Get the free 765-GP - Kentucky: Department of Revenue - revenue ky

Show details

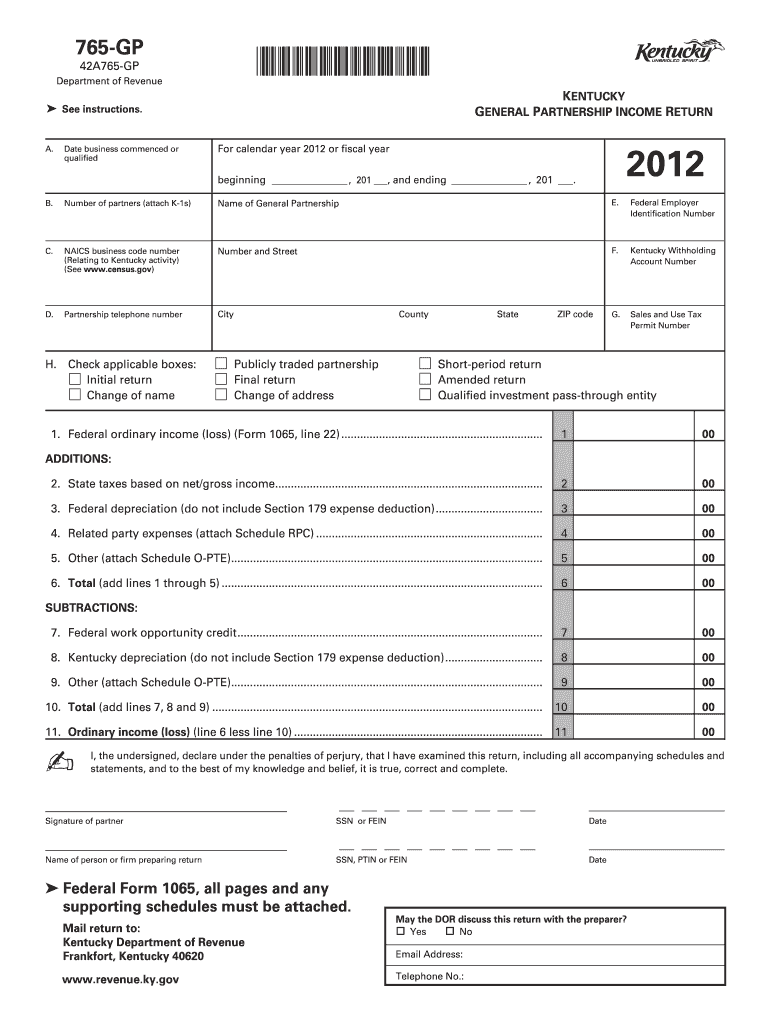

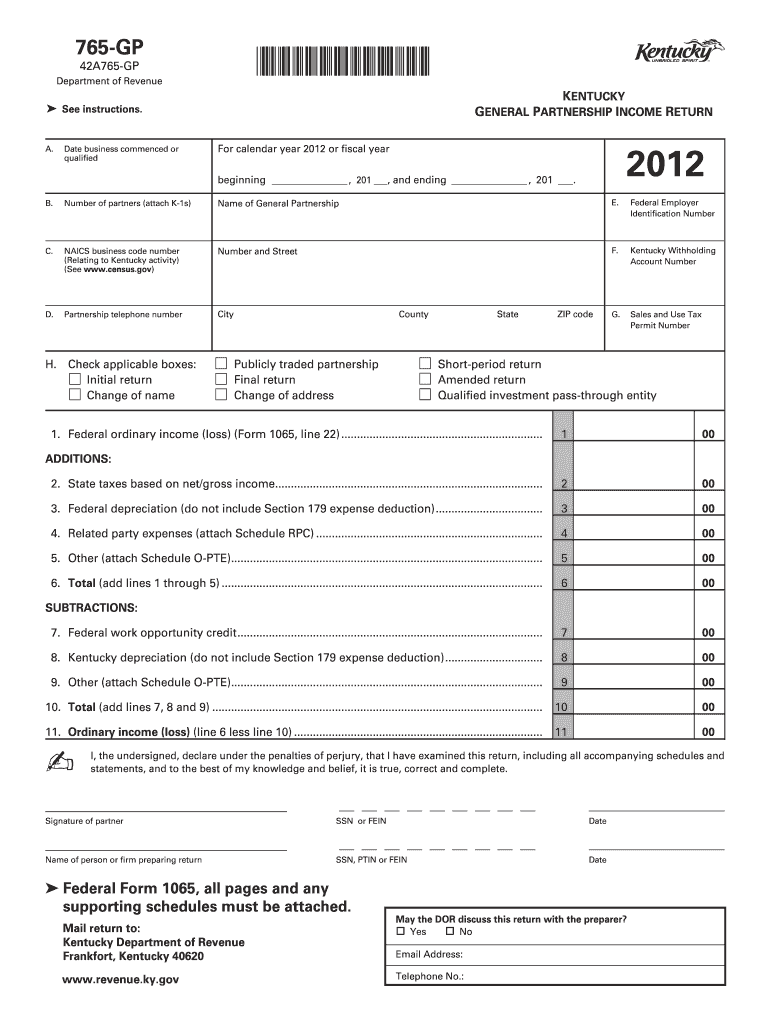

765-GP *1200020034* 42A765-GP Department of Revenue KENTUCKY GENERAL PARTNERSHIP INCOME RETURN ?? See instructions. A. Date business commenced or qualified 2012 For calendar year 2012 or fiscal year

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 765-gp - kentucky department

Edit your 765-gp - kentucky department form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 765-gp - kentucky department form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 765-gp - kentucky department online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 765-gp - kentucky department. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 765-gp - kentucky department

How to fill out KY DoR 765-GP

01

Gather necessary information such as your business details and tax identification numbers.

02

Obtain the KY DoR 765-GP form from the Kentucky Department of Revenue's website or your local tax office.

03

Fill in your name, address, and other personal information in the designated fields.

04

Provide specific details about your income and deductions as required by the form.

05

Review the instructions that accompany the form for any additional requirements.

06

Double-check all filled information for accuracy before submission.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form to the appropriate address listed on the form or electronically if available.

Who needs KY DoR 765-GP?

01

Individuals or businesses seeking to report their income in Kentucky for tax purposes.

02

Those who have earned income within Kentucky and are subject to state income tax.

Fill

form

: Try Risk Free

People Also Ask about

Can I pay my Ky income tax online?

Welcome to the Kentucky Department of Revenue's Electronic Payment Application. This site uses Secure Socket Layer (SSL) 128-bit encryption to safeguard the security of your transactions. At this time, DOR accepts payments by credit card or electronic check.

Is there a Kentucky state tax form?

A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the year or is a full-year nonresident files Form 740-NP.

What is the form 720 ext in Kentucky?

Form 720EXT grants an automatic 6-month extension of time to file Form 720. Kentucky State Partnership tax extension Form 720EXT is due within 4 months and 15 days following the end of the partnership reporting period.

How do I pay my Kentucky state income tax?

Electronic payment: Choose to pay directly from your bank account or by credit card. Service provider fees may apply. Tax Payment Solution (TPS): Register for EFT payments and pay EFT Debits online. Filing Login: Utility Gross Receipts License Tax online filing.

What is Ky Form 765?

These partnerships are required by law to file a Kentucky Partnership Income and LLET Return (Form 765). Form 765 is complementary to the federal form 1065. Forms and instructions are available at all Kentucky Taxpayer Service Centers (see page 19).

How do I contact KY Revenue?

Public Service Branch Phone(502) 564-8175. Fax(502) 564-8192. Address. Kentucky Department of Revenue. Public Service Branch 501 High Street, Station 32. Frankfort, KY 40601. EmailSend us a message.

Where do I send my Ky state tax return?

To File a Return Refund or No Payment 740 or 740-NP. Kentucky Department of Revenue. Frankfort, KY 40618-0006. 740-NPR. Kentucky Department of Revenue. Frankfort, KY 40620-0012. Overnight Address. Kentucky Department of Revenue. If paying by check or money order, make it payable to "KY State Treasurer" and mail to.

What is a Kentucky pass-through entity?

The bill allows a pass-through entity (PTE) to elect to pay its tax liability at the entity level on behalf of its individual partners, members, or shareholders for taxable years beginning on or after January 1, 2022. This is a retroactive measure to January 1, 2022 and is a key component of HB 360.

Does Kentucky have a passthrough entity tax?

On March 24, 2023, Gov. Andy Beshear signed Kentucky House Bill (HB) 360 into law. The bill allows a pass-through entity (PTE) to elect to pay its tax liability at the entity level on behalf of its individual partners, members, or shareholders for taxable years beginning on or after January 1, 2022.

Does my 17 year old need to file taxes?

A minor who may be claimed as a dependent must file a return if their income exceeds their standard deduction ($12,950 for tax year 2022). A minor who earns less than $12,950 will not owe taxes but may choose to file a return to receive a refund of withheld earnings.

Do I need to file an extension for Kentucky state tax return?

If you expect to owe Kentucky income taxes, you must pay at least 75% of your tax payment owed with the Extension Payment Voucher below the KY extension form by April 18, 2023 to avoid interest and late payment penalties.

Who must file KY state tax return?

Kentucky does not require you to use the same filing status as your federal return. Generally, all income of Kentucky residents, regardless of where it was earned, is subject to Kentucky income tax.

How much do you have to Make to file taxes in KY?

Do I need to file a Kentucky tax return? A. No, you do not have a filing requirement with Kentucky because your modified gross income is not greater than $13,590; however, you will need to file a return to claim a refund of any Kentucky income tax withheld.

What is Kentucky Form 765?

These partnerships are required by law to file a Kentucky Partnership Income and LLET Return (Form 765). Form 765 is complementary to the federal form 1065. HOW TO OBTAIN ADDITIONAL FORMS. Forms and instructions are available at all Kentucky Taxpayer Service Centers (see page 19).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 765-gp - kentucky department for eSignature?

When you're ready to share your 765-gp - kentucky department, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the 765-gp - kentucky department in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 765-gp - kentucky department in minutes.

Can I create an electronic signature for signing my 765-gp - kentucky department in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 765-gp - kentucky department right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is KY DoR 765-GP?

KY DoR 765-GP is a form used by the Kentucky Department of Revenue for reporting various types of income and taxes, particularly related to gross income from certain businesses.

Who is required to file KY DoR 765-GP?

Entities or individuals who have gross receipts from business activities that meet the criteria set by the Kentucky Department of Revenue are required to file KY DoR 765-GP.

How to fill out KY DoR 765-GP?

To fill out KY DoR 765-GP, you should complete the form by providing the relevant business information, reporting the gross receipts, and including any necessary calculations and supporting documentation as required.

What is the purpose of KY DoR 765-GP?

The purpose of KY DoR 765-GP is to collect accurate information regarding gross income from businesses in Kentucky for the assessment of state taxes.

What information must be reported on KY DoR 765-GP?

The information that must be reported on KY DoR 765-GP includes the taxpayer's name, address, the nature of the business, period of income, total gross receipts, and any deductions if applicable.

Fill out your 765-gp - kentucky department online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

765-Gp - Kentucky Department is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.