 schedule j form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 740 schedule j form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 740 schedule j online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 740 schedule j. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

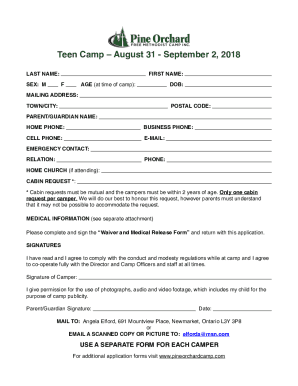

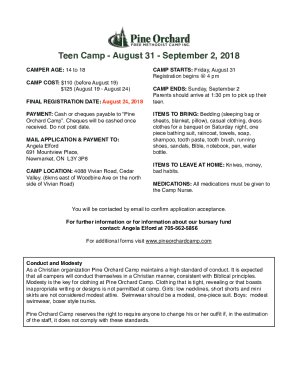

How to fill out form 740 schedule j

How to fill out Form 740 Schedule J

01

Gather your financial documents including your federal return and any relevant state tax information.

02

Download Form 740 Schedule J from the Kentucky Department of Revenue website.

03

Begin by filling in your personal information at the top of the form, including your name and Social Security number.

04

Report your income for the tax year under the appropriate categories, such as wages, dividends, and interest.

05

Calculate your allowable deductions and credits, using the guidelines provided in the form's instructions.

06

Complete the year-end reconciliation sections, following the prompted calculations.

07

Double-check all entries for accuracy and completeness.

08

Sign and date the form at the bottom before submission.

09

Submit Form 740 Schedule J along with your main tax return to the Kentucky Department of Revenue by the due date.

Who needs Form 740 Schedule J?

01

Individuals who have income from farming or who need to adjust their tax liability based on income earned over multiple years.

02

Taxpayers looking to average their income to reduce their overall tax burden may also need to file.

Fill

form

: Try Risk Free

People Also Ask about

What is the Schedule J for Kentucky income tax?

Purpose of Form — Use Form Schedule J to elect to figure your 2024 Kentucky income tax by averaging, over the previous 3 years, all or part of your 2024 Kentucky taxable income from your trade or business of farming or fishing.

What is a J form?

The Form J is the general form to apply to resolve a dispute between a landlord and a tenant. It can be filed by either a landlord or a tenant.

What is Schedule J on tax return?

Use Schedule J (Form 1040) to elect to figure your income tax by averaging, over the previous 3 years (base years), all or part of your taxable income from your trade or business of farming or fishing.

What is a Kentucky 740 form?

Form 740 (2023): Kentucky Individual Income Tax Return Full-Year Residents. Tax Forms Tax Codes. Form 740 is the Kentucky Individual Income Tax Return used by residents of the state of Kentucky to report their income and calculate any taxes owed or due for the tax year 2023.

What is a schedule J tax form?

Use Schedule J (Form 1040) to elect to figure your income tax by averaging, over the previous 3 years (base years), all or part of your taxable income from your trade or business of farming or fishing.

What is a J-1 form?

The J-1 classification (exchange visitors) is authorized for those who intend to participate in an approved program for the purpose of teaching, instructing or lecturing, studying, observing, conducting research, consulting, demonstrating special skills, receiving training, or to receive graduate medical education or

What is the purpose of i485j?

Use Supplement J to: Confirm that the job offered to you in Form I-140, Immigrant Petition for Alien Workers, remains a valid job offer that you intend to accept when we approve your Form I 485, Application to Register Permanent Residence or Adjust Status.

What does I485J approval mean?

The I-485J approval notice means that the job offer has been confirmed and is bonafide by USCIS. How long does it take to get a green card after I-485J approval? Approval times can range from 8-14 months and receipt of your application by USCIS can be 4-6 weeks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 740 Schedule J?

Form 740 Schedule J is a tax form used in Kentucky for individuals to calculate their tax liability on the income from the sale of capital assets and certain income received from estates and trusts.

Who is required to file Form 740 Schedule J?

Individuals who receive income from the sale of capital assets or certain distributions from estates and trusts in Kentucky are required to file Form 740 Schedule J if they want to report this income and calculate the appropriate tax.

How to fill out Form 740 Schedule J?

To fill out Form 740 Schedule J, taxpayers must provide details of their capital gains and the types of income received from estates or trusts. They will then calculate the tax owed based on the specific rates applicable to these incomes, following the instructions provided with the form.

What is the purpose of Form 740 Schedule J?

The purpose of Form 740 Schedule J is to specifically report taxable income from capital gains and certain estate or trust distributions in order to determine the correct amount of Kentucky state income tax owed.

What information must be reported on Form 740 Schedule J?

Form 740 Schedule J requires reporting information related to capital assets sold, income received from estates and trusts, and the corresponding amounts to calculate the effective tax rate on these incomes.

Fill out your form 740 schedule j online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 740 Schedule J is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.