Get the free kentucky 72a110

Show details

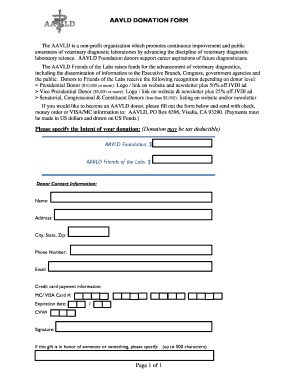

72A110 (04-11) Commonwealth of Kentucky DEPARTMENT OF REVENUE certification of MOTOR fuels nonhighway use See instructions on reverse side. SECTION A I hereby certify that motor fuels purchased from

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kentucky 72a110

Edit your kentucky 72a110 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kentucky 72a110 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kentucky 72a110 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit kentucky 72a110. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is exempt from sales tax in Kentucky?

While the Kentucky sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Kentucky. CategoryExemption StatusFood and MealsMedical ServicesEXEMPTOccasional SalesGeneral Occasional SalesEXEMPT19 more rows

What services are taxable in KY?

labor and services such as car repair, landscaping, janitorial services, and more are subject to sales tax on the labor charges as well as the materials consumed.

What is exempt from Kentucky sales tax?

While the Kentucky sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Kentucky. CategoryExemption StatusFood and MealsGeneral Occasional SalesEXEMPTMotor VehiclesEXEMPT *Optional Maintenance Contracts19 more rows

What state has the highest gas tax 2023?

The five states with the highest gas taxes are: Pennsylvania ($0.61) California ($0.54)Here are the 10 states with the highest gas taxes: Pennsylvania - 61 cents. California - 54 cents. Washington - 49 cents. Illinois - 42 cents. Maryland - 42 cents. New Jersey - 42 cents. North Carolina - 40 cents. Oregon - 38 cents.

What would suspending the gas tax do?

ing to the findings, a 10-month gas tax suspension would save a grand total of $16 to $47 per person for the entire period. More broadly, a gas tax holiday also would do little to curb the most ferocious inflation the U.S. has faced in 40 years.

Did Kentucky suspend gas tax?

Beshear Stops State Gas Tax Hike, Providing Relief to Kentuckians at the Pump. FRANKFORT, Ky. (June 2, 2022) – Today, Gov. Andy Beshear's administration filed an emergency regulation to freeze the state gas tax and to prevent a 2-cent increase per gallon that would have taken effect July 1.

What is the weight mile tax in Kentucky?

Weight Distance (KYU) For each qualified vehicle operating upon the public highways within Kentucky, the weight distance tax is computed by the rate of $0.0285 (2.85 cents) per mile. Tax returns and remittance covering the taxes owed are due on the last day of the next calendar month following each quarter.

How much is the fuel tax in Kentucky?

See current gas tax by state. We've included gasoline, diesel, aviation fuel, and jet fuel tax rates for 2023. Plus, see which states have the highest and lowest excise tax rates.Gas tax by state. StateKentuckyGasoline Tax$0.266 / gallonUndyed Diesel Tax$0.236 / gallonAviation Fuel TaxNo Fuel TaxJet Fuel TaxNo Fuel Tax50 more columns

What is kyu on semi trucks?

Kentucky Highway Use License ( KYU ) This license is required for vehicles with a combined licensed weight of 60,000 lbs. and above to report mileage tax.

How do you qualify for IFTA in Kentucky?

Prior to submitting a Kentucky IFTA License application, you should determine whether or not your vehicle(s) qualifies. You required to obtain an IFTA license if your vehicle meets the following standards: Has two axles and a GVW or registered GVW exceeding 26,000 pounds. Has three or more axles regardless of weight.

How do I register for Kentucky withholding?

Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100). Please visit the Kentucky DOR Tax Registration Information page or additional resources or call the KY DOR at (502) 564-4581.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my kentucky 72a110 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your kentucky 72a110 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I fill out kentucky 72a110 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your kentucky 72a110. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete kentucky 72a110 on an Android device?

Complete your kentucky 72a110 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is kentucky 72a110?

Kentucky 72a110 refers to a specific form used for reporting certain tax information in the state of Kentucky.

Who is required to file kentucky 72a110?

Individuals or entities that meet certain criteria established by the Kentucky Department of Revenue are required to file Kentucky 72a110.

How to fill out kentucky 72a110?

Kentucky 72a110 can be filled out by following the instructions provided by the Kentucky Department of Revenue. The form may require the reporting of specific tax information.

What is the purpose of kentucky 72a110?

The purpose of Kentucky 72a110 is to gather tax information from individuals or entities in order to ensure compliance with state tax laws and regulations.

What information must be reported on kentucky 72a110?

The specific information that must be reported on Kentucky 72a110 may vary depending on the requirements set by the Kentucky Department of Revenue. Generally, it may include information such as income, deductions, and credits.

Fill out your kentucky 72a110 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kentucky 72A110 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.